Inflation is in the news again

Inflation rises at 5.4% yearly pace in September, CPI shows, and stays at 30-year high

The pace of inflation over the past year, meanwhile, edged up to 5.4% in September from 5.3% in the prior month. That’s more than double the Federal Reserve’s 2% average target.

As many have noted, the CPI probably underestimates the ‘true’ inflation. Energy, rental cars, gas, food, college tuition, healthcare, rent, real estate prices, insurance, daycare etc. by some measures have all exceeded the ‘official’ CPI.

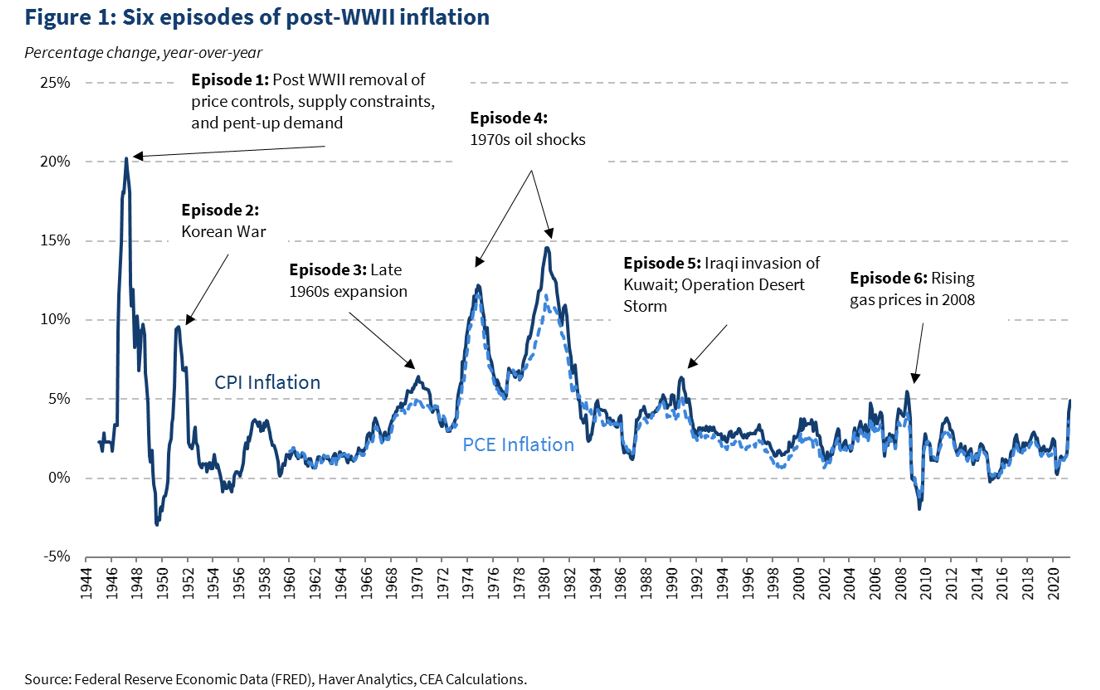

To put this in context, year-over-year inflation still still well-below the 70s:

Also, this 5% gain is just for a single year. In the ’70s and ’80s inflation was not only high, but prolonged over two decades, so the percentage price level increase was much greater.

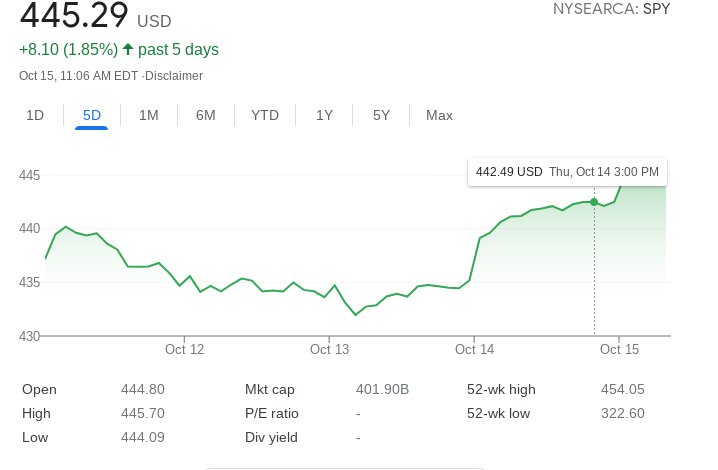

In the past 2 days the S&P 500 has gained around 2.5%, which is enough to negate a year’s worth of excess inflation above the baseline of what is considered ‘normal’ (5%-2.5%).

This goes to show the unrivaled power of the stock market to hedge inflation. People are losing their minds over inflation, but simple hedging strategies, whether it’s stocks or long-term mortgages, work great. When the market is up 25% year-over-year, who cares about 5% inflation. I would strongly advise staying away from precious metals (such as silver or gold) or Bitcoin as a hedge, as these have proven to be too volatile and unreliable.

I would agree with the general sentiment online that surging inflation hurts the poor, who are unable to take advantage of rising stock prices or cheap 30-year mortgages, and by having to constantly piss away money on rent, which often exceeds the CPI. It is commonly assumed that rising inflation helps borrowers, but lenders shield themselves from the risks of high inflation by jacking up borrowing costs to cover anticipated inflation. So if a credit card company charges 20% interest in a low-inflation environment, and they expect 6% inflation next year, they will raise interest rates to 27-30%.

Not surprisingly, seeing weakness in Biden’s approval ratings and an opening for attack, conservatives are blaming Biden for this inflation, although in fairness I don’t think it would made a difference under Trump either. The president is very limited in his ability to control inflation, either to raise it or lower it.

The post-Covid recovery is stronger than anyone, myself included, could have ever foreseen in early 2020, when it seemed like the world was falling apart. The expectation was that it would take years to recover lost GDP, consumer spending, and corporate profits and earnings from the depths of Covid, yet GDP and other metrics by late 2020 and early 2021 staged a v-shaped recovery. Even with super-accommodative fed policy and trillions of Covid aid/stimulus, this huge and sudden recovery came as a major surprise to economists and pundits everywhere. It was assumed that things would just muddy along for years as the nation slowly recovered from Covid, but that was not the case.

If hundreds of random people today were polled about how much U.S. GDP recovered from Covid, few, if any, would answer “all losses and then some”. Even I wouldn’t have known until I looked it up myself to write this article. It’s mind-blowing how quickly things recovered.It defies what was thought was possible. It goes to show how in crisis or boom times, the U.S. keeps coming out ahead.

The ‘meme stock’ craze took over by January 2021, further helping to inflate prices. Although Covid cases would continue to surge by late 2020 and then again by summer 2021 in spite of vaccines, the economic losses of these deaths and cases proved insignificant. Covid has not put a dent in the propensity of people to shop on Amazon and at Walmart, to rage about politics on Facebook and Twitter, to go to the movies, to click on Facebook and Google ads, to buy homes, to stream Netflix, to buy Teslas, to go to Disneyland, etc.

So this unexpected, v-shaped recovery not surprisingly caused acute shortages everywhere and inflation to spike, as capacity and labor had been cut in anticipation of a multi-year post-Covid slog.

Domestic oil production likely would not have risen under Trump. Gas prices also rose from 2016-2019 under Trump, and Trump didn’t make energy affordability and independence a major part of either his 2016 or 2020 campaigns . Had Trump won in 2020, it’s unlikely he would have done anything, and even if he wanted to, his options would have been limited anyway

The options of POTUS to lower inflation are limited to raising taxes, cutting off stimulus, or compelling the fed to aggressively raise interest rates. Such solutions would probably also cause the stock market to fall, particularly by raising interest rates. As president, Trump was obsessed with the stock market, so raising rates or raising taxes to stem inflation at the cost of the economy and stock market, would without a doubt be off the table had he won in 2020. Like Biden, Trump was fully onboard more stimulus spending and forever-low interest rates. Raising taxes and cutting stimulus would also be politically unpopular, either under Trump or Biden.

I think most people if given a choice would choose high inflation, some shortages, a strong economy, and rising stock market, versus a weak economy, a falling stock market, and low inflation, which explains the apparent lack of urgency of the Biden administration to do anything about inflation even if the media is making it seem like a crisis.