Warren Buffett’s 2018 shareholder letter went viral. This passage stood out:

I agree. Over and over again, the pronouncements of debt crisis have proven to be wrong. Had you sold your stocks n 2010 due to the national debt being too high, you would have missed out on 200% inflation-adjusted gains in the S&P 500 that followed. And also the US dollar is stronger than ever in spite of high deficits and Trump tariffs. Peter Schiff, who is of the libertarian-right, has been calling for a debt crisis and dollar collapse since 2008, to no avail. I don’t care what your politics are, if you’re wrong, you’re wrong. People who are consistently wrong should not be giving financial advice.

As discussed, in spite of dysfunction in Washington and a political and social media climate that feels more divided and angrier than ever, a reason for America’s long-standing economic dominance and resilience and strong stock market performance, is the due to the strength and autonomy of the private sector, which is insulated from the dysfunctional and incompetent public one. Also, having the number one global reserve currency helps greatly, because the Treasury can create money with impunity without loss of wealth (because all wealth, such as the Forbes 400 list, is denominated in U.S. dollars).

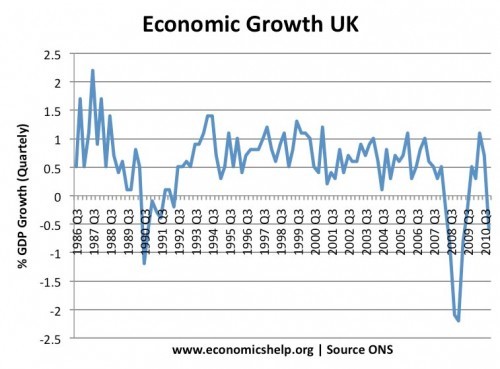

However, I disagree slightly with Buffett that America was always destined for economic greatness. In the late 90’s and mid 2000’s, things weren’t a good as they were now, and America was losing ground economically to Europe (France, Germany, and U.K.) and emerging markets. As I discuss here and here, by the late 90’s interest rates were high and profit margins began to contract; and by 2001, the U.S. economy entered recession due to a combination of these factors, but the UK avoided recession:

The 2003-2007 bull market was short and the S&P 500 only gained 60%; furthermore, interest rates were high (5% versus 2% today) making the real gains even worse. By comparison, the post-2009 bull market and economic expansion is the biggest and longest ever in both nominal and real terms. So something changed in 2009.

After following each other closely, by 2008-2011, the US pulled way ahead of the UK and the rest of Europe and never looked back:

The US-UK GDP growth gap is huge and keeps widening. Not just compared European countries but also Canada, Brazil, Japan, Australia…pretty much everywhere except China. A similar divergence also exists for stock market performance.

Some blame this on austerity, but my explanation for this divergence has to do with the post-2009 tech boom and the increased financialization of the world. All of the most important payment processing and social media and tech companies are from the U.S., such as Visa, MasterCard, Apple, Facebook, Google, Microsoft, Netflix, and Amazon, as well as major brands and industrial high-tech, high-IQ companies such as Boeing, all of which have seen immense growth from the 2009 lows of the recession. Far fewer such equivalents exist in Europe (Airbus and Vodafone are not as dominant and competitive compared to America’s top tech and aerospace and defense firms). There is no tech and entrepreneurial culture in Germany, France, and UK like there is in America. Some time in 2009, America was able to tap into its high-IQ talent pool and saw a huge economic and stock market boom as a result, but also the strength of the US and global consumer plays a role too.

Like Buffett, I, for the above reasons, am optimistic about the U.S. economy and stock market. A few months ago I wrote that the market would go higher, and now the S&P 500 is just 150 points from making new highs, a gain of over 15% from the lows.