On August and October of 2019, I predicted the stock market would go much higher, and that the fed lowering rates in an expansion was unprecedented and extremely bullish. So far, with the S&P 500 up 8.6% since October, it would seem I was right yet again.

Interest rates are at just 2%, versus 6% in 2000, 6% in 2006, and 10% in 1987, which were prior market peaks. It may be at least 5 years before rates bump against the upper-end of the cycle, around 5%, and then another 3 years for the market to finally crest. Until this happens, the S&P 500 can easily post 15% annual returns (including dividends). But this is just the minimum. If we’re in a new economic paradigm, which I think is possible given the unprecedented duration of the economic expansion already, it may be decades until there is another recession and bear market. It’s possible we have reached a stage in capitalism and monetary policy that increasing efficiency, productivity, and corporate profits, as well as forever-low interest rates, may make market and economic cycles a thing of the past. There is no rule set in stone that economies and markets must cycle. Some might scoff at this, invoking oft-cited failed prediction before the Great Depression of a ‘permanently high plateau’ for stock prices (attributed to economist Irving Fisher), but a single datapoint of hubris doesn’t actually disprove the possibly of a new paradigm. Things do change, for example, how the industrial revolution and assembly lines marked a new paradigm for manufacturing.

The data shows, what some economists have called the ‘great moderation’, that expansions have gotten longer since the ’80s, and the current one, now 9 years with no hint of slowing, is the longest yet and further empirical evidence that market and economies need not have to cycle:

13% annual compounded returns (this is just for the index itself. the total return, which includes dividends, would be 15% based on past analysis of dividend data) gives a 165% gain for the S&P 500 [1], or a target of around 8,400. Also, I’m expecting 25% annual returns for tech stocks such as Microsoft, Google, Apple, Facebook, and Amazon, which will be worth $2-3 trillion apiece. Telsa will be worth $250 billion, minimum, versus $60 billion now. These numbers may seem outlandish, especially Amazon and Facebook being worth $2-3 trillion each or the S&P 500 gaining 165% in just 8 years, but keep in mind that few (as in maybe one or two people, myself included) foresaw in 2009-2014 that the post-2009 expansion would last so long, nor did anyone in 1995 foresee that the S&P 500 would triple in just five years from 500 to 1,500, yet it did.

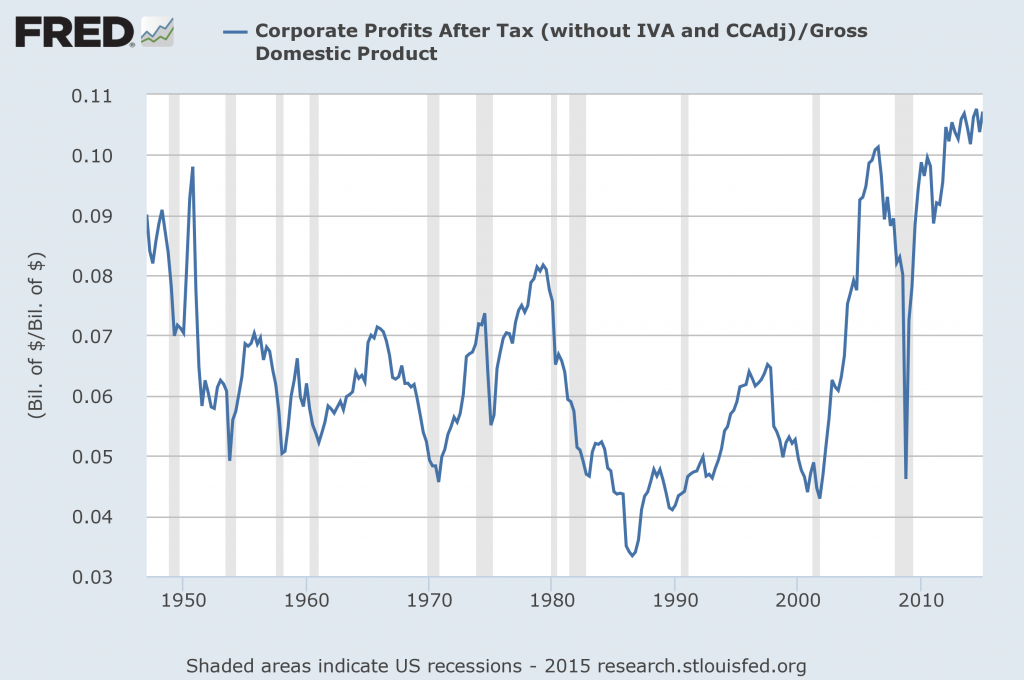

But unlike in the ’90s, corporate profits are much fatter and interest rates are much lower. As shown below, corporate profits relative to GDP was falling by the late ’90s:

When the market finally peaked in 2000, interest rates were at 6% and profits were contracting, yet today profits are expanding and rates are falling. Greenspan, despite his ill-earned reputation for being reckless, by the late ’90s was trying to rein in the economy by aggressively raising rates (which the media ignores, instead only focusing on his supposed responsibility for the 2008 housing crisis). But, here, today, we have Powell trying to accelerate the economy by lowering rates.

[1] If the expansion lasts at minimum 8 more years until the interest rate cycle peaks, and given 13% annual returns for the index, I extrapolate a target of 3150 * 1.13^8=8375 for the S&P 500. However, if one just buys and holds, there is no need to worry about exact targets. Even 6-10% annual returns would still be better than cash, which yields 2% or, in other words, a real return of around 0%.