The topic of delayed family formation often comes up in the news, but especially on online discussions such as Reddit:

Why are so many Americans delaying having children, or not having any at all? I posit workaholism is at the root of this problem. Rather than ‘amusing ourselves to death’, it’s more like we’re working ourselves to death.

In the post Why Americans Work So Much I give some reason for why Americans work so much. In summary, people are working longer and delaying family formation, especially in the US, because the returns to careerism, such as income and status, have never been greater. Thanks to the post-2008 boom in white-collar salaries, stock prices, and real estate (due to cheap mortgages and low interest rates), household net worth has surged. According to a report by The Federal Reserve, Between 2019 and 2022, the median net worth of U.S. households surged 37% to $192,900, according to the report. The mean is around 1.06 million.

First, it found that the average American household’s net worth is over $1 million. Outliers can distort averages, of course, but even median household wealth is at the Fed’s highest level ever recorded. In 2019, it was still stuck below pre-Great Recession levels. By 2022, however, it had reached $192,000, eclipsing the 2007 mark by more than 10 percent, and almost doubling the post-Great Recession 2010 figure. (These and all subsequent data are adjusted for inflation.)

This creates an incentive to maximize working hours and necessary credentials for the attainment of wealth and status. Climbing the corporate ladder means decades of increased earnings power, which may not be possible if family formation is prioritized.

The marginal returns for each year of family formation deferred peaks in one’s early 20s, so delaying having children at 22 after college, confers greater returns than at 23, 24, etc. Taking a year off at 22-25 means possibly an irrecoverable loss of career momentum. Thus, the optimal time to settle down is around 30, as one’s career trajectory levels off, at which point some couples may decide to have no kids or fewer.

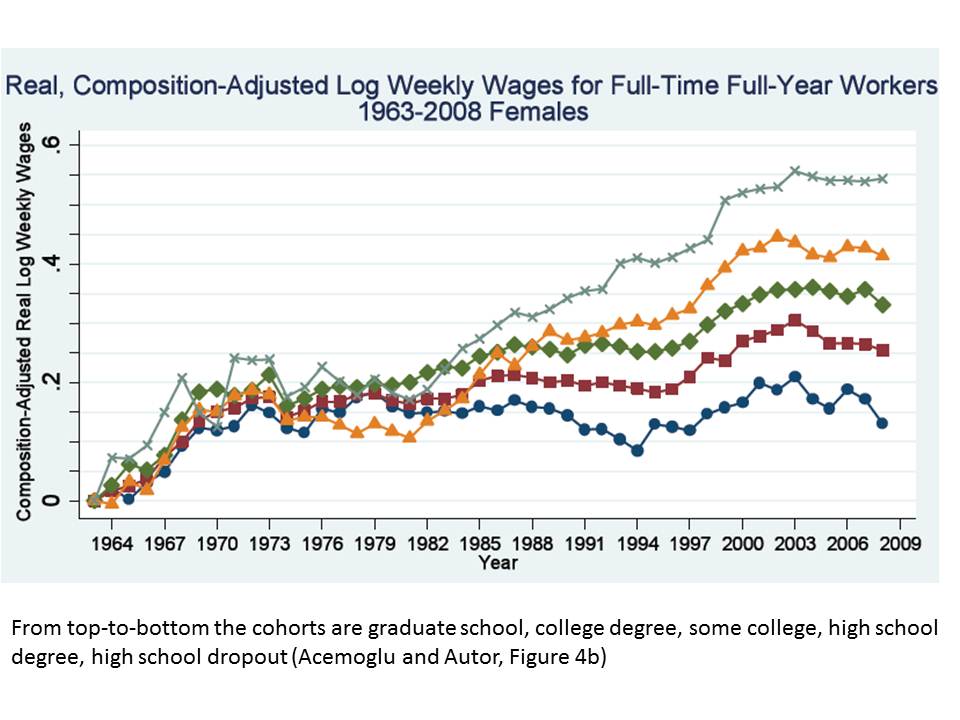

In the past, high-IQ couples (if we use credentials as a proxy for intelligence) had more kids because the returns to IQ were not that remunerative compared to today. In the ’50s-’60s, even adjusted for inflation and student loan debt, wages were much lower for white collar professionals compared to today. A prestigious tech job at IBM or Bell Labs in the ’60s paid the equivalent of about $100k today, not the mid-6-figure salaries commonly seen today.

Also, the wage gap between white-collar vs. blue-collar or service sector jobs was not as wide either. Doctors and lawyers in the ’60s didn’t make that much compared to today, in which the average salary for doctors in the US is a mouth-watering $350,000. The college wage premium was not even a ‘thing’ until the early ’80s:

Same for intellectual pursuits, which were were not that lucrative back then either. In the past, intellectuals were obscure and worked at university writing papers and writing books that no one read for a small salary, but now they can make millions in the public sphere, a notable example being Dr. Jordan Peterson. Or the thousands of writers making a living on Substack and or Twitter.

The boom in AI, for example, had led to huge demand for computer science professors to lend their expertise, such as consulting, which can be very lucrative. According to a 2018 article “..specialists with little or no industry experience can make between $300,000 and $500,000 a year in salary and stock.” This was 6 years ago; presumably, pay and demand for AI researchers has only gone up.

Or people making millions with options trading and investing in tech, such as AI. Every cycle keeps being bigger than the prior one. 2020-2021 was big, but 2023- AI boom blows that away. Even in 2020-2021 people were not making this much with meme stocks, but nowadays the utterance of the word ‘AI’ turns people into overnight millionaires. Who wants to settle down when getting rich is as easy as pushing some buttons. This is the ‘post-scarcity era’ that academics and others wrote about happening before our eyes.

The incentives need to chance if society is to change. This can mean a major financial crisis (like a repeat of the ’30s) or World War 3. I don’t see either of these as a possibility; nor, of course, would we want this. The US economy is in a period of unprecedented strength and stability in spite of declining social trust and possible instability on a small-scale (e.g. community-level racial strife such as the 2020 George Floyd riots, societal/political polarization, and the occasional mass shooting). Even if people are less trusting of each other, this does not affect the ability of huge corporations to generate record profits, or the ability of the US to throw its weight around globally–culturally, economically, or militaristically.

I still believe Pinker’s thesis of increased peace and stability is correct despite provocations by Putin or the usual saber rattling by China. Same for Fukuyama about the post-Cold War ascendance of democracy. If I had to put money it, these trends are not going to change. Investing in big tech, as I am doing, is an indirect bet on these trends continuing.

At the same time, I disagree with Turchin about elite overproduction or how the rise and fall of civilizations follows predictable or definite cycles. His theories are hand-waving, by finding a couple datapoints and then trying to predict the collapse of the US or draw a grand narrative about ‘elite overproduction’ around it . It’s not convincing at all. The cyclicality of history cannot be taken for granted, and there is no ‘iron law’ that empires must fall even if they become decadent or overextended.

If white-collar employers stop relying so heavily on degrees, obviously this will put a dent in careerism, but I don’t see that happening either. Employers like credentialism because degrees are a legally risk-free filter for baseline competence, conscientiousness, and political correctness–all-in-one. There is a huge pool of high school-educated grads to choose from (only 30-40% of American adults have a 4-year degree), but paying the hefty college wage premium is evidently still worth it from the eyes of employers.

Status-seeking also explains why remittances to encourage family formation will not work, which tends to be the default or go-to solution. The lower classes have no problem having children, and it’s not like the upper classes cannot afford it when everyone is getting richer than ever. And there already exists generous aid for married couples with children. Although welfare is comparably stingy for childless individuals, benefits are quite generous for couples with children regardless of martial status or income. Instead, they–the upper and educated-classes–are choosing not to. ‘Raising the bottom’ will not help if people are competing to be at the top.