Online, the wealth inequality debate rages on. Here are two recent stories that generated significant discussion:

Jeff Bezos Becomes the Richest Man in Modern History, Topping $150B

People want to know, will inequality lead to revolution? Will it keep widening? Is wealth redistribution the answer?

To answer those: no, yes, and no.

Regarding uprising and Amazon, yeah, let’s all raise our pitchforks against the guy who has created thousands of jobs and is making our life more convenient and affordable.

Others try to draw parallels between the present and the late 20’s, just before the Great Depression, when wealth inequality was as high as it is now, implying that history will repeat:

Trying to extrapolate a trend or pattern from a single datapoint (1929) is fallacious. Scott Adams is correct that analogies are of little use. My prediction is, the top .1%’s share will not fall, because I see no compelling reason for it to. Unlike the gilded age, it will not end in crisis.

I was correct in predicting earlier in the year that Amazon stock would go to $2,000, rebuking Trump’s USPS tweets. It will eventually go to $5,000 and beyond, and Jeff Bezos will be wealthier than any historical figure, including John D. Rockefeller, too. And unlike the the plutocrats of yesteryear, these tech fortunes will not dissolve. In fact, I predict his wealth will keep growing at an average rate of 10-20% a year until he dies (which probably won’t be for many decades), until eventually stabilizing at whatever the global GDP growth rate becomes.

This is probably why the ultra-wealthy are so interested in life extension, because death is the ultimate and unavoidable limiting factor of one’s wealth and power. The wealthy have much more to lose by dying than everyone else.

But what about the so-called European right-wing uprising?

That is due to concerns over immigration, not wealth inequality. Also, such a purported uprising is another example of the media creating a narrative where none exists, or the evidence is, at best, weak. Another example of a media-invented narrative is the ‘mass outrage over Facebook privacy,’ when such outrage is limited to only a handful of very vocal people, but is generalized by the media to mean everyone. Viktor Orbán, Putin, and Erdogan rose to power in the early 2000’s, well before the narrative was established. Merkel (who was sworn in for a forth term in 2018), Macron (who beat the far-rightLe Pen in 2017), Trudeau, etc. are recent examples of leftist leaders that run counter to the narrative. And Theresa May bungled Brexit so badly that ever hew own party wants her to step down.

Russia 1918

This had to do with famine and massive unemployment as a consequence of ww1, not merely wealth inequality. America is a long way from being as bad as Russia was in 1918. The Great Depression is far worse than anything now, yet there was no civil unrest in America.

French revolution

Wealth inequality was just a single factor. France was in financial crisis due to debt from various wars, causing high taxes and food shortages, again, which are problems America does not have.

The evidence (such as Red Revolution, English Revolution, French Revolution, etc.) shows that such revolution, when it occurs (which is not often) is lead by the upper-middle class (the rank below the top; the gentry), not the lowest of tiers. This includes high-ranking bureaucrats, lawyers, educators, clergy, etc. Most people are content with being fed , having jobs and stability, not whether some people have much more than others.

Marxists may speak of the inevitably of revolution, but despite wealth inequality in America widening to such great widths, revolution over class has never seemed more unlikely. The divide between the left and right, globalist vs. nationalist is over issues such as immigration vs. borders and ‘Hollywood values vs. Christian values’ etc, not wealth inequality. Look how Trump, a billionaire, won.

The upper classes are more concerned about macro and societal factors such as wealth inequality, welfare, and perceived injustices, whereas the lower classes are concerned about things that are immediate and pressing at the individual level, such as employment and trying to afford healthcare. Although the lower classes can easily be coaxed to join a revolution, they don’t foment it.

A common misconception is that the economy is a zero-sum game, and that inequality is due to exploitation. As discussed here, one has to take into account that the total economy is growing and total wealth is growing. It’s not like the rich a consuming an increasingly large percentage of a fixed pie, but rather the pie is growing, so it’s possible for the rich to have a larger percentage but everyone still see gains. This is manifested by rising standards of living, more purchasing power, and so on.

The US dollar has also gained a lot relative to foreign currencies since 2008, which makes imports cheaper and further boosts American standards of living and purchasing relative to the rest of the world.

The emphasis should be on boosting living standards than trying to enforce equality.

However, a common counterargument is that the wealth of the top .1% is growing faster than economic growth, meaning that if the US economy is growing at 3%, the top .1% are gaining 7% or so. I don’t see this as a problem, because the economy is doing well, such as low unemployment, and almost everyone is benefiting to some degree. In the late 90’s, for example, tech executives, who owned shares of their companies, because much wealthier than their employees, and at much greater rate. By the left’s logic, employees were being exploited, but employees had good-paying jobs and were still making a decent amount of money through stock options and other benefits. When the market crashed in the early 2000’s, wealth inequality narrowed (because the same wealthy CEOs who became paper-rich on the way up lost it all on the way down), but employees were worse-off due to layoffs, even though wealth inequality had narrowed.

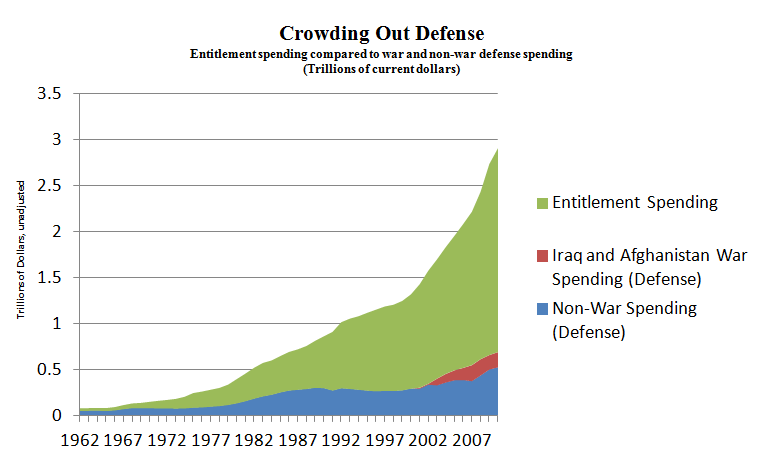

Another counterargument is that real wages for the lowest of earners have not budged since the 70’s. This depends on how one measures inflation. But also, even if real wages are stagnant, this is compensated by more employee benefits and higher entitlement spending.

Does this settle all the possible objections? Hardly, and it would be presumptuous of me to assume so. This is why this is such a big debate. With the exception of the most fundamental and obvious of concepts that we all take for granted–such as supply and demand–very little in macroeconomics, unlike the ‘hard sciences’, is settled. Someone can cite a study showing how raising the minimum wage hurts employment, and someone can cite an opposite study, and then one has to take into accounts all the confounding factors. To be continued…