I saw this going viral Americans Lose Faith That Hard Work Leads to Economic Gains. I don’t think it’s as black and white or bleak as portrayed. I’ve argued in “The New ‘Success Sequence’” that the college-to-career route is the best path to prosperity. If you’re smart or lucky enough to to land a 6-figure job, then times are pretty good. There are tons of stories on subreddits, e.g. r/FIRE, r/investing, r/fatfire, r/TheRaceTo10Million etc., of ordinary people with large nest eggs and home ownership at an early age by investing the proceeds of white-collar work into rapidly appreciating assets.

As a caveat though, those are outliers. There are many opportunities to get rich if you are lucky and or smart enough to land them, like in tech or finance. But this is not much consolation for those who lack those attributes. By statistical certainty, most people cannot be exceptionally smart or talented. American society is increasingly becoming delaminated, with an elite that has pulled away. Or in Dr. Charles Murray’s words, America is “coming apart”.

Adjusted for inflation and student loan debt, white-collar professionals still earn way more compared to 30 years ago. If you graduate and get a decent job, you can accumulate a lot of wealth fast through compounding, such as in the QQQ and/or VOO, especially if you keep expenses low. This common belief about college degrees being a ripoff is a lie promoted by social media; the large majority of people with 6 or 7-figure nest eggs in their 30s and 40s have degrees. Or to put it another way: a degree is no assurance of success, but almost everyone who is successful has one.

To get an idea of how much salaries have ballooned, in the early 2000s an entry-level Apple or Microsoft engineer likely earned only $50-60k/year, or about $100k today. Facebook’s success saw the start of the talent bidding wars, at around 2008 coinciding also with the bottom of the Great Recession, when the survivors began to bid huge for talent. This is when tech salaries and compensation really took off and never looked back. Nowadays, compensation of $300k+ is not unheard of for top tech companies (usually a combination of salary, bonusses, and stock), a 200% inflation-adjusted increase.

Even non-FAMNG white-collar salaries have seen real increases of 70-100% since the early 2000s. When accounting for student loan debt and living expenses, this still represents a real increase of income. True, home ownership is more expensive compared to the early 2000s, but this is offset by greater appreciation and lower long-term mortgage rates. Home prices, similar to stocks, have seen significant real returns since the early 2000s.

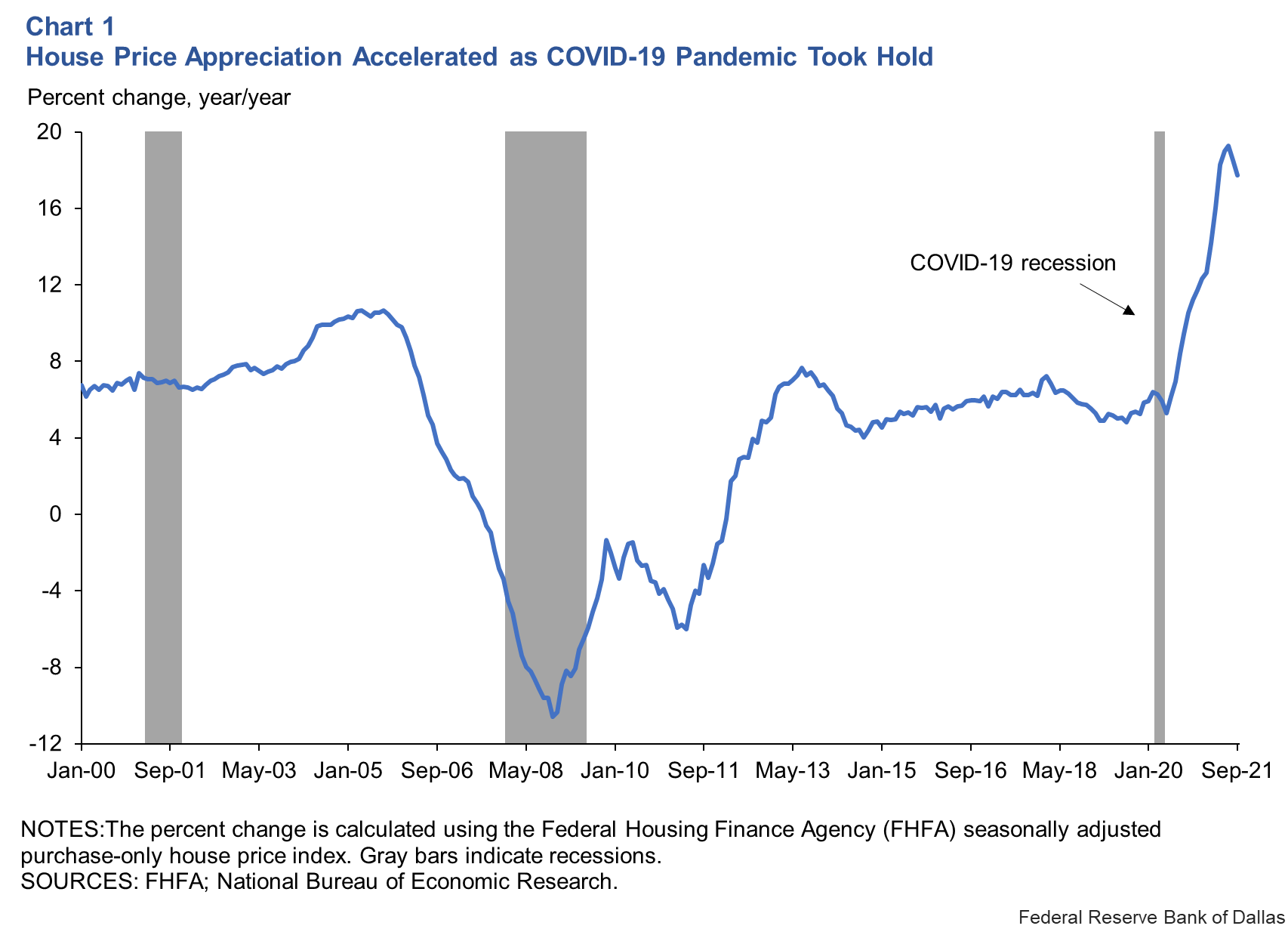

This was evident after Covid, when home prices rocketed to new highs after a tiny dip. The arc of U.S. policy is to make home prices go up, as so many Americans are invested in the notion of homes being a spigot of wealth, even if this at the same time makes them less affordable. You’re in a doomed if you do, doomed if you don’t situation: either pay through the nose for a home now, or forever be priced out of home ownership.

When the Fed and the Treasury intervene during crises, like in 2008 or Covid, asset prices consequently increase, benefiting those who are already invested, but it penalizes those on the sidelines who are forced to buy-in at a higher price. In effect, policies designed to stabilize the system, reward existing participants while raising the barriers for new entrants.