Dyseconomics: The New Macro Econ and the Greatest Economic Boom Ever [Edit or Delete]14 comments

May 10, 2011 9:19 AM

Dyseconomics: The New Macro Econ and the Greatest Economic Boom Ever

This is the centerpiece of the entire blog. Read this first.

The greatest economic and stock market boom in human history is unfolding because of a counterintuitive economic system called ‘dyseconomics’. Dyseconomics is a portmanteau of dystopian with economics. It’s dystopian because it consists of things that people generally don’t like such as high government debt, high unemployment, proliferate spending, bailouts, surging living expenses, and a falling dollar. As I will explain later these ‘negatives’ are paradoxically good for the economy in terms of earnings and growth. Dyseconomics is not only an economic system practiced by policy makers but also describes new economic developments and phenomena over the past decade. It’s as if the rules of macroeconomics are being re-written.

Dyseconomics in summary:

1. Increased government intervention and aggressive monetary policy to keep economic growth steady and recessions and bear markets increasingly brief.

2. Deficit spending subsidized by BRIC, hence necessitating strong trade relations and globalization.

3. Increased government spending for things that create economic growth but are not necessarily socially popular such as war, national security, bailouts, stimulus, and tax cuts for the rich.

4. Disregard for US dollar and deficits by policy makers. A lower dollar combined with low rates makes the deficit less burdensome, while falling dollar helps multinationals. This spending is subsidized by foreign governments.

6. Two-track inflation characterized by low core CPI and perpetually low treasury yields, but steadily rising cost of living inflation due to relentless global economic growth, permanently low rates, and to a lesser degree price gouging and speculation.

7. Dyseconomics is an economic system that seems to exclusively benefit the ‘elite’ and multinationals though globalization and low borrowing rates.

8. Fed keeping the foot on the gas even during strong economic expansion and then only releasing the pedal very slowly. It’s not like the 80’s and 90’s when interest rates were high as the economy boomed.

9. Breakdown of Okun's law (decoupling of employment and GDP). What this means is economic output is unaffected much less today and in the future by high unemployment than in the past.

10. Asset classes (oil, euro, gas prices, high-end real estate, metals, grains, stocks, and even web 2.0 company valuations) rising and falling in lockstep with the stock market. This is in contrast to the 80’and 90’s when commodities, the dollar, and stocks showed little correlation.

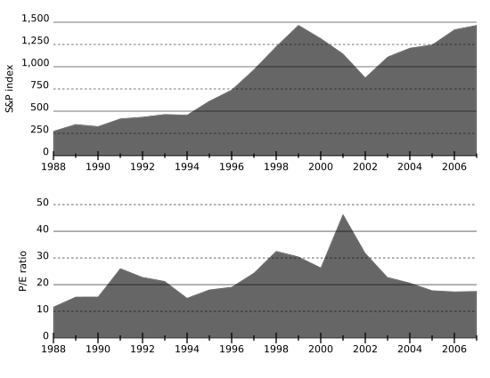

Alan Greenspan’s non-mistake and the 2002-present economic boom

Contrary to popular belief Alan Greenspan didn’t hurt the economy by keeping ‘rates too low’ in the early part of the last decade, but was instead adhering to dyseconomics which gave him the luxury of leaving rates low for an extended period. The liberal and libertarian leaning blogosphere would have you believe that if George W. Bush and Greenspan had been more fiscally conservative economy would have been better off in the long run by preventing the 2008 recession. The media is wrong because when the stock market crashed, so did PE ratios falling from a high of 22 in 2007 to the low teens. If the fundaments were in trouble PE ratios would have risen or stayed the same. That is what happened in 2001 when the PE ratio of the S&P 500 actually hit a peak of 47 after the crash due to falling earnings. At the peak of the technology bubble the S&P 500 had a PE ratio of nearly 35 with the index at 1,500; now it’s at 1,350 but the PE is only on the low 20's so you could extrapolate that if it were valued at the same level it was in 1999 it would be at over 2,600. That 1,100 point difference (even after the 2008 recession) is pure earnings that can be attributed to the politically unpopular yet market-friendly economic policies of the past decade.

As of March 2011 median US home prices are slightly lower than they were in early 2009, but GDP and profits have recovered markedly lending further doubt to the supposed correlation between the housing market and overall economic strength. During Greenspan’s 18-year tenure the US economy was in recession for only sixteen months, and even after the 2007-09 recession the total duration of recessions was just thirty-four months over the past two decades.

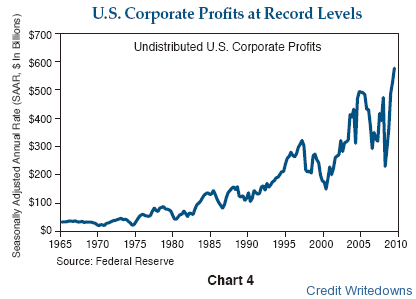

Remember the infamous Clinton federal budget surplus of 1999-2000? The economy entered a recession on it, further dispelling the commonly held belief that high debt implies an unhealthy economy. High interest rates, a relatively high personal savings rate, stagnant aggregate demand contributed to the early 2000's recession. Essentially, money began stagnating the late 90’s as the country became a giant piggybank. As you can see from the chart below U.S. corporate profits began falling in the late 90's and picked up after policy makers eschewed fiscal conservatism and embraced dyseconomics.

The early 2000's brought about Middle East occupations (Iraq and Afghanistan wars and now Libya and possibly Iran), massive tax cuts, low rates, and the BRIC boom - these simulative events prevented what could have been decade-long period of economic malaise. Corporations began to report record profits & earnings - a trend that continues to this day even after the 2008 recession.

As you can see from the chart below during the 90’s PE ratios gradually rose in tandem with the S&P 500, eventually peaking after the market plunged. Since 2002 there has been a divergence meaning that earnings are so good that PE ratios fell despite stocks rallying. Therefore, you can surmise that the economic fundamentals in the past decade (under the least popular president and fed chairman) till the present are better than they were in the 80’s and 90’s, but you won’t hear that from the media.

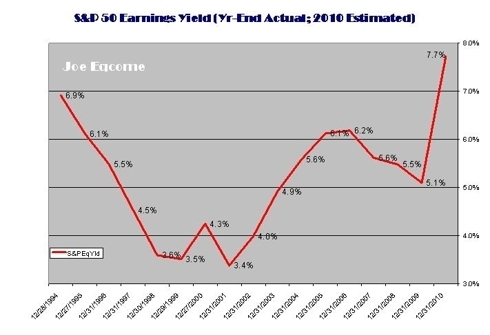

S&P 500 earnings growth rivals that of the 90’s according to the chart

Earnings yields for the past decade matched or exceeded that of the 90’s and presently at the highest rate since 1994.

GDP calculations don’t fully reflect this growth due to the imports deduction, which has become irrelevant as trade deficits haven’t been shown to be inflationary and economically detrimental. Fund managers know this and that is why the S&P 500 has doubled even though projected GDP growth is only at three percent.

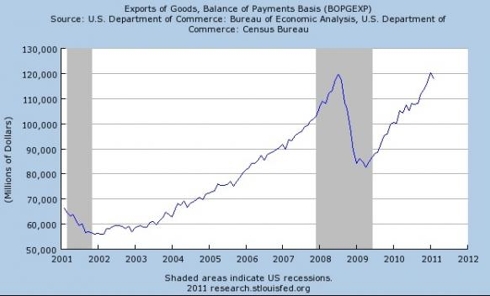

Huge gains in exports, productivity, government spending, information technology, permanently low rates, globalization, robust profits and earnings for multinationals and permanently low taxes are the key driving factors for this decade-long economic expansion and huge bull market. None of these things shows signs of slowing. The chart below shows an obvious ‘v’ shaped recovery in exports:

Bank bailouts …a success and a necessity

We constantly read on the blogosphere and to a lesser extent in the mainstream media about how the bank bailouts would lead to moral hazard and a Zimbabwe like hyperinflationary scenario. While risk taking is making a comeback, there was no hyperinflation. Short term yields are hypersensitive to financial shocks allowing bailouts and infusions to be made with impunity. The cost of TARP according to the bond markets was essentially free and it would have been reckless for policy makers to not take advantage of this opportunity.

Think about it this way: the bailouts were justified because the costs of not bailing out the banks (in terms of stock market & real estate decline, falling profits & earnings) would have easily exceeded the costs of the bailout. While it may have only been a ‘band aid’ solution and failed to address the underlying problems of risk and leverage, it’s been over two years since TARP and no hint of a relapse. By March 30th, 2011 the TARP program had turned a profit.

Letting the banks ‘run wild’ can lead to failure and volatility, but it’s easy to remedy by printing it away as was demonstrated the weekend following Black Friday, the1998 LTCM crisis, and the 2008 financial crisis, which while deep was brief thanks to the expediency of Bernanke, Geithner, Paulson, and G.W Bush. Risk tasking should be encouraged because it creates innovation and when things do, on occasion, go badly it’s pretty easy to fix the problem due to ‘free money’ in the form of perpetually low rates.

In retrospect the Bernanke’s TIME ‘Man of the Year’ nomination was justified when you look at how well the stock market and economy has done in the past two years when so many people were predicting disaster. The dotcom bear market was about twice the duration of the financial crisis bear market, the later lasting around seventeen months (October 2007-March 2009) whereas the dotcom bear market lasted from spring 2000 to spring 2003 – a total of thirty-six months. If fiscal conservatives such as Ron Paul or Paul Volcker ran the fed we’d probably still be in a bear market.

The debt binge is sustainable

Dyseconomics is not Reaganomics in that ‘reckless’ government spending is encouraged because it’s subsidized by an insatiable demand for US treasuries by BRIC and public and institutional holders, thus allowing deficit fueled growth without upsetting the bond vigilantes. This is evidenced by perpetually low ten and thirty year treasury yields. Until the turn of the new millennium the BRIC was in its infancy and income taxes and interest rates were raised on numerous occasions out of necessity. The rise in BRIC economies, more specifically BRIC surpluses, correlates negatively with long term rates. The republican and libertarian fears about tax hikes because of deficit spending were unfounded and still are. Despite the bailouts, two wars, and stimulus - income taxes have not increased a single penny since Clinton’s tax hike and they will probably never increase again thanks to huge demand for treasuries.

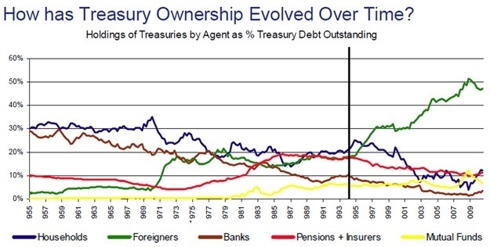

The chart shows below shows how foreign ownership of treasuries has surged in the past decade- enabling the fed to keep rates low

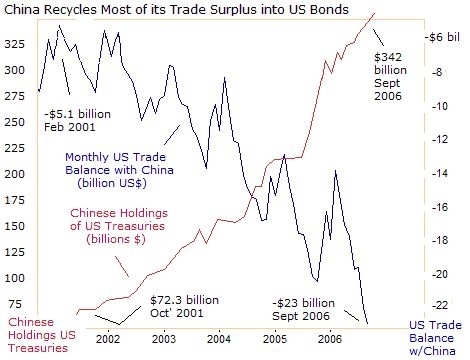

The next chart shows how China’s trade surplus depresses yields allowing Bernanke to not have to raise rates:

What about China dumping treasuries? Japan and China, whose economies depend on exports aren’t going to begin a trade war by dumping treasuries, so the politically unpopular trend of foreign government helping to subsidize ‘reckless’ spending will continue.

(5/11 revision) One of those most amazing properties of dyseconomics is perpetually low treasury yields regardless of the direction economic growth- the so called ‘great moderation’ the US economy has enjoyed since the early 80’s. BRIC economic growth helps S&P 500 multinationals and BRIC surpluses depress rates. This deflationary pressure offsets inflation stemming from strong US globalism based economic growth, so rates remain low even as the global economy booms. Weakness in BRIC economies would shrink surpluses and create inflationary pressure, but this is offset by the deflationary force of pessimism and slower economic growth, so rates would remain low, anyway.

A huge bull market

The DJIA is poised to hit 17,000-20,000 within the next two to three years. By the time the interest rate cycle peaks at four to six percent the DJIA may be well above 50,000. The S&P 500 has already doubled from its March 2009 lows and interest rates still haven’t bunged. Bernanke may finally raise rates by a quarter or half point when the DJIA crosses 15,000.

Will there be a repeat of the 2008 commodities crash now that prices seem overheated again? Odds are no. It's a coincidence that the financial panic of 2008 coincided as oil hit $150 dollars a barrel. The failure of several financial institutions, plunge in confidence and stock market crash had nothing to do with commodities. Unless there is a double dip commodities will continue their rally due to huge global demand, speculation and low rates. Furthermore, the unpopular truth is that surging commodity prices will not hurt growth, but may actually increase growth by forcing people to reduce their personal savings to purchase inelastic goods.

What if the fed begins to raise rates? Will this cause stocks and commodities to crash? No. Between 2004-2006 commodities, stocks, and interest rates rose together because rates were low relative to the expected/anticipated rates. When Bernanke does eventually get around to raising rates the rate hikes will be well-anticipated according to various prediction markets. Rate hikes trigger deflation when they are unexpected and exceed the federal funds forecast rate.

Living expenses through the roof

Surging commodity and living expenses will result in even more populist angst on the internet (if that’s even possible), but have no negative impact on economy. The demand for food, energy, healthcare, education (the things that are rising the most) is considered to be inelastic. But the increased spending on these inelastic goods will translate into pure top line GDP growth without impacting elastic goods such as computers, appliances, and apparel. Thus, surging living expenses helps the economy and stock market by forcing consumers to spend more on these inelastic goods.

The personal savings rate will fall into negative territory like it did in 2008. We’ll see $6/gallon gas, $2,000+/ounce gold, $160+ oil and parabolic charts for grains. Unlike in 2008 there will be no collapse; non-core components of the consumer and producer price index will keep rising, but treasury yields will rise only slightly confounding many of the experts who have been pounding the table about an impending hyperinflationary economic collapse. Technically there is inflation but it is non-core inflation, which is the kind Bernanke and the bond market ignores.

Healthcare and college tuition costs will not relent. There will be no popping of the credit card or tuition bubble. The seismic shift in the labor market in the past decade to more technical, specialized jobs is contributing to the college boom.

Winner takes all economy

Large capitalization companies with global exposure and high net worth individuals are the main beneficiaries of current economic policy. CEO pay is already at pre-recession levels and the wealth gap continues to widen. If you’re out of college and have a lot of debt or unemployed don’t expect much help from the government after the current round of benefits expire and austerity kicks in. Job creation, small business, and low and medium-end housing will have to sit on the sidelines in this boom. Small business is unable to take advantage of low corporate bond rates, pricing power and globalization that multinationals enjoy and there’s nothing the government can do to spur more hiring and small business expansion that isn’t already being done, especially considering interest rates and taxes are at historic lows.

How to invest in Dyseconomics

Large and medium cap companies with dominant market share and global exposure are strong buys. That’s why I'm bullish on Google, Apple, IBM, Netflix, Priceline, Baidu, and IBM. These companies are also immune to unemployment or fluctuations in consumer spending. Or simply buy an index fund like SPY or DIA. Rising gas prices and unemployment will force people to stay at home benefiting internet stocks.

I recommend long Silver, Gold, Oil ETFs (SLV,GLD, USO) Potash miners (POT, MOS) and the gasoline ETF (UGA). These will keep rising as Bernanke refuses to raise rates. Also buy the Euro and short the dollar.

Buy treasuries because as explained earlier BRIC surpluses are creating deflationary pressure. Bill Gross and Peter Schiff are wrong. There will be no hyperinflation and treasuries keep drifting higher.

When Facebook, Twitter, and Groupon go public they will be strong buys. Pay no mind to the PE ratio or bubble 2.0 fears because these web 2.0 companies are growing at a blistering pace and have minimal competition.

Job loss, unemployment not such a big deal

High unemployment has been shown to have a negligible to non-existent impact on consumer spending. Ref (http://www.savingpontiac.org/images/torturethenumbers.pdf ) According to MSNBC Consumer spending was growing at the fastest pace in four years in the final three months of 2010. The S&P 500 consumer discretionary spider is well above its 2007 pre-recession highs. But the economic gains from high unemployment cannot be dismissed in the context of dyseconomics. High unemployment gives the fed a good excuse to never raise rates that the public will buy (the real reason is BRIC surpluses as explained earlier). High unemployment makes the remaining workers more productive which means higher profit margins. When consumers are less confident they are more productive, but still spending the same amount of money on essentials like gas and food as well as iPods, Netflix, Priceline etc. Finally, any weakness in American consumer and business spending from high unemployment is easily compensated by growing foreign business and consumer demand, and when combined with a falling dollar you have a win-win situation for S&P 500 exporters. It’s not like the 80’s and 90’s when foreign consumption played a much smaller role in earnings.

For the aforementioned reasons policy makers aren’t expressing much enthusiasm for getting people back to work and companies aren’t too enthusiastic to hire. That explains why The New Deal/FDR resurgence of 2008/2009 of ‘public works’ and ‘shovel ready projects’ predictably went nowhere.

Wall St. and the fund managers don’t care about unemployment or housing because the economy in terms of S&P 500 earnings and profits is doing great. That’s what matters from an investor’s standpoint. If you’re a trader a good strategy is to buy the dip on any disappointing employment data.

Unemployment will remain above eight percent for remainder of the decade, and may exceed ten percent if more people look for jobs. Their efforts will prove mostly futile as outsourcing, productivity, and technology means fewer workers needed. The baselines unemployment will settle at 7-8% and the total US labor force will continue to shrink. Structured labor tracked by the government will continue to be replaced by underground work.

Conclusion

Even with main street is sitting on the sidelines the American economy in terms of profits and earnings now is stronger than it was at any other time in history thanks to dyseconomics. Permanently low interest rates combined with booming earnings and profits makes for a formidable bull market.

Instablogs are blogs which are instantly set up and networked within the Seeking Alpha

community. Instablog posts are not selected, edited or screened by Seeking Alpha editors,

in contrast to contributors' articles.

Well, all I can say is that the money has funneled to the top. And this money is distorting the prices of everything and impoverishing mainstreet. Bernanke and his buddies allowed the housing bubble and yet he is looked upon as a hero? I think that is like saying that a fireman who sets fires and then puts one out is a hero.

I'm surprised you found this article because Seeking Alpha rejected it so my only option was to publish it as an instablog. Mainstreet isn't participating in this economic expansion, and that's the unfortunate, but unavoidable reality. Exports at record high

Have a closer look at the last 2 centuries of the Western Roman Empire. There is your windscreen. Briefly the population declines and people's alligencies become fluid. Until now people have had a working life in something they felt part of. If they have to join a new tribe to belong why assume it will be quite and passive. These are the moments revolutions seem to come from no where. Most will read and laugh. But that's because they belong. The unemployed and workers without full contracts don't have the luxury of laughing and their numbers are growing, the areas they dominate spreading. The internet is not a new "opium of the masses". It's a teacher, organiser, group builder. Stock Creeper. Macro analysis is wide like history.

Macro economics should not be confused with sociology. A lot of pundits try to merge the two and result is incorrect predictions, even if they feel good writing it.

It's surprising how a seemingly well educated man like you can express such total bs. You, of all people should realize where the money came from that created the extraordinary growth for S&P 500 and other big companies. It was first from the consumers, who borrowed money to pay for this, then the governments in US and Europe came in and bailed out the banks from their self-created debt misery. But now that both the consumers and governments are broke, who will pay in the future? It's gonna fall like a rock, but fortunately for the financial elite, their fall will be softened by the middle man, who will fall first. So relatively speaking, the rich will gain from this, in that their relative piece of the cake will be bigger, but the cake is going to get so small that there will only be crumbs left for all.

i love your blog but how do you account for the big fall in the market yesterday? i understand that it coincides with the end of qe2, but does that mean that the dow will continue to fall? and also i have a lot more question to ask you but would rather talk via email

As far as your blog is concerned, perhaps you could just change the picture. I heard Glenn Beck talk about the poor corporations on one of his shows. Hardly the stuff of real economic recovery. Read this about Beck:

I realize this comment is a bit late, but I followed it from a comment you made on Business Insider.

I don't agree with everything you've said, but your observation about commodity prices reflects something I've been observing: I've noticed for the past couple years that the monthly jobs reports seem to have a positive correlation with the price of oil: The higher the price of oil in a month, the more jobs generally are created in that month. It's not a perfect relationship but it seems to be a pretty strong one.

Your dismissal of libertarian views is also interesting. Most of them seem to be gold bugs, but most of them are also constantly preaching doom and gloom while, at the same time, predicting the price of gold to go to the moon. They don't seem to be particularly observant: For the past 10 years, the price of gold has mostly risen and fallen in concert with the stock market. If the economy crashes, so will gold, just as it did in 2008. The gold bugs are going to be continually frustrated as the economy gains momentum even while they get excited at the rising price of their shiny metal. It's more probable we'll have $3,000 gold and the Dow at 20,000 than to have $3,000 gold and the Dow at 5,000. They're right, but for the wrong reason. Until recently I've been one of those people eagerly awaiting the crash of gold, but lately my views have become more subtle. For the time being I'm going to wait and see what happens after the debt ceiling debacle resolves itself, and maybe some of the European debt issues simmer down. If gold keeps going up, I may actually start routing for it to continue climbing. Or, at least tolerate it.

I was also intrigued by this analysis in the WSJ recently: online.wsj.com/article... ^ ----------------------... "In a what-if scenario run for The Wall Street Journal, IHS Global Insight examined the likely effects of a further sharp drop in the dollar.

The firm's current forecast assumes the value of the dollar will be roughly flat over the next several years. If, however, the dollar fell by an additional 20% over the next eight quarters, the IHS model shows that exports in 2015 would be 12% higher than otherwise predicted. Unemployment would be 5.3%, compared with 6.7% under the steady-dollar assumption. Consumer price inflation would be 3.3% in 2015, compared with 2%." ----------------------...

Of course a computer model is not likely to be exactly right, but I think it's got the generally right idea. Anyone who follows the markets knows for the past 10 years that the dollar goes down when the stock market (and everything else) goes up. This didn't used to be the case but with US companies getting more of their revenue from overseas, and with that unlikely to change any time in the next few decades (and perhaps centuries), the public will have to get used to the fact that a falling dollar is a sign of an improving economy, not one getting worse.

BTW I don't think gas is going to $5 or $6/gallon any time soon. There is going to be a ton of new supply coming online in the next 2-5 years, and long afterwards too. But $3-$4 gas is probably here to stay.

I know you are speaking to the author as a libertarian. I would say that we are to the point where lowering unemployment with a weak dollar is a dangerous game. It may be necessary due to globalization, but it will make almost everything unaffordable.

Peter Schiff would likely say your analysis is correct in dollar terms but not priced in gold. Capital gains through currency devaluation by printing feel good but are ultimately illusory. Buying your own treasuries with printed money will keep rates low for sure and deficit spending creates demand. The problem is savers get reamed twice. Once by low yields and again by loss of purchasing power. This pushes them into equities. Time will tell how this works out.

Evaluate Jim Rogers comments August 2, 2011. re: interntional commodities, US Treasuries/the dollar. and why. . .echos dyseconomics.

Of course denial goes well with a few bottels of Kindell Jackson Merlot. Oh sublime. . . Suggest you offer wheres the delight, showing the way to realizing our bliss, then acheiving the sublime.

Do you know where the wild rose grows, or do you enjoy the pose while looking at the rose more than the rose.

Stumbled across this post which I realise is quite old now. While I admire you for your outspoken views, I have to disagree with a number of your points and would like to comment as follows:

"when things do, on occasion, go badly it’s pretty easy to fix the problem due to ‘free money’ in the form of perpetually low rates" - Are you advocating for this as a solution or merely stating it as the likely outcome? The solution here (irresponsible monetary policy )is exactly the problem - as I will explain below

"Despite the bailouts, two wars, and stimulus - income taxes have not increased a single penny since Clinton’s tax hike and they will probably never increase again thanks to huge demand for treasuries." - How sustainable is this "huge demand" for treasuries? The Fed cannot go on printing money and buying treasuries indefinitely without disastrously undermining confidence in the USD. Furhtermore, we shouldn't make the mistake of assuming that foreign demand for treasuries is a God-given right. Over the long term, alternative markets of the necessary liquidity will emerge. Financial repression cannot continue indefinitely.

"What about China dumping treasuries? Japan and China, whose economies depend on exports aren’t going to begin a trade war by dumping treasuries" - As per above, foreign worship of the holy "T-bill" is not a given. In particular, as China looks to moderate its dependence on exports and builds a more sustainable model with domestic consumption as a key component, China will be able to sell USD assets (including Treasuries) and allow the RMB to appreciate. A stronger RMB will be in China's interests long-term.

"But the increased spending on these inelastic goods will translate into pure top line GDP growth without impacting elastic goods such as computers, appliances, and apparel. Thus, surging living expenses helps the economy and stock market by forcing consumers to spend more on these inelastic goods." - Consumers have finite spending power - if they spend more on inelastic items they will necessarily spend less on inelastic ones.

And now for my views ---

What really concerns me is the likely long-term economic consequences of an extended period of artificially low interest rates. I am afraid that current monetary policy is storing up huge trouble for the future and is sewing the seeds for a Japan-like scenario of low growth and deflation.

The Fed, through its various iterations of bond-buying (QE1, QE2, Operation Twist, recent talk of future sterilised bond-buying), is holding interest rates lower than they would be otherwise in a ‘free’ market, and this in turn is sending dangerous signals through the economy.

What is the economy apart from a complex series of price signals? And what is the purpose of the financial markets except to raise capital and direct it to where it will achieve the highest return? In a free market where the pricing mechanism works as it should – that is to say, not perfectly or even efficiently but you could say ‘sufficiently’ – the result is ‘efficient/sufficient’ allocation of capital, maximising economic growth for the long-term.

This entire system breaks down when central banks step in to ‘save’ the system, bail out businesses and hold down interest rates in the name of ‘recovery’. What they are doing is in fact preventing recovery and creating a zombie economy. Taking the example of interest rates, when the ‘cost’ of money goes down, business projects which didn’t make sense before suddenly look profitable. Over time this means a lot of new business ventures which – in an unsubsidised market – would never have seen the light of day. In the short term central bankers and politicians congratulate themselves, marvelling at their accomplishment and revelling in their genius.

In the long-term however, this hubris is inevitably exposed, and the Emperor is shown once again to be naked (being generous I might throw them a loin cloth or two). When market forces inevitably reassert themselves and rates rise, those businesses which survived only by suckling at the cheap money teat are exposed as frauds. In essence, they were zombie businesses, the walking dead, built on artificially cheap money.

The tricky part is that the effect of cheap money permeates the entire economy and we will not be able to tell the zombie businesses from the non-zombies until it’s too late. As they say, it’s not until the tide goes out that you realise who’s swimming naked.

Stumbled across this post which I realise is quite old now. While I admire you for your outspoken views, I have to disagree with a number of your points and would like to comment as follows:

"when things do, on occasion, go badly it’s pretty easy to fix the problem due to ‘free money’ in the form of perpetually low rates" - Are you advocating for this as a solution or merely stating it as the likely outcome? The solution here (irresponsible monetary policy )is exactly the problem - as I will explain below

"Despite the bailouts, two wars, and stimulus - income taxes have not increased a single penny since Clinton’s tax hike and they will probably never increase again thanks to huge demand for treasuries." - How sustainable is this "huge demand" for treasuries? The Fed cannot go on printing money and buying treasuries indefinitely without disastrously undermining confidence in the USD. Furhtermore, we shouldn't make the mistake of assuming that foreign demand for treasuries is a God-given right. Over the long term, alternative markets of the necessary liquidity will emerge. Financial repression cannot continue indefinitely.

"What about China dumping treasuries? Japan and China, whose economies depend on exports aren’t going to begin a trade war by dumping treasuries" - As per above, foreign worship of the holy "T-bill" is not a given. In particular, as China looks to moderate its dependence on exports and builds a more sustainable model with domestic consumption as a key component, China will be able to sell USD assets (including Treasuries) and allow the RMB to appreciate. A stronger RMB will be in China's interests long-term.

"But the increased spending on these inelastic goods will translate into pure top line GDP growth without impacting elastic goods such as computers, appliances, and apparel. Thus, surging living expenses helps the economy and stock market by forcing consumers to spend more on these inelastic goods." - Consumers have finite spending power - if they spend more on inelastic items they will necessarily spend less on inelastic ones.

And now for my views ---

What really concerns me is the likely long-term economic consequences of an extended period of artificially low interest rates. I am afraid that current monetary policy is storing up huge trouble for the future and is sewing the seeds for a Japan-like scenario of low growth and deflation.

The Fed, through its various iterations of bond-buying (QE1, QE2, Operation Twist, recent talk of future sterilised bond-buying), is holding interest rates lower than they would be otherwise in a ‘free’ market, and this in turn is sending dangerous signals through the economy.

What is the economy apart from a complex series of price signals? And what is the purpose of the financial markets except to raise capital and direct it to where it will achieve the highest return? In a free market where the pricing mechanism works as it should – that is to say, not perfectly or even efficiently but you could say ‘sufficiently’ – the result is ‘efficient/sufficient’ allocation of capital, maximising economic growth for the long-term.

This entire system breaks down when central banks step in to ‘save’ the system, bail out businesses and hold down interest rates in the name of ‘recovery’. What they are doing is in fact preventing recovery and creating a zombie economy. Taking the example of interest rates, when the ‘cost’ of money goes down, business projects which didn’t make sense before suddenly look profitable. Over time this means a lot of new business ventures which – in an unsubsidised market – would never have seen the light of day. In the short term central bankers and politicians congratulate themselves, marvelling at their accomplishment and revelling in their genius.

In the long-term however, this hubris is inevitably exposed, and the Emperor is shown once again to be naked (being generous I might throw them a loin cloth or two). When market forces inevitably reassert themselves and rates rise, those businesses which survived only by suckling at the cheap money teat are exposed as frauds. In essence, they were zombie businesses, the walking dead, built on artificially cheap money.

The tricky part is that the effect of cheap money permeates the entire economy and we will not be able to tell the zombie businesses from the non-zombies until it’s too late. As they say, it’s not until the tide goes out that you realise who’s swimming naked.

Instablogs are Seeking Alpha's free blogging platform customized for finance, with instant set up and exposure to millions of readers interested in the financial markets. Publish your own instablog in minutes.

Dyseconomics: The New Macro Econ and the Greatest Economic Boom Ever [Edit or Delete]14 comments

Dyseconomics: The New Macro Econ and the Greatest Economic Boom Ever

This is the centerpiece of the entire blog. Read this first.

The greatest economic and stock market boom in human history is unfolding because of a counterintuitive economic system called ‘dyseconomics’. Dyseconomics is a portmanteau of dystopian with economics. It’s dystopian because it consists of things that people generally don’t like such as high government debt, high unemployment, proliferate spending, bailouts, surging living expenses, and a falling dollar. As I will explain later these ‘negatives’ are paradoxically good for the economy in terms of earnings and growth. Dyseconomics is not only an economic system practiced by policy makers but also describes new economic developments and phenomena over the past decade. It’s as if the rules of macroeconomics are being re-written.

Dyseconomics in summary:

1. Increased government intervention and aggressive monetary policy to keep economic growth steady and recessions and bear markets increasingly brief.

2. Deficit spending subsidized by BRIC, hence necessitating strong trade relations and globalization.

3. Increased government spending for things that create economic growth but are not necessarily socially popular such as war, national security, bailouts, stimulus, and tax cuts for the rich.

4. Disregard for US dollar and deficits by policy makers. A lower dollar combined with low rates makes the deficit less burdensome, while falling dollar helps multinationals. This spending is subsidized by foreign governments.

6. Two-track inflation characterized by low core CPI and perpetually low treasury yields, but steadily rising cost of living inflation due to relentless global economic growth, permanently low rates, and to a lesser degree price gouging and speculation.

7. Dyseconomics is an economic system that seems to exclusively benefit the ‘elite’ and multinationals though globalization and low borrowing rates.

8. Fed keeping the foot on the gas even during strong economic expansion and then only releasing the pedal very slowly. It’s not like the 80’s and 90’s when interest rates were high as the economy boomed.

9. Breakdown of Okun's law (decoupling of employment and GDP). What this means is economic output is unaffected much less today and in the future by high unemployment than in the past.

10. Asset classes (oil, euro, gas prices, high-end real estate, metals, grains, stocks, and even web 2.0 company valuations) rising and falling in lockstep with the stock market. This is in contrast to the 80’and 90’s when commodities, the dollar, and stocks showed little correlation.

Alan Greenspan’s non-mistake and the 2002-present economic boom

Contrary to popular belief Alan Greenspan didn’t hurt the economy by keeping ‘rates too low’ in the early part of the last decade, but was instead adhering to dyseconomics which gave him the luxury of leaving rates low for an extended period. The liberal and libertarian leaning blogosphere would have you believe that if George W. Bush and Greenspan had been more fiscally conservative economy would have been better off in the long run by preventing the 2008 recession. The media is wrong because when the stock market crashed, so did PE ratios falling from a high of 22 in 2007 to the low teens. If the fundaments were in trouble PE ratios would have risen or stayed the same. That is what happened in 2001 when the PE ratio of the S&P 500 actually hit a peak of 47 after the crash due to falling earnings. At the peak of the technology bubble the S&P 500 had a PE ratio of nearly 35 with the index at 1,500; now it’s at 1,350 but the PE is only on the low 20's so you could extrapolate that if it were valued at the same level it was in 1999 it would be at over 2,600. That 1,100 point difference (even after the 2008 recession) is pure earnings that can be attributed to the politically unpopular yet market-friendly economic policies of the past decade.

As of March 2011 median US home prices are slightly lower than they were in early 2009, but GDP and profits have recovered markedly lending further doubt to the supposed correlation between the housing market and overall economic strength. During Greenspan’s 18-year tenure the US economy was in recession for only sixteen months, and even after the 2007-09 recession the total duration of recessions was just thirty-four months over the past two decades.

Remember the infamous Clinton federal budget surplus of 1999-2000? The economy entered a recession on it, further dispelling the commonly held belief that high debt implies an unhealthy economy. High interest rates, a relatively high personal savings rate, stagnant aggregate demand contributed to the early 2000's recession. Essentially, money began stagnating the late 90’s as the country became a giant piggybank. As you can see from the chart below U.S. corporate profits began falling in the late 90's and picked up after policy makers eschewed fiscal conservatism and embraced dyseconomics.

The early 2000's brought about Middle East occupations (Iraq and Afghanistan wars and now Libya and possibly Iran), massive tax cuts, low rates, and the BRIC boom - these simulative events prevented what could have been decade-long period of economic malaise. Corporations began to report record profits & earnings - a trend that continues to this day even after the 2008 recession.

As you can see from the chart below during the 90’s PE ratios gradually rose in tandem with the S&P 500, eventually peaking after the market plunged. Since 2002 there has been a divergence meaning that earnings are so good that PE ratios fell despite stocks rallying. Therefore, you can surmise that the economic fundamentals in the past decade (under the least popular president and fed chairman) till the present are better than they were in the 80’s and 90’s, but you won’t hear that from the media.

S&P 500 earnings growth rivals that of the 90’s according to the chart

Earnings yields for the past decade matched or exceeded that of the 90’s and presently at the highest rate since 1994.

GDP calculations don’t fully reflect this growth due to the imports deduction, which has become irrelevant as trade deficits haven’t been shown to be inflationary and economically detrimental. Fund managers know this and that is why the S&P 500 has doubled even though projected GDP growth is only at three percent.

Huge gains in exports, productivity, government spending, information technology, permanently low rates, globalization, robust profits and earnings for multinationals and permanently low taxes are the key driving factors for this decade-long economic expansion and huge bull market. None of these things shows signs of slowing. The chart below shows an obvious ‘v’ shaped recovery in exports:

Bank bailouts …a success and a necessity

We constantly read on the blogosphere and to a lesser extent in the mainstream media about how the bank bailouts would lead to moral hazard and a Zimbabwe like hyperinflationary scenario. While risk taking is making a comeback, there was no hyperinflation. Short term yields are hypersensitive to financial shocks allowing bailouts and infusions to be made with impunity. The cost of TARP according to the bond markets was essentially free and it would have been reckless for policy makers to not take advantage of this opportunity.

Think about it this way: the bailouts were justified because the costs of not bailing out the banks (in terms of stock market & real estate decline, falling profits & earnings) would have easily exceeded the costs of the bailout. While it may have only been a ‘band aid’ solution and failed to address the underlying problems of risk and leverage, it’s been over two years since TARP and no hint of a relapse. By March 30th, 2011 the TARP program had turned a profit.

Letting the banks ‘run wild’ can lead to failure and volatility, but it’s easy to remedy by printing it away as was demonstrated the weekend following Black Friday, the1998 LTCM crisis, and the 2008 financial crisis, which while deep was brief thanks to the expediency of Bernanke, Geithner, Paulson, and G.W Bush. Risk tasking should be encouraged because it creates innovation and when things do, on occasion, go badly it’s pretty easy to fix the problem due to ‘free money’ in the form of perpetually low rates.

In retrospect the Bernanke’s TIME ‘Man of the Year’ nomination was justified when you look at how well the stock market and economy has done in the past two years when so many people were predicting disaster. The dotcom bear market was about twice the duration of the financial crisis bear market, the later lasting around seventeen months (October 2007-March 2009) whereas the dotcom bear market lasted from spring 2000 to spring 2003 – a total of thirty-six months. If fiscal conservatives such as Ron Paul or Paul Volcker ran the fed we’d probably still be in a bear market.

The debt binge is sustainable

Dyseconomics is not Reaganomics in that ‘reckless’ government spending is encouraged because it’s subsidized by an insatiable demand for US treasuries by BRIC and public and institutional holders, thus allowing deficit fueled growth without upsetting the bond vigilantes. This is evidenced by perpetually low ten and thirty year treasury yields. Until the turn of the new millennium the BRIC was in its infancy and income taxes and interest rates were raised on numerous occasions out of necessity. The rise in BRIC economies, more specifically BRIC surpluses, correlates negatively with long term rates. The republican and libertarian fears about tax hikes because of deficit spending were unfounded and still are. Despite the bailouts, two wars, and stimulus - income taxes have not increased a single penny since Clinton’s tax hike and they will probably never increase again thanks to huge demand for treasuries.

The chart shows below shows how foreign ownership of treasuries has surged in the past decade- enabling the fed to keep rates low

The next chart shows how China’s trade surplus depresses yields allowing Bernanke to not have to raise rates:

What about China dumping treasuries? Japan and China, whose economies depend on exports aren’t going to begin a trade war by dumping treasuries, so the politically unpopular trend of foreign government helping to subsidize ‘reckless’ spending will continue.

(5/11 revision) One of those most amazing properties of dyseconomics is perpetually low treasury yields regardless of the direction economic growth- the so called ‘great moderation’ the US economy has enjoyed since the early 80’s. BRIC economic growth helps S&P 500 multinationals and BRIC surpluses depress rates. This deflationary pressure offsets inflation stemming from strong US globalism based economic growth, so rates remain low even as the global economy booms. Weakness in BRIC economies would shrink surpluses and create inflationary pressure, but this is offset by the deflationary force of pessimism and slower economic growth, so rates would remain low, anyway.

A huge bull market

The DJIA is poised to hit 17,000-20,000 within the next two to three years. By the time the interest rate cycle peaks at four to six percent the DJIA may be well above 50,000. The S&P 500 has already doubled from its March 2009 lows and interest rates still haven’t bunged. Bernanke may finally raise rates by a quarter or half point when the DJIA crosses 15,000.

Will there be a repeat of the 2008 commodities crash now that prices seem overheated again? Odds are no. It's a coincidence that the financial panic of 2008 coincided as oil hit $150 dollars a barrel. The failure of several financial institutions, plunge in confidence and stock market crash had nothing to do with commodities. Unless there is a double dip commodities will continue their rally due to huge global demand, speculation and low rates. Furthermore, the unpopular truth is that surging commodity prices will not hurt growth, but may actually increase growth by forcing people to reduce their personal savings to purchase inelastic goods.

What if the fed begins to raise rates? Will this cause stocks and commodities to crash? No. Between 2004-2006 commodities, stocks, and interest rates rose together because rates were low relative to the expected/anticipated rates. When Bernanke does eventually get around to raising rates the rate hikes will be well-anticipated according to various prediction markets. Rate hikes trigger deflation when they are unexpected and exceed the federal funds forecast rate.

Living expenses through the roof

Surging commodity and living expenses will result in even more populist angst on the internet (if that’s even possible), but have no negative impact on economy. The demand for food, energy, healthcare, education (the things that are rising the most) is considered to be inelastic. But the increased spending on these inelastic goods will translate into pure top line GDP growth without impacting elastic goods such as computers, appliances, and apparel. Thus, surging living expenses helps the economy and stock market by forcing consumers to spend more on these inelastic goods.

The personal savings rate will fall into negative territory like it did in 2008. We’ll see $6/gallon gas, $2,000+/ounce gold, $160+ oil and parabolic charts for grains. Unlike in 2008 there will be no collapse; non-core components of the consumer and producer price index will keep rising, but treasury yields will rise only slightly confounding many of the experts who have been pounding the table about an impending hyperinflationary economic collapse. Technically there is inflation but it is non-core inflation, which is the kind Bernanke and the bond market ignores.

Healthcare and college tuition costs will not relent. There will be no popping of the credit card or tuition bubble. The seismic shift in the labor market in the past decade to more technical, specialized jobs is contributing to the college boom.

Winner takes all economy

Large capitalization companies with global exposure and high net worth individuals are the main beneficiaries of current economic policy. CEO pay is already at pre-recession levels and the wealth gap continues to widen. If you’re out of college and have a lot of debt or unemployed don’t expect much help from the government after the current round of benefits expire and austerity kicks in. Job creation, small business, and low and medium-end housing will have to sit on the sidelines in this boom. Small business is unable to take advantage of low corporate bond rates, pricing power and globalization that multinationals enjoy and there’s nothing the government can do to spur more hiring and small business expansion that isn’t already being done, especially considering interest rates and taxes are at historic lows.

How to invest in Dyseconomics

Large and medium cap companies with dominant market share and global exposure are strong buys. That’s why I'm bullish on Google, Apple, IBM, Netflix, Priceline, Baidu, and IBM. These companies are also immune to unemployment or fluctuations in consumer spending. Or simply buy an index fund like SPY or DIA. Rising gas prices and unemployment will force people to stay at home benefiting internet stocks.

I recommend long Silver, Gold, Oil ETFs (SLV,GLD, USO) Potash miners (POT, MOS) and the gasoline ETF (UGA). These will keep rising as Bernanke refuses to raise rates. Also buy the Euro and short the dollar.

Buy treasuries because as explained earlier BRIC surpluses are creating deflationary pressure. Bill Gross and Peter Schiff are wrong. There will be no hyperinflation and treasuries keep drifting higher.

When Facebook, Twitter, and Groupon go public they will be strong buys. Pay no mind to the PE ratio or bubble 2.0 fears because these web 2.0 companies are growing at a blistering pace and have minimal competition.

Job loss, unemployment not such a big deal

High unemployment has been shown to have a negligible to non-existent impact on consumer spending. Ref (http://www.savingpontiac.org/images/torturethenumbers.pdf ) According to MSNBC Consumer spending was growing at the fastest pace in four years in the final three months of 2010. The S&P 500 consumer discretionary spider is well above its 2007 pre-recession highs. But the economic gains from high unemployment cannot be dismissed in the context of dyseconomics. High unemployment gives the fed a good excuse to never raise rates that the public will buy (the real reason is BRIC surpluses as explained earlier). High unemployment makes the remaining workers more productive which means higher profit margins. When consumers are less confident they are more productive, but still spending the same amount of money on essentials like gas and food as well as iPods, Netflix, Priceline etc. Finally, any weakness in American consumer and business spending from high unemployment is easily compensated by growing foreign business and consumer demand, and when combined with a falling dollar you have a win-win situation for S&P 500 exporters. It’s not like the 80’s and 90’s when foreign consumption played a much smaller role in earnings.

For the aforementioned reasons policy makers aren’t expressing much enthusiasm for getting people back to work and companies aren’t too enthusiastic to hire. That explains why The New Deal/FDR resurgence of 2008/2009 of ‘public works’ and ‘shovel ready projects’ predictably went nowhere.

Wall St. and the fund managers don’t care about unemployment or housing because the economy in terms of S&P 500 earnings and profits is doing great. That’s what matters from an investor’s standpoint. If you’re a trader a good strategy is to buy the dip on any disappointing employment data.

Unemployment will remain above eight percent for remainder of the decade, and may exceed ten percent if more people look for jobs. Their efforts will prove mostly futile as outsourcing, productivity, and technology means fewer workers needed. The baselines unemployment will settle at 7-8% and the total US labor force will continue to shrink. Structured labor tracked by the government will continue to be replaced by underground work.

Conclusion

Even with main street is sitting on the sidelines the American economy in terms of profits and earnings now is stronger than it was at any other time in history thanks to dyseconomics. Permanently low interest rates combined with booming earnings and profits makes for a formidable bull market.

Instablogs are blogs which are instantly set up and networked within the Seeking Alpha community. Instablog posts are not selected, edited or screened by Seeking Alpha editors, in contrast to contributors' articles.

Share this page

This post has 14 comments:

www.businessinsider.co...

and unemployment at 9%. Wall st. is about profits & earnings, not job creation.

Until now people have had a working life in something they felt part of. If they have to join a new tribe to belong why assume it will be quite and passive. These are the moments revolutions seem to come from no where.

Most will read and laugh. But that's because they belong. The unemployed and workers without full contracts don't have the luxury of laughing and their numbers are growing, the areas they dominate spreading. The internet is not a new "opium of the masses". It's a teacher, organiser, group builder.

Stock Creeper. Macro analysis is wide like history.

It's gonna fall like a rock, but fortunately for the financial elite, their fall will be softened by the middle man, who will fall first. So relatively speaking, the rich will gain from this, in that their relative piece of the cake will be bigger, but the cake is going to get so small that there will only be crumbs left for all.

hubpages.com/hub/We-Al...

I don't agree with everything you've said, but your observation about commodity prices reflects something I've been observing: I've noticed for the past couple years that the monthly jobs reports seem to have a positive correlation with the price of oil: The higher the price of oil in a month, the more jobs generally are created in that month. It's not a perfect relationship but it seems to be a pretty strong one.

Your dismissal of libertarian views is also interesting. Most of them seem to be gold bugs, but most of them are also constantly preaching doom and gloom while, at the same time, predicting the price of gold to go to the moon. They don't seem to be particularly observant: For the past 10 years, the price of gold has mostly risen and fallen in concert with the stock market. If the economy crashes, so will gold, just as it did in 2008. The gold bugs are going to be continually frustrated as the economy gains momentum even while they get excited at the rising price of their shiny metal. It's more probable we'll have $3,000 gold and the Dow at 20,000 than to have $3,000 gold and the Dow at 5,000. They're right, but for the wrong reason. Until recently I've been one of those people eagerly awaiting the crash of gold, but lately my views have become more subtle. For the time being I'm going to wait and see what happens after the debt ceiling debacle resolves itself, and maybe some of the European debt issues simmer down. If gold keeps going up, I may actually start routing for it to continue climbing. Or, at least tolerate it.

I was also intrigued by this analysis in the WSJ recently:

online.wsj.com/article...

^

----------------------...

"In a what-if scenario run for The Wall Street Journal, IHS Global Insight examined the likely effects of a further sharp drop in the dollar.

The firm's current forecast assumes the value of the dollar will be roughly flat over the next several years. If, however, the dollar fell by an additional 20% over the next eight quarters, the IHS model shows that exports in 2015 would be 12% higher than otherwise predicted. Unemployment would be 5.3%, compared with 6.7% under the steady-dollar assumption. Consumer price inflation would be 3.3% in 2015, compared with 2%."

----------------------...

Of course a computer model is not likely to be exactly right, but I think it's got the generally right idea. Anyone who follows the markets knows for the past 10 years that the dollar goes down when the stock market (and everything else) goes up. This didn't used to be the case but with US companies getting more of their revenue from overseas, and with that unlikely to change any time in the next few decades (and perhaps centuries), the public will have to get used to the fact that a falling dollar is a sign of an improving economy, not one getting worse.

BTW I don't think gas is going to $5 or $6/gallon any time soon. There is going to be a ton of new supply coming online in the next 2-5 years, and long afterwards too. But $3-$4 gas is probably here to stay.

re: interntional commodities, US Treasuries/the dollar.

and why. . .echos dyseconomics.

Of course denial goes well with a few bottels of Kindell Jackson Merlot. Oh sublime. . . Suggest you offer wheres the delight,

showing the way to realizing our bliss, then acheiving

the sublime.

Do you know where the wild rose grows, or do you

enjoy the pose while looking at the rose more than the rose.

Release your bias. . .

"when things do, on occasion, go badly it’s pretty easy to fix the problem due to ‘free money’ in the form of perpetually low rates"

- Are you advocating for this as a solution or merely stating it as the likely outcome? The solution here (irresponsible monetary policy )is exactly the problem - as I will explain below

"Despite the bailouts, two wars, and stimulus - income taxes have not increased a single penny since Clinton’s tax hike and they will probably never increase again thanks to huge demand for treasuries."

- How sustainable is this "huge demand" for treasuries? The Fed cannot go on printing money and buying treasuries indefinitely without disastrously undermining confidence in the USD. Furhtermore, we shouldn't make the mistake of assuming that foreign demand for treasuries is a God-given right. Over the long term, alternative markets of the necessary liquidity will emerge. Financial repression cannot continue indefinitely.

"What about China dumping treasuries? Japan and China, whose economies depend on exports aren’t going to begin a trade war by dumping treasuries"

- As per above, foreign worship of the holy "T-bill" is not a given. In particular, as China looks to moderate its dependence on exports and builds a more sustainable model with domestic consumption as a key component, China will be able to sell USD assets (including Treasuries) and allow the RMB to appreciate. A stronger RMB will be in China's interests long-term.

"But the increased spending on these inelastic goods will translate into pure top line GDP growth without impacting elastic goods such as computers, appliances, and apparel. Thus, surging living expenses helps the economy and stock market by forcing consumers to spend more on these inelastic goods."

- Consumers have finite spending power - if they spend more on inelastic items they will necessarily spend less on inelastic ones.

And now for my views ---

What really concerns me is the likely long-term economic consequences of an extended period of artificially low interest rates. I am afraid that current monetary policy is storing up huge trouble for the future and is sewing the seeds for a Japan-like scenario of low growth and deflation.

The Fed, through its various iterations of bond-buying (QE1, QE2, Operation Twist, recent talk of future sterilised bond-buying), is holding interest rates lower than they would be otherwise in a ‘free’ market, and this in turn is sending dangerous signals through the economy.

What is the economy apart from a complex series of price signals? And what is the purpose of the financial markets except to raise capital and direct it to where it will achieve the highest return? In a free market where the pricing mechanism works as it should – that is to say, not perfectly or even efficiently but you could say ‘sufficiently’ – the result is ‘efficient/sufficient’ allocation of capital, maximising economic growth for the long-term.

This entire system breaks down when central banks step in to ‘save’ the system, bail out businesses and hold down interest rates in the name of ‘recovery’. What they are doing is in fact preventing recovery and creating a zombie economy. Taking the example of interest rates, when the ‘cost’ of money goes down, business projects which didn’t make sense before suddenly look profitable. Over time this means a lot of new business ventures which – in an unsubsidised market – would never have seen the light of day. In the short term central bankers and politicians congratulate themselves, marvelling at their accomplishment and revelling in their genius.

In the long-term however, this hubris is inevitably exposed, and the Emperor is shown once again to be naked (being generous I might throw them a loin cloth or two). When market forces inevitably reassert themselves and rates rise, those businesses which survived only by suckling at the cheap money teat are exposed as frauds. In essence, they were zombie businesses, the walking dead, built on artificially cheap money.

The tricky part is that the effect of cheap money permeates the entire economy and we will not be able to tell the zombie businesses from the non-zombies until it’s too late. As they say, it’s not until the tide goes out that you realise who’s swimming naked.

Nick Hays

"The Long and the Short"

"when things do, on occasion, go badly it’s pretty easy to fix the problem due to ‘free money’ in the form of perpetually low rates"

- Are you advocating for this as a solution or merely stating it as the likely outcome? The solution here (irresponsible monetary policy )is exactly the problem - as I will explain below

"Despite the bailouts, two wars, and stimulus - income taxes have not increased a single penny since Clinton’s tax hike and they will probably never increase again thanks to huge demand for treasuries."

- How sustainable is this "huge demand" for treasuries? The Fed cannot go on printing money and buying treasuries indefinitely without disastrously undermining confidence in the USD. Furhtermore, we shouldn't make the mistake of assuming that foreign demand for treasuries is a God-given right. Over the long term, alternative markets of the necessary liquidity will emerge. Financial repression cannot continue indefinitely.

"What about China dumping treasuries? Japan and China, whose economies depend on exports aren’t going to begin a trade war by dumping treasuries"

- As per above, foreign worship of the holy "T-bill" is not a given. In particular, as China looks to moderate its dependence on exports and builds a more sustainable model with domestic consumption as a key component, China will be able to sell USD assets (including Treasuries) and allow the RMB to appreciate. A stronger RMB will be in China's interests long-term.

"But the increased spending on these inelastic goods will translate into pure top line GDP growth without impacting elastic goods such as computers, appliances, and apparel. Thus, surging living expenses helps the economy and stock market by forcing consumers to spend more on these inelastic goods."

- Consumers have finite spending power - if they spend more on inelastic items they will necessarily spend less on inelastic ones.

And now for my views ---

What really concerns me is the likely long-term economic consequences of an extended period of artificially low interest rates. I am afraid that current monetary policy is storing up huge trouble for the future and is sewing the seeds for a Japan-like scenario of low growth and deflation.

The Fed, through its various iterations of bond-buying (QE1, QE2, Operation Twist, recent talk of future sterilised bond-buying), is holding interest rates lower than they would be otherwise in a ‘free’ market, and this in turn is sending dangerous signals through the economy.

What is the economy apart from a complex series of price signals? And what is the purpose of the financial markets except to raise capital and direct it to where it will achieve the highest return? In a free market where the pricing mechanism works as it should – that is to say, not perfectly or even efficiently but you could say ‘sufficiently’ – the result is ‘efficient/sufficient’ allocation of capital, maximising economic growth for the long-term.

This entire system breaks down when central banks step in to ‘save’ the system, bail out businesses and hold down interest rates in the name of ‘recovery’. What they are doing is in fact preventing recovery and creating a zombie economy. Taking the example of interest rates, when the ‘cost’ of money goes down, business projects which didn’t make sense before suddenly look profitable. Over time this means a lot of new business ventures which – in an unsubsidised market – would never have seen the light of day. In the short term central bankers and politicians congratulate themselves, marvelling at their accomplishment and revelling in their genius.

In the long-term however, this hubris is inevitably exposed, and the Emperor is shown once again to be naked (being generous I might throw them a loin cloth or two). When market forces inevitably reassert themselves and rates rise, those businesses which survived only by suckling at the cheap money teat are exposed as frauds. In essence, they were zombie businesses, the walking dead, built on artificially cheap money.

The tricky part is that the effect of cheap money permeates the entire economy and we will not be able to tell the zombie businesses from the non-zombies until it’s too late. As they say, it’s not until the tide goes out that you realise who’s swimming naked.

Nick Hays

http://bit.ly/yD7fSG

Latest Followers

StockTalks

-

Buy the dips...profits & earnigns for S&P 500 companies still better than ever Buy AAPL BIDU NFLX PCLN AMZN AWAY UGA

Aug 28, 2011

More »Latest Comments

Most Commented

Posts by Themes