For the past 2 months, I have been seeing many discussions and references to the website “WTF Happened in 1971?” (wtfhappenedin1971.com), which purports to show how society underwent drastic societal and economic change around 1971.

If I was going to make a similar website, I would put the cut-off point as recently as 2008, as when society underwent drastic societal and economic change. I would divide it into the pre-2008 period and the post-2008 period, because that is really when the US began to pull ahead of the rest of the world economically and solidified its dominance, and the fed and other central banks began to implement 0% or lower interest rates, which in the pre-2008 era seemed inconceivable. Also, 2008 saw the election of Obama, who I think engendered an era of increasing radicalization of the American-left (such as the rise of ‘cancel culture,’ antifa, BLM, the censorship and de-platforming of academics, and loss of creative freedom, whereas in the pre-2008 era its was conservatives who were considered repressive, and it was liberals were defenders of free speech), and the increasing polarization of US politics.

Although, for generations, America has always been divided into a left-right dichotomy, this division seems to have intensified under Obama, who by virtue of his skin color made race a focal issue even if unintentional (but also intentionally, such as Obama invoking the likeness of his hypothetical son to Treyvon Martin, who was killed by ‘white-Hispanic’ George Zimmerman–a case that further exacerbated such division in America, and made worse by Obama taking a side). The Obama presidency had the effect of dividing America, not just in terms of the issues, but along implicit racial lines and identity, as many whites perceived Obama as embodying or conveying anti-white sentiment, and likewise many blacks became increasingly distrustful of Whites. Groups such as the Tea Party, antifa, and BLM rose in the early 2010s, as evidence of increasing division. Obama’s presidency seemed like a step backwards, in contrast to Clinton, who had the effect of mending race relations, especially after the 1992 Rodney King riots. Now, 18 years later, cities are burning again. Even if there is less crime than ever, as noted by Steven Pinker, it feels like America is on the precipice of blowing up, if it hasn’t already.

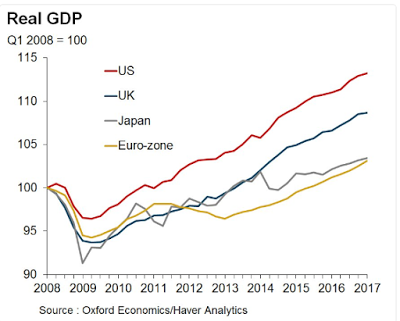

Economically, a characteristic the post-2008 era is America solidifying its dominance globally in the aftermath of the 2008 crisis; for example, the increasing strength of the US dollar relative to the Euro, Pound, and emerging market currencies, whereas pre-2008 the US dollar was not that strong or such strength was cyclical. During the crisis and its aftermath, from 2008-2010, many pundits predicted a ‘post-America era’ or that America would take a backseat to Europe or China , but the opposite has happened, with America pulling way ahead of the rest of the world (with the possible exception of China) in terms of GDP growth, stock market gains, cultural and economic influence (such as Hollywood blockbusters grossing billons of dollars overseas, and rich Chinese flocking to the safety of the US housing market, pushing up up prices in Seattle and the Bay Area, to the chagrin of the media, who for years have been complaining about housing being unaffordable, a 180-degree change in sentient from 2008-2011 when everyone was talking about falling prices), and tech innovation. Europe initially seemed to have exited the 2008 crisis in better economic shape compared to the US, but since 2010, similar to Japan’s 3-decade-long slump, has entered a period of prolong stagnation.

As shown below, since 2014, the US dollar index has been very strong. Although we cannot say how long this will last, I predict the dollar will remain strong for many years, even decades, to come. The Euro/US exchange rate, now at 1.17, will likely never revisit its pre-2008 highs.

Increasing global uncertainty due to Covid and other factors, but also the weakening of foreign and emerging market economies, will likely create a strong demand for the dollar and treasury bonds due to ‘flight to safety’ trade, for the foreseeable future. As bad as the US may seem–with BLM protests, increasing Covid cases and deaths, increasing political division and uncertainty about Trump, Biden, and China–much of the rest of the world is even worse in terms of economic weakness, unrest, and uncertainty.

For example, in July-September during the so-called ‘second wave’ of Covid cases, Trump was criticized heavily by the media and blamed for the resurgence of cases, but now Germany, Denmark, Spain, Norway, and other European countries, which were praised earlier in the year for seemingly having the virus under control, have all experienced massive second waves. Germany is now seeing record number of new daily cases, so this shows how even countries that initially seemed to be doing better than the US, have also succumbed to second waves. Moreover, as discussed earlier, the stock market indexes of countries with fewer per capita Covid deaths as the US, such as Germany, have not outperformed the S&P 500 since the pandemic began.

So this counters two media narratives: that the US handled Covid exceptionally poorly compared to the rest of the world [Germany’s second wave shows that either Covid is very hard to contain regardless of competence or lack thereof of leadership and that second waves are inevitable; and or, that if Trump handled it incompetently, so did other leaders, but only that such incompetence manifested itself later (in September, October) rather than sooner (June, July) due to second waves being prolonged and delayed rather than averted completely. Germany was never able to prevent a second wave, but only delayed it due to aggressive social distancing measures early on]; and the second narrative: and that the US economy is lagging or weak due to Covid (if we use the S&P 500 as a proxy for economic health). As discussed above, S&P 500 performance post-Covid is equal to that of Germany, which has had 80% fewer per-capita deaths as the US. The same pattern also holds for Sweden. But also, the S&P 500 made new highs in October, as further evidence of Covid’s impact on the US economy only being temporary. So even if the media is right and Trump handled Covid poorly, the US economy still came out ahead of the rest of the world as further evidence of America’s economic dominance and strength in the post-2008 era, that even Covid could not undo.

Low US treasury yields, even lower than in the early 40s; but more importantly, how low yields have become permanent and the ‘new normal’. This trend has also been observed globally, with Western European countries such as Germany also having permanently low interest rates, even negative rates:

Permanently low inflation, but coupled with strong real GDP growth. Just as interest rates are permanently low in the US, so is inflation, but unlike Western European countries or Japan, there is no deflation, and real US GDP growth remains strong, at 2-3% a year [The assumption by Krugman and other Keynesians is that low inflation must come at the cost of growth. This has been the case with Japan, but not the US]. This may not seem like much, but 2% real GDP growths exceeds that of South American economies, much of Europe, Japan, Turkey, the Middle East, Russia, and much of Asia. Sure, such the economies of the of the aforementioned countries may have more nominal GDP growth, but also much more inflation and collapsing or weak currencies, so the real, US-dollar adjusted growth is either flat or negative. Moreover, since 2008, the S&P 500 has also outperformed all foreign peers by a huge margin.

As shown below, in terms of real GDP growth, the US has outperformed all developed economies since 2008 by a considerable margin:

Meanwhile, in spite of trillions of dollars of spending under Trump and Obama (and endless predictions by the likes of Peter Schiff about dollar collapse, hyperinflation, and so on)–such as the 2008 bank bailouts, The American Recovery and Reinvestment Act, Obamacare, the Covid stimulus and bailouts, defense spending, healthcare, and much more to come–inflation just refuses to budge , at around 2% year. This is partly due to insatiable demand for low-yielding US debt, as creditors (such as pensions, corporations, wealthy individuals, sovereign wealth funds, and institutions) have nowhere else to park their money, and also that such spending is not really entering the US economy in terms of activity, but rather is being parked/saved or used to pay down existing debts. For example, in regard to the CARES Act, according to the NBER, “US households report spending approximately 40 percent of their stimulus checks, on average, with about 30 percent saved and another 30 percent used to pay down debt.” When Trump in early 2018 announced tariffs against China, the economic consensus at the time was that this would hurt the US economy and or cause high inflation. The media was, yet again, wrong on all counts: inflation did not budge, there was no trade war, there was no recession, and the stock market would go on to make new highs not long after.

As the rest of the world stagnates, since 2008 especially, the US has also pulled way ahead in terms of innovation and tech dominance, with mega-sized tech and retail companies such as Tesla, Google, Apple, Walmart, Visa, PayPal, Nike, Amazon, Zoom, Space-X, Facebook, Microsoft, Netflix, Uber, etc., having either been founded since 2008 or have seen their dominance and and market capitalization surge since 2008, even relative to the S&P 500. The Nasdaq, which is composed of such tech companies, is the best-performing index of any developed economy since 2008 by a huge margin, and even exceeding its 90s performance even after factoring in the 90s tech boom (and such performance is magnified even more so by a backdrop of very low inflation, whereas inflation was 5-6% in the 90s, versus 2% now). Same for China, which saw the rise of Alibaba, Baidu, ByteDance (parent company of TikTok), TenCent and other hugely influential and dominant tech companies since 2008. Meanwhile, since 2008, there have been few non-American or non-Chinese equivalents, with the exceptions of Spotify (founded in Sweden) and Shopify (founded in Canada). In the pre-2008 era, financial services and housing played a larger role, both terms of the composition of the S&P 500 and role the US economy, but since 2008 housing, commodities, apparel, and other sectors have been eclipsed by tech. Due to Covid–Amazon, Shopify, and Walmart have largely supplanted smaller, struggling US retailers, although this trend long predates Covid.

The widening of the US college wage premium, and widening of the wage and employment gap between college grads–especially grads with advanced degrees–and everyone else. Although this trend precedes 2008, as far backs as the 80s, it has accelerated since 2008. Many of the jobs lost in 2008 were low-skilled and low income , such as construction. The 2014-2016 collapse of the fracking, oil, and natural gas markets, also saw similar layoffs of low or semi-skilled blue collar workers:

2020 saw a similar pattern of low-skilled workers being the most vulnerable, with low-skilled workers being the first to be fired and the last to be rehired. Meanwhile, since 2008, STEM wages and jobs have been on an uninterrupted upward trajectory, largely immune to Covid and the 2008 recession; but not just higher wages and low unemployment , but also windfalls from stock grants and buyouts. Many tech workers, epically in the Silicon Valley, were given the luxury of working from home for full pay, while service sector workers were fired or forced to work in conditions that heighted their risk of contracting Covid. Amazon, Uber and Walmart have boomed since 2008 and employ a lot of low-skilled workers, but working conditions and pay sucks, and inflation-adjusted wages are at multi-decade lows for these workers (not just Amazon and Walmart, but this goes for almost all low-skilled work).

Pre-2008 you did not need a 4-year degree to enter the middle class, as construction, automotive work and other blue collar professions paid well relative to living expenses, but expenses such as healthcare, rent, insurance, childcare, phone data plans, cable bill, and college and high school tuition have increased in spite of low inflation. The CPI does not capture how rent prices have surged since 2008, with Covid providing only a tiny and temporary respite from nosebleed rent prices. More than ever, due to regulation that makes to hard to evict or discrminate against potentially unprofitable tenants, landlords require huge, multi-month deposits and credit checks, further making it hard for low-income workers to find affordable living. Airbnb, another hugely successful and influential post-2008 tech company, has possibly contributed to housing shortages in the Bay Area and elsewhere, as property owners can make more money with short-term rentals, compared to multi-month leases. Supposedly, Covid has hurt Airbnb and the rental market, but I predict it will be temporary and things will quickly go back to how they were pre-Covid. There is simply too much demand and not enough supply in many of these urban areas.

But not only have tech workers, tech VCs, and tech founders have thrived since 2008 and especially since Covid, but so have the ‘professional, creative, and managerial class,’ such as doctors, specialists, bureaucrats, bankers, lawyers, social media personalities, ad and publishing executives, media personalities, consultants, and tenured academics, with employment prospects, demand, and inflation-adjusted wages, for such professions the strongest it has ever been. In spite of record student loan debt, professionals still stand to earn more more over their lifetime than individuals without a degree. Sure, doctors may go hundreds of thousands of dollars into debt, but they by their 30s they earn it back and then some. The fact that the college wage premium keeps widening, is evidence, contrary to the media narrative of college being ‘too expensive and bubble,’ is a ‘good deal’ provided that you finish and major a lucrative field such as computer science or finance, even in spite of student loan debt.

In 2014, I wrote that were was no college bubble. 6 years later, the prediction is still correct. Even with Covid, tuition and demand refuses to fall, and the wage premium keeps rising:

This is not surprising. In the hyper-competitive post-2008 economy, for virtually all industries the supply of labor vastly exceeds demand, especially as shown by the record low labor force participation rate. This gives employers the luxury of being very selective when hiring, by only hiring the best and the brightest from a huge applicant pool – even for very mundane jobs. You need to have the credentials that 40 years ago would have gotten you a job at NASA just to file paperwork or wait tables. The premium for prestigious schools in STEM majors is even greater. I agree with the washingtonpost.com article that there will be no bursting of any alleged ‘bubble’ and prices will just keep rising.

From the post The revenge-of-the-nerds economy (in 18 charts), you can see how real wages for non-STEM work began a precipitous decline starting in 2009 or so:

Due to the above factors, since 2008, the US labor market has become increasingly bifurcated (the so-called hollowing-out of the middle) between two extremes: well-paid creative and professional work on one extreme, and low-paid service sector work on the other, and not much in-between.

The underlying factor appears to be IQ, in that IQ has increasingly, since 2008, become a sorting mechanism for who succeeds or falls between the cracks in our increasingly competitive yet prosperous society. High-IQ people, more than ever, thanks to lucrative STEM and professional-class jobs, permanently low interest rates, and the biggest and longest bull market in equities ever, have more opportunities than ever to accumulate and compound wealth, whereas those with average IQs have much more limited options for wealth creation, partly because living expenses relative to wages are high enough that such individuals do not have much money left over, after expenses, for investing. Consequently, wealth inequality has also widened since 2008 to widths never before imagined. In the aftermath of Covid, the wealth of billionaires increased substantially, especially the CEOs and founders of major tech companies such as Amazon and Apple. In summery, it would seem the post-2008 era has accelerated many of the pre-2008 trends, whether it’s wealth inequality, the importance of IQ as it pertains to individual success, rising college tuition and healthcare costs, technological innovation and the dominance of large tech firms, political division, and the US economic and cultural hegemony.