Ross continues…”but cold hard economic data also suggest that ours was a uniquely blessed coming-of-age: a time of low unemployment, surging productivity, strong working-class wage growth — and all without a huge overhang of public and private debt;” however, the unemployment rate currently stands at 3.8%, which is as low as it was in the late ’90s, but the labor force participation rate is lower, as Ross notes. Also, the national debt relative to GDP was lower in the ’90s, too (75% of GDP in the mid-’90s compared to 115% of GDP today). But more importantly, and a detail the media always omits, the amount of interest paid on the debt as a percentage of GDP was much higher in the ’90s than today, because interest rates were high and the US economy did not have much that much real growth. The problem is the media, especially the anti-Trump liberal media is much more negative, so people’s perception of the economy is distorted and overly pessimistic.

Although pundits effusively praise Clinton for the ’90s economic boom, on an inflation-adjusted basis, the post-2009 bull market and economic expansion exceeds that of the ’90s, because inflation and interest rates have been so low for the past decade. Same for the post-2011 real estate boom. The job market may seem worse now than in the ’90s, and a study shows that “Net worth of Americans aged 18 to 35 has dropped 34 percent since 1996,” but smart millennials in computer science, math, econ, and finance are doing well. On Reddit one can easily find many of examples of millennials in the tech industry who are investing, are not broke, and are not struggling.

Although in the ’90s there was less student loan debt and college was cheaper, real wages for tech and finance workers were lower and the jobs were not as lucrative as they are today. One such example is an article that went viral I’m A Data Scientist Making $125K. Such a job didn’t exist in the ’90s , and her success runs counter to the prevailing media narrative that young people are always broke and struggling. Yes, many are, but many are not, especially in STEM fields. The short-term inconvenience in exchange for making a lot of money (especially if one keeps expenses low) makes it worthwhile in the long-run by being able to retire sooner. 10 years in a high-paying job that is not one’s passion beats 40+ years in a low-paying job and never having enough to retire. In fact, as part of the burgeoning ‘FIRE movement,’ there are thousands of 30 and 40-somethings who are retiring early thanks in large part to lucrative tech jobs, that in the ’90s either didn’t exist or had much lower pay on an inflation-adjusted basis.

The post-2009 tech boom and Bay Area housing market makes the ’90s tech boom quaint by comparison. A tech start-up being worth $30-100 million was a huge deal in the ’90s; now that’s just the ‘starting round,’ and valuations exceeding a billion dollars are increasingly common. Yahoo buying Broadcast.com in 1999 for $5.7 billion was considered the pinnacle of dotcom excess that at the time seemed inconceivable would ever be surpassed, yet just 15 years later, Facebook bought What’s App for $15 billion, which at the time was a smaller company than even Broadcast.com was. [Given that Broadcast.com was an immediate failure and write-off and now redirects to the Yahoo.com homepage, also makes it the most expensive domain name purchase of all time, too.] In the ’90s, to have a few million dollars was considered a lot of money and enough to retire anywhere in the world; nowadays, you cannot afford live in the most expensive parts of New York without at least $10 million. Homes in Silicon Valley are more expensive than ever and have much as quadrupled in price from the late ’90s. In the span of just 20-25 years, the concentration of wealth in high-IQ regions such as Silicon Valley and Manhattan has increased by over 5-10x despite the US economy itself only doubling in size. Of course, there is the irony that one of the wealthiest cities in the world also has the biggest public poop problem in the world, too.

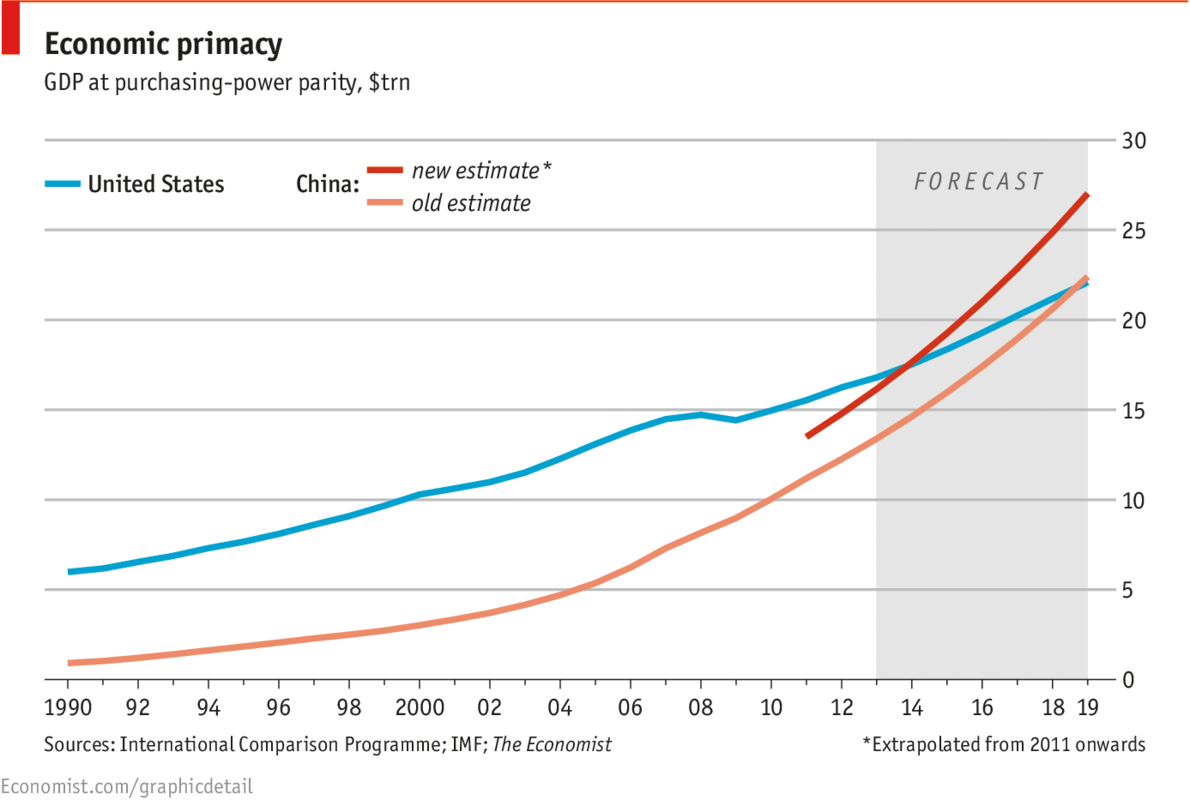

China’s economy went from being nearly insignificant in the ’90s to now being tied with the US as the biggest economy in the world:

No doubt, healthcare and education are more expensive, but the sticker price is not the same as what’s actually paid. Studies that purport negative millennial net worth, erroneously subtract student loan debt from one’s net worth, but student loan debt is not like other types of debt. After taking into account deferments, forbearance, scholarships, and other payment plans and programs, the picture improves a lot. As discussed in Student loan crisis: putting it in perspective, when one takes into higher account wages and lower rates unemployment, college debt may actually be a ‘good deal’ relative to other types of debt such as credit card debt, small business debt, mortgage, or auto. Regarding healthcare, one must take into account the quality of healthcare. Healthcare was cheaper generations ago but not nearly as good at treating advanced disease such as cancer, neurodegenerative disorders, and heart disease. To put it another way, imagine if someone who was alive in the 50’s were offered the opportunity to have access to modern healthcare; how much would they pay? Presumably more than they were paying for their existing healthcare, which although cheap was much more limited.

Furthermore, in many respects, living standards are markedly higher today for Americans then they were 20 years ago. In the ’90s, people paid $40/month or hourly for slow internet. They paid for an expensive cable plan, an expense phone plan, late fees at Blockbuster, etc. An iPhone or Kindle can consolidate all or most those things into a single device that in the long-run is much cheaper and more convenient than paying for a bunch of separate, inferior services.