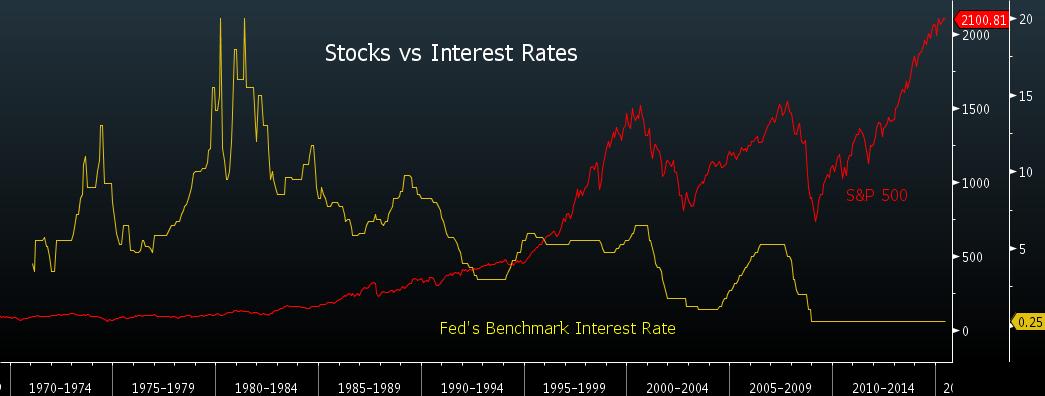

The first rate hike in almost a decade is expected this week. Historically speaking, rate hikes are not always bearish for stocks, provided rates don’t go up too much too quickly. But because the fed has been dovish for the past three decades, not hawkish, that should be a concern. In the 90’s, the S&P 500 rose 400% despite high interest rates. Same for the 2002-2007 bull market, which was undeterred by rising rates:

A cursory observation of the chart above shows that in 2000 and in 2007, stocks entered a bear market after interest rates exceeded 5%, but 5% is a long way from now. There are plenty of reasons for the fed to raise rates very slowly, or not at all, such as:

1. A labor market that, while improving, is far from overheated. Labor force participation still very low, wage growth is also sluggish.

2. Low CPI-based inflation:

(Yes, I’m aware of other types of inflation and the potential flaws of the index, but the CPI index is among the most important indexes used by the fed in determining policy.)

CPI hasn’t budged much despite record high stock prices.

3. Oil prices keep falling, acting as a deflationary force.

4. Weakness in foreign markets, particularly Western Europe, Russia, Australia, China, and South America.

5. Strong US dollar, which is also deflationary.

6. Monetary velocity still at rock-bottom levels:

7. Private residential construction spending is well off the 2006 highs

8. US GDP growth is below the historical average

I would not be surprised if the fed does not raise rates this week, choosing to delay rate hikes yet again to the dismay of many.