The main thesis of Capital in the Twenty-First Century by French economist Thomas Piketty is that wealth inequality arises from capital growing faster the economic growth, summarized succinctly by his famous equation r>g.

Piketty bases his argument on a formula that relates the rate of return on capital (r) to economic growth (g), where r includes profits, dividends, interest, rents and other income from capital and g is measured in income or output. He argues that when the rate of growth is low, then wealth tends to accumulate more quickly from r than from labor and tends to accumulate more among the top 10% and 1%, increasing inequality. Thus the fundamental force for divergence and greater wealth inequality can be summed up in the inequality r > g. He analyzes inheritance from the perspective of the same formula.

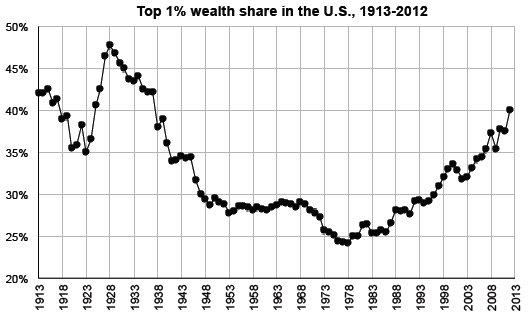

Income inequality as measured by the income of the top 1% in several countries. Inequality tended to drop in the middle of the century but has increased in the past several decades.

The book argues that there was a trend towards higher inequality which was reversed between 1930 and 1975 due to unique circumstances: the two world wars, the Great Depression and a debt-fueled recession destroyed much wealth, particularly that owned by the elite.[18] These events prompted governments to undertake steps towards redistributing income, especially in the post-World War II period. The fast, worldwide economic growth of that time began to reduce the importance of inherited wealth in the global economy.[18]

In the four years since its publication, Capital has generated significant criticism. Much of the criticism pertains to possible methodological errors, or whether wealth inequality is as important of an issue as Piketty says it is. But it’s hard to dispute that wealth inequality has widened notably since the mid 20th-century.

It’s not that Piketty is completely wrong, but my criticism, however, is that Piketty paints with too broad of a brush. When one applies the HBD-investing thesis, one finds many instances where r does not exceed g and that excess gains in capital are only limited to certain regions and industries, specifically high-IQ industries, countries, and regions.

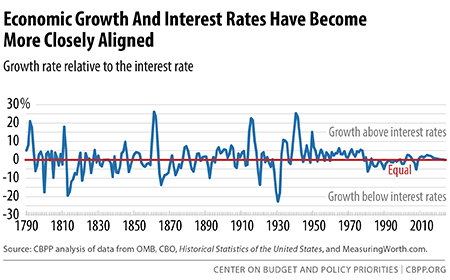

The r>g phenomenon is only limited to specific regions and sectors, namely Silicon Valley, Manhattan, tech, and financial sector, and America. Piketty only focuses on Continental Europe and the U.S., but many foreign countries have not seen such rapid and concentrated capital accumulation, especially when capital in a local currency is converted into U.S. dollars and adjusted for interest. Same for the energy sector and retail, which have also lagged. For example, home prices in Brazil are unchanged (and many regions are negative) since 2004 when local currencies are converted into U.S. dollars. But when one takes into account risk free interest paid on such dollars, the performance is even worse. For example, an investment in Brazilian stocks has since the 90’s lagged the compounded interest of 3-month U.S. treasuries–that is, someone who put $10,000 in 1995 in a U.S. saving account that invests in 3-month bills would have outperformed an investor who put that same amount into Brazilian stocks. This is due to the falling Brazilian Real relative to the U.S. dollar and high Brazilian inflation. This is also observed for other countries, such as Spain, France, Turkey, Italy, Argentina, and so on. If compounded 3-month U.S. treasury bills are used as a ‘benchmark’ for capital growth, as it turns out, many countries, regions, and industries underperform. This also means that capital not growing faster than growth, if interest rates are used as a proxy for economic growth:

Pickety’s mistake is that he fails to use an adequate benchmark for capital growth and he ignores that much of the world has lagged this benchmark. This means the very wealthy that live in these under-performing countries– Russian Oligarchs, Saudi Princes, Brazilian Petro executives, etc.– have not gained wealth even though the U.S. economy has grown. Silicon Valley, certain sectors of the 500, and Wall St. elite have seen enormous r>g gains, but not so much elsewhere.

Countries & regions where r>g (using my benchmark):

China

S. Korea

Singapore

Taiwan

Northern Europe (Nordic countries especially)

United States, specifically high-IQ regions such as Silicon Valley and Manhattan

Countries where it has lagged:

Brazil (much of South America)

Turkey (much of the Middle East)

Italy, Spain (much of Southern Europe)

Japan is a notable exception depending on when you begin recording data. If recording begins at the peak of the 1990 bubble, it lags enormously.

Industries and sectors where r>g:

Tech, web 2.0, financial services, healthcare, biotechnology, aerospace &defense, online and ‘big box’ retail, legal, medical, low-income service sector (such as payday loans) and fast food

Where it lags or is equal:

Energy, mining, commodities, auto, apparel