Freddie deBoer argues that Harvard ditching the SAT is a money maker. I think the issue is framed as a false dichotomy in which elite schools must choose between meritocracy or money. The evidence shows, however, that it’s possible to have both, and that optimizing for merit also maximizes donations.

It’s a common misconception that elite schools, such as the eight institutions that make up Ivy League, cater exclusively to the wealthy/elite. For 2021, of 300,000 individuals who applied across all eight Ivy League schools, about 21,000, or 7% were accepted, so one may be under the mistaken assumption that those who are accepted must have been selected from the crust of society.

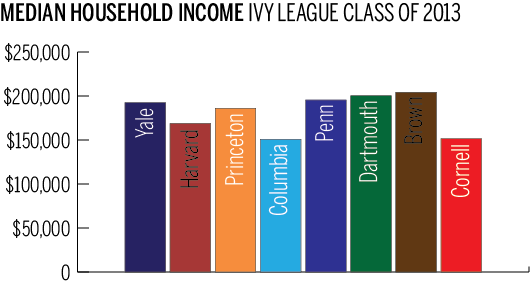

The data however shows that most Ivy League students are just upper-middle class:

It’s above average, but a far cry from elite-level wealth. And according to a NYTs infographic, fewer than 20% of Harvard admittees are from the top 1%.

Moreover, even though only 21,000 students are admitted annually among the eight schools, this is actually more common than top SAT scores. In 2020, 1.5 million high school students took the SATs. So there is more than enough room for the Ivy League to take the top 1% of scorers (~15,000 students) and still have 6,000 slots remaining for athletes and legacy admittees.

Also, the SAT has been dumbed down so much since the 2000s that perfect or near-perfect scores (1550-1600) are only top 1% instead of top .1-.5% or so. The SAT has stopped being a reliable way to screen for truly exceptional talent, but rather just tests for competency of the material, which although is important when choosing applicants, merely competent graduates are generally not going to produce world-class results that bring recognition to the university.

He writes:

At the top of the pyramid, elite schools with big endowments are less exposed to enrollment swings. But they need students whose parents will donate and who will in turn become donors after graduation themselves. And the SAT has traditionally been a barrier to harvesting the dullard sons of the 1% for that purpose. That’s who benefits the most from the demise of entrance tests, not poor Black strivers but those who could slouch their way to success everywhere but in the examination room.

The top 1% is not that wealthy though. Harvard cares more about the top <.1%; that is where the major donations come from, so dropping the SAT is not going to suddenly open the floodgates to more money if they were already automatically admitting the children of top .1% donors. There is a huge difference between having a household net worth of <$1,000,000, versus >$100 million.

It’s more likely that dropping the SAT will cost the Ivy League in the long-term, by reducing its prestige and reducing future donations. Owing to the positive correlation between wealth, career success, and IQ, by admitting dullards whose parents are not super-wealthy (top .1%), the Ivy League risks losing future wealthy donors. It’s high-IQ bankers, executives, and entrepreneurs who grew up middle class and then became wealthy later in life, such as billionaire Harvard Business School grad John A. Paulson, who in 2015 donated $400 million to Harvard, who are among the biggest donors, not just Kennedy and Rockefeller heirs.

The Rockefeller estate recently donated $50 million, but it’s still dwarfed by other donations, such as a $200 million donation to the Harvard medical school by entrepreneur Leonard Blavatnik. And Swiss billionaire businessman Hansjörg Wyssa, of the ’63 Harvard Business School, who donated $131 million. Hedge fund manager David E. Goel ’93, donated $100 million. Kenneth C. Griffin ’89, another hedge fund manager, donated $50 million. The Chan Zuckerberg initiative in 2021 pledged $500 million over a 15-year-period to fund AI research.

The bulk of Harvard’s donations are from individuals who graduated many decades ago, when the SATs were harder and getting into Harvard was a more reliable signifier of superior intellect. Diluting the quality of the student body today, such as through affirmative action, ‘holistic admissions,’ and by dropping the SAT, will likely cost future donations, decades from now, even if in the short term there is no effect. But then again, it’s not like Harvard needs more money.

Naomi Schaefer Riley, a senior fellow at the American Enterprise Institute (AEI) interviewed by James Pethokoukis, also of the AEI, makes a similar argument that legacies admissions are financially expedient:

The decision is not exactly a binary one. The question is whether it is worth it to schools to give a little on the SAT scores in order to gain a little more goodwill with alumni. Elite schools want it to be known among their alumni population that they reward loyalty, that their children will be welcomed as members of the university “family.” They have made the calculation that this kind of family continuity is worth it for their bottom line.

Unfortunately, the rest is paywalled. But the argument is common. I decided to investigate this further. Surely, if legacies are the backbone of endowments, then colleges that don’t have legacy favoritism should be struggling, but this is not the case. MIT, for example, has an astonishing $27.4 billion endowment, about half of Harvard, despite that “MIT doesn’t consider legacy or alumni relations in its admissions process,” and they are pretty upfront about it too. That’s way more than I would have guessed. This is even more impressive given that MIT is a much newer school (founded 230 years after Harvard, in 1861) and has half the student body compared to Harvard (11,376 vs 22,947). Caltech, which also disregards legacies, has a $4 billion endowment, which is small, but its student body is 1/10 that of Harvard.

As it turns out, newly-rich smart people in the private sector donate a lot. ‘Old money’ is overrated and not as rich as commonly assumed. The Ford and Rockefeller foundations are pocket change compared to the wealth of today’s top tech and hedge fund people.