NYC Housing Market Report: Rent Prices Are Skyrocketting

The median rental price for Manhattan is now at an average of $4,050, which is $800 over what it was just a year ago, according to the eye-opening June market reports compiled by Douglas Elliman and Miller Samuel. Specifically, the average rental price in Manhattan has reached $5,000 for the first time in Big Apple History. The median rent is the mid-point value of the total price samples. Average rent is the sum of all rents divided by the number of the sample size.

In August 2020 during the peak of Covid panic, James Altucher’s article NYC is dead forever went viral. I took the opposite position (for some reason I felt compelled to write five article about it) that NYC was not dying and that prices would recover fast, and as usual was right.

After a dip during Covid, rent prices are back at record highs (sale prices are flat, so it’s not like the market crashed as he predicted):

Social media hype by Richard Hanania and others about supposed high crime in NYC and SF is not enough to deter buyers. Prices keep going up in the Bay Area:

Pinker and myself are right about crime. Rather than falling for social media hype and confirmation bias, it’s better defer to the aggregate data across all cities, not just cherrypicked cities. The trend is clearly down (for California for example), including 2020-2021 and Covid:

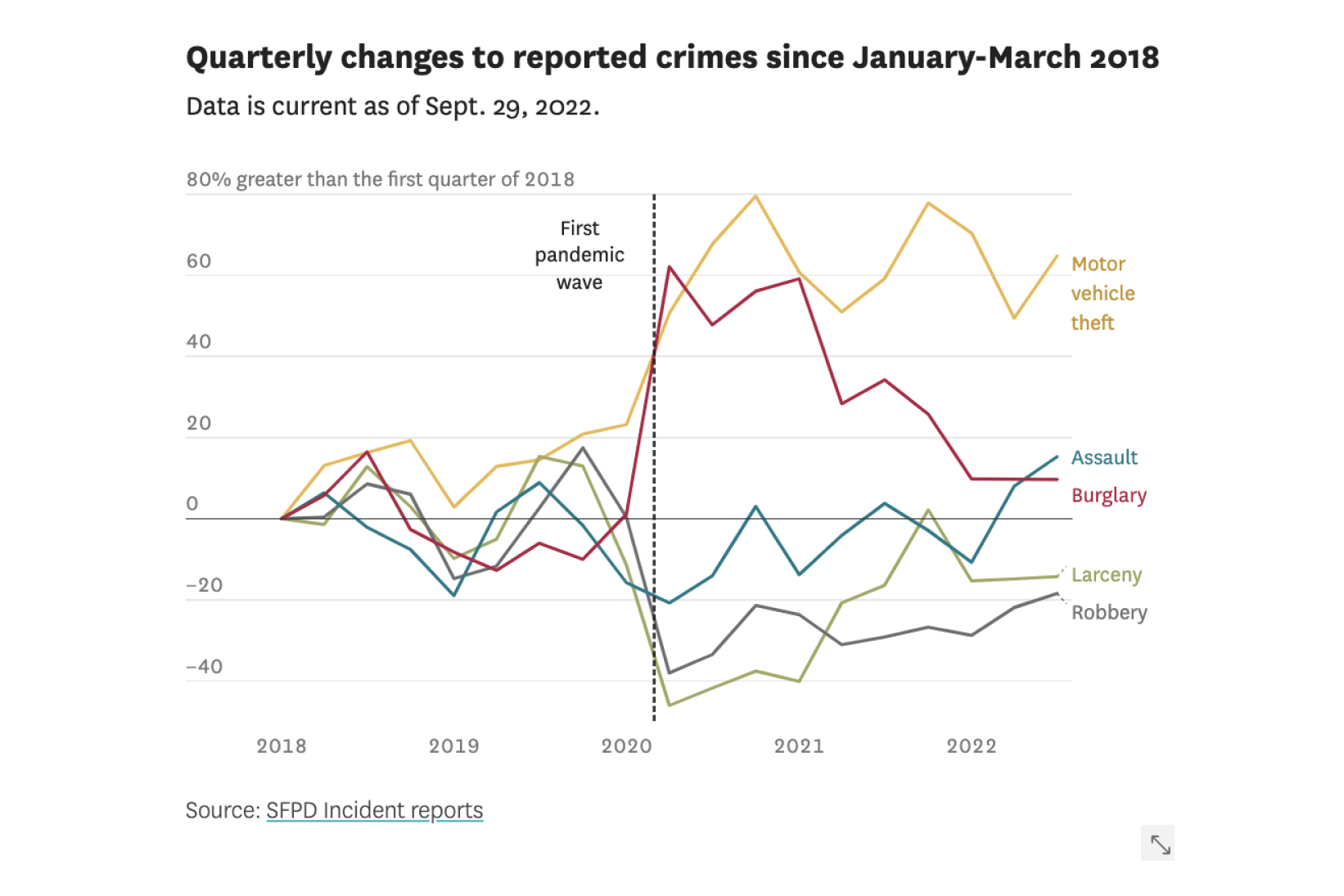

And crime in SF is back to pre-Covid levels after a small spike:

California’s spike in homicides post-Covid, tracks the rest of the nation:

Even if there is a lot of homelessness in the Bay Area, which is a big problem, there are many factors at play buoying prices, such as scarcity, capital inflows, economic opportunity, good weather, convenience (such as walkability), and the general ‘niceness’ and amenities of living in a high-IQ, high-trust area. Not to mention, ‘red’ areas tend to also have plenty of drug use, diversity, homelessness, and other problems. If we assume that cheaper red areas are objectively better than expensive blue areas, then prices should eventually equalize, yet this has not happened.

But regardless of who is right about crime, yet again calls or pronouncements of a real estate bubble or crash keep being premature. Or making financial decisions based on social media sentiment is not a good idea.

The homeless issue is actually a non issue. Colombia, a poor country, already solved it with CIA help.

A concerted effort to clean homeless from main cities can be finished within 24 hrs, with no trace by the next morning.

Robberies probably aren’t reported anymore, for stores at least. They are probably up there is vehicle theft. Thieves don’t need to rob houses and people anymore.

Prices are going up in white-majority areas in general. Whites are slowly being corralled into smaller functional zones, therefore these areas are more desirable. Cities like 65% black Baltimore are collapsing house prices.