Aside from sex scandals and the occasional shoot-up, the news cycle has been tumbleweeds for much of 2017. The gaps between Trump administration events and progress are wide, and successes and far and few between.

The U.S. Yield Curve Is Flattening and Here’s Why It Matters

Bond Investors Are Stock Investors’ Latest Concern

Many on the left are hoping that a flattening of the yield curve will portend to recession and a decline in stocks, hence increasing the odds of Trump losing reelection. However, as the articles above show, such indicators are unreliable, but they don’t explain exactly why that is so.

In a video many months ago, Martin Shkreli said that the strength of the treasury bond market was indicative of an imminent decline in stocks. Bonds are often seen as a safer alternative to stocks, and investors will sometimes sell stocks and buy bonds during periods of panic, economic weakness, or uncertainly. So in Shkreli’s mind, the market was overpriced relative to bonds, and that bonds were acting as leading indicator for a market decline. Despite the outward appearance of superior intelligence and all his purported expertise on drugs and such, the second possibly never occurred to him, that bonds were overpriced relative to stocks. And that was the case; no later than a week after the video, the S&P 500 made new highs and the bond market fell precipitously.

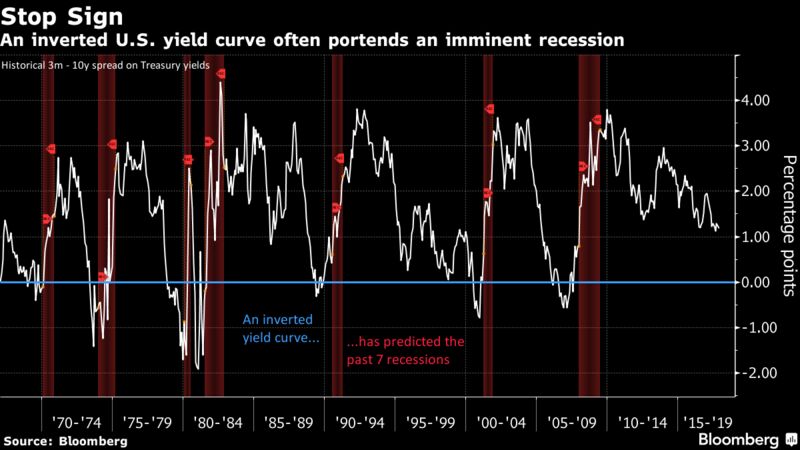

What about the flat yield curve? A flat or inverted curve is when the long-term rate (LTR) is equal to or lower than the federal funds rate (FFR). But there are two ways this can happen: if the LTR (10 yr. treasury bonds) goes down–or–the FFR goes up. If the FFR is high and the economy becomes weak, the LTR will fall due to (as I mention above) investors seeking the safety of treasury bonds. The LTR falls faster than the fed can lower the FFR (the fed is generally restricted to lowering rates during FOMC meetings, which are spaced many weeks apart). But the second possibility is that the FFR is rising but the LTR is not, either due to the fed being too aggressive or investors being sanguine about long-term inflation expectations. The media latches onto the first possibility, which fits with their political bias and agenda, but ignore the second, which is the most likely one given that none of the economic data portends to weakness but also because the fed is raising rates explicitly because they perceive the economy to be doing well.