From Noah Smith Hey tech folks: The West is not failing. He’s right about all of these:

The notion that there is a “global American empire”, and that this empire is “ending”

The idea that the U.S. dollar is falling and will be replaced by either crypto or a BRICS currency

The belief that the U.S. economy is much weaker than the official statistics suggest

He’s not wrong:

“America is successful and will continue to rule the world but I hate it because it has drag queens.” Say that, and I’ll at least credit you with your honesty.

But most people can’t do that. They have to pretend like Russia is actually awesome. The rise of BRICS! It’s pathetic.

— Richard Hanania (@RichardHanania) June 25, 2023

Talk about the US ’empire’ ending, about de-dollarization, or the US economy being weak are wrong, unsupported by evidence, or premature. Sure, inflation is very high and may not be fully captured by the CPI, and also ignores hidden inflation such as shrinkflation–but relative to the rest of the world–the US still has less inflation compared to much of Europe, such as Germany and Turkey.

The belief that nations are autonomous entities outside of the sphere of the US influence, is obviously false. If anything, this influence has strengthened. A physical empire is not needed when influence is cultural, economic, electronic, legal etc. and the rest of the world kowtows at your whim. An obvious example of the US flexing its might is in regard to crypto regulation. Many countries have copied the US in this regard, and have cooperated with the US to extradite crypto fugitives, notably the Bahamas arresting Sam Bankman-Fried at the US’ request without delay or resistance.

A ‘woke military’ doesn’t do much to attenuate said influence when the rest of the developed and developing world is struggling, much weaker, equally woke, and has no imperialistic ambitions, unlike centuries ago. Not to mention, the US has made significant progress in autonomous warfare such as drones (like the 2020 assassination of Qasem Soleimani ) which does not necessitate needing a ‘manly’ military anymore.

If Balaji tweeted it you know it’s gonna be stupid or wrong, and this is no exception:

One Biden appointee said “the government needs to drop its commitment to maintaining the dollar's reserve-currency status”

Another now says “crypto appears to have staying power as an asset class”

They’re gradually conceding on de-dollarization and decentralization. https://t.co/0vieNaNd4y

— Balaji (@balajis) June 21, 2023

As shown below, the dollar was so strong in 2022 that much of the gains are still intact:

The dollar is still 7 percent higher today compared to early 2022, so I am not sure where this ‘dollar collapse’ narrative is coming from. Look how much the Turkish Lira has fallen for example. Look how poorly ‘dollar alternatives’ such as Bitcoin have performed recently. Or the Yen. These people have a long history of being wrong and being impervious to feedback or criticism, so why should they be taken seriously now?

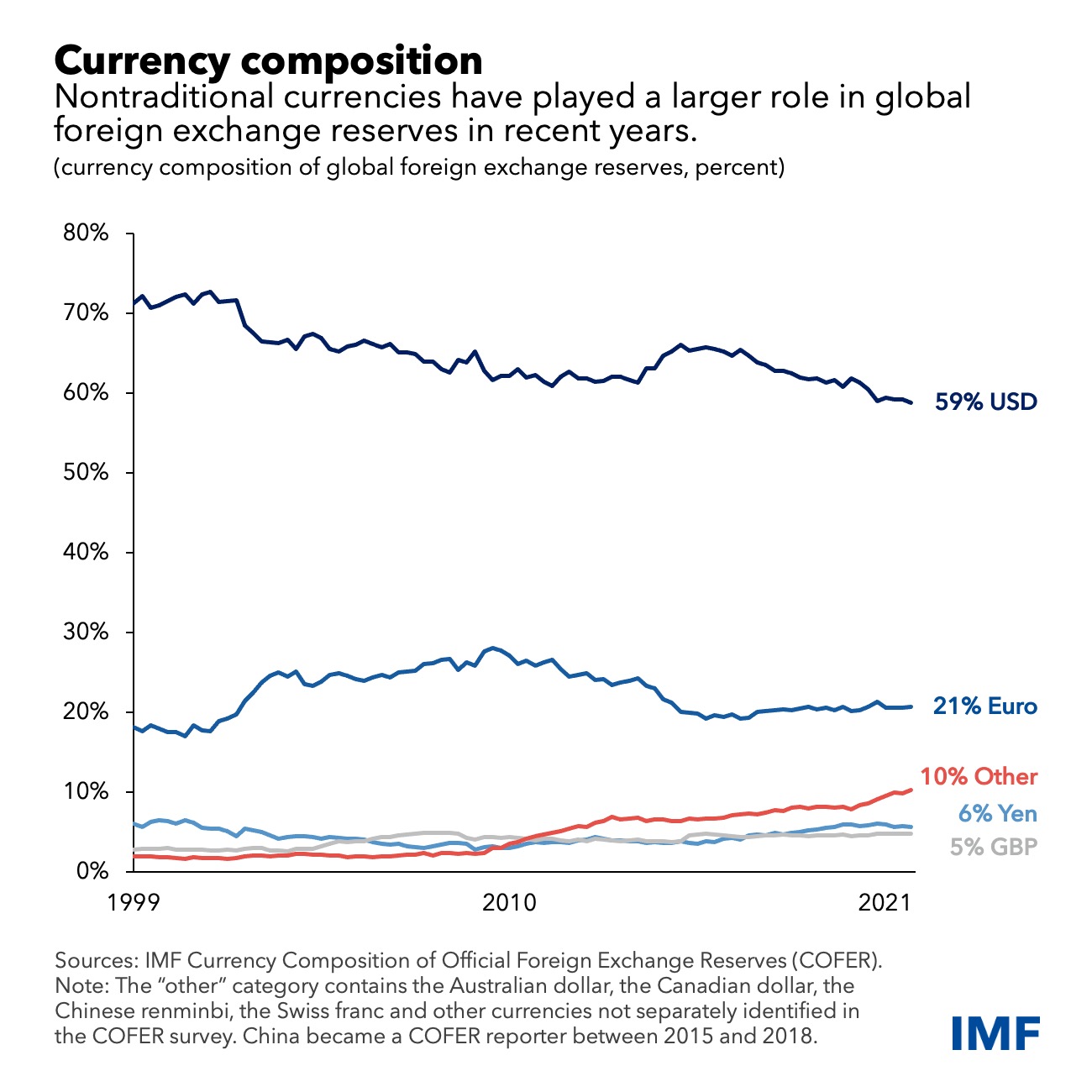

Much of the alleged de-dollarization is a small uptick of ‘other’ currencies, not major competing currencies such as the Yen, Pound, or Euro:

Overall, de-dollarization is yet another ‘current thing’ or meme. It begins by smaller social media accounts and outlets coining a neologism, which goes viral and is picked up by the mainstream media even if there is scant or no evidence to back it up. It then keeps spreading until the public loses interest or it’s replaced by the next new thing that captures the public’s attention. Again, there is no evidence to suggest this is happening.

It’s been true that lot of people gone broke betting against USA also true markets can be wrong longer than you can stay solvent betting against USA.

But Russia is kicking living shit out of western weapons systems and able to resin ply its own at order of magnitude faster. This is really important cuz dollar is only backed by USA military capability. Additionally we have sucked at urban and jungle war for ever.

The debt is insane and they’re trapped and everyone is pissed at our fag values etc. just blew up europes oil pipes and about to blow a nuclear reactor. We have zero rule of law and most corrupt govt imaginable.

But yeah there’s no easy replacement for dollar at this point. But there’s a lot of will to escape it so it’s gonna happen and without 9/10 dollars held outside that debt becomes crushing and only that debt can pay for the millions of mud people Jew imports for protection and the shit weapons wasps sell people govt. did I mention falling national IQ

YOURE RIGHT ONLY IN SO MUCH AS THERES A LOT OF RUIN IN A NATION BUT BEEN CONSOLING OURSELVES WITH THAT FOR LONG TIME DEBT CLOCK WENT UP ALMOST 50 years ago. And btc actually would do well for large transnational transactions in fact it’s already doing that. It’s clear many nations are stocking up on gold not mortgaging house to by more metal and btc but I got my stacks