Every day, investors are bombarded by forecasts and predictions by people who are held up as experts or who lay claim to expertise. This can include economists, CEOs, or analysts who work for major publicly-traded investment banks or smaller private firms, whose forecasts are disseminated by the financial media. It’s the only profession, AFIK, where people are paid envious sums of money and have status to be habitually wrong, or in which the value proposition is so detached from the pay. A common critcism is that pro athletes are overpaid, but at least they are good at their jobs and provide quantifiable economic value in terms of ratings and ticket sales. But what are financial analysts good at or good for?

The apparent uselessness of analysts has become so obvious it has attracted media attention, ironically by very the media who broadcast those predictions, like Forbes and Bloomberg:

In diagnosing the problem or motive, the financial media has to fill airtime or space. ‘Content’ is just the filler in-between the ads. That is the business model, regardless of the medium, whether it’s print, TV, or online. The media cannot just say nothing or “we don’t know,” but are expected to provide some post hoc rationalization for why the market was up or down, when there may be no reason. Or are expected to provide forecasts or analysis, even if it’s useless. Same for bullshit ads masquerading as content (Warren Buffett is always a favorite, but other adverts feature Bill Gates):

This is similar to what has been described as the ‘content creation treadmill’ of YouTube, in which creators are incentivized to produce a uninterrupted supply of content in order to ‘feed’ the algorithm, or otherwise channels which fail to do so are gradually algorithmically demoted. Unsurprisingly, as a consequence, content becomes increasingly repetitive, much like financial content, to fill the airtime, as the algorithm cannot readily distinguish between new content and rehashed content; rather, it’s the quantity and frequency that matters most.

Regarding the content itself, financial analysis typically falls into multiple categories, such as opinions, headlines, bullish or bearish market directional forecasts, or vague macroeconomic forecasts. The opinionated commentary is typically based on some unsubstantiated hunch, wishful thinking, or motivated by the personal bias or financial interest of the forecaster, such as Peter Schiff predicting ‘dollar collapse’ for the 15th year in a row whilst peddling overpriced gold coins. The vague macro forecasts typically offer no actionable insight or value (e.g. “We see a 40% chance of recession in the next 2-3 years.”) Gee, thanks, but how does one make use of this?

The directional predictions tend to be across the map, so a third of predictions will be bearish or pessimistic, a third neutral, and a third bullish or optimistic about the economy or stock market. For example, CNBC recently published the headline, “Today’s market is a ‘bubble dream’ with rate cuts, China inflating economy, Bank of America says.” But at around the same time, on a more optimistic note, is the headline, “Big returns before Fed rate cut doesn’t mean stocks can’t keep rising, history shows.”

Yet we are led to believe that this represents value creation that justifies their huge salaries, or that these people are more accurate than flipping a coin, when in either case they aren’t. Why does someone need to be paid $600,000/year to say there will be a “40% chance of recession next year” when a Magic 8 Ball can do the job for free? How does publishing this same or similar predictions every year possibly create value, but to generate clicks and ad revenue?

Other commentary is more political, such as headlines along the lines of “Inflation expected to rise if Trump wins a second term, due to trade tensions and tariffs,” or “Kamala’s tax policy will be bad for investors.” Thanks, but again, so what. Experts made this exact prediction in 2016 after Trump was elected. Not only did stocks surge, but inflation was tame despite the tariffs and trade tensions with China. Nor was there geopolitical turmoil, as widely predicted. In spite of Kamala winning her debate against Trump, the stock market was unfazed and posted one of its strongest weeks ever. Regardless, the financial media benefits by collecting ad revenue as people click the headline out of curiosity or fear to see if BlackRock’s “dire recession forecast for 2024” is true.

Here are forecasts in 2016 warning of Trump tanking the stock market and economy:

(Albeit some forecasts were optimistic.)

And again in 2024:

The stock market would go on to surge from 2016-2019, until falling due to Covid, not anything specifically attributable to Trump’s economic/trade policy. This is not to defend Trump: similar incorrect predictions were voiced by the conservative media during Obama’s terms, such as predictions of hyperinflation, debt crisis, and dollar collapse, none of which came to be. Given that bear markets and recessions tend to be much briefer than bull markets, stocks tend to do well regardless of who or which party is in charge. Stocks do well in any administration, because stocks tend to go up over the long run.

Below is the S&P 500 over the past decade. Despite endless headlines and forecasts of recession or crisis of either the Obama, Trump, or Biden administrations, anyone who sold would have missed out on subsequent gains or likely been forced to reenter at a higher price:

Yes, someone could have sold right before Covid and bought back at the bottom, but anecdotal evidence and studies has consistently shown market timing to be futile for most people.

Same for the dollar, which hasn’t yet crashed:

As we know, inflation would go on to surge in 2021-2022, but forecasting high inflation every year, only to be right eventually, is more demonstrative of luck than skill, which proves my broader point. As the same time, predicting low inflation every year, only to eventually be catastrophically wrong in 2021-2022, isn’t much more useful either or indicative of skill; it’s just that the second forecaster appears more more skilled because inflation tends to be tame most of the time. Maybe in hindsight it was obvious inflation would surge due to Covid stimulus spending, but then why didn’t stimulus spending cause high inflation in 2009-2010, as widely predicted at the time? Economists had come up with varying theories as to why inflation was not going up (Keynesian liquidity trap anyone?). Or Japan, which during the ’90s and 2000s also had multiple stimulus programs but little success, until a sudden turnround in 2012?

Moreover, financial analysis tends to be lagging. As the market rallies, forecasts tend to be increasingly optimistic. Conversely, forecasts tend to be increasingly pessimistic as the stock market falls. Bearish predictions reached a climax during early 2009, early 2023, and March/April 2020 as the market was reeling due to Covid. Anyone who acted on said advice would have sold at the worst possible time. An example of this was analysts slashing their Enron stock forecasts, but only after the stock had lost 99% of its value–thanks for the heads-up!

Another problem is interpreting the significance or usefulness of data. Let’s assume there is a 50-percent likelihood of recession next year according to analysts at Goldman Sachs, or U.S. GDP is expected to grow by 4.3% instead of 4.5% according to UBS, or the stock market is overvalued according to certain metrics. What am I supposed to do with this? What does this mean in practical terms? Should I sell half my holdings? How meaningful is a .2% percent shortfall of GDP? What if the recession never comes? Who knows. No one can answer this. If the Nasdaq gains 20-30%/year–as it has consistently since 2009–after only two years I would need another crisis or bear market on the order of magnitude as 2008 or 2022 just to get back to the original point where I sold. Given the rarity of such events, spaced apart by 8-12 years, I would likely be forced to buy back at a higher price. Or in microeconomics parlance, there is an opportunity cost of selling, that being missing out on future gains and likely never having an opportunity to buy back at a lower price. It would seem like the best choice is to just ignore the forecasts and stay invested.

Of course, one can retort that analysts do more than give bullish vs. bearish targets, or that the media distills complicated research into soundbites and clickbait headlines. But even detailed analysis is not uncommonly wrong or useless. Many smart analysts gave at the time seemingly compelling arguments for why Amazon, Tesla, or Uber would be worthless, due to either uncontrollable cash burn or changing market conditions. Uber, despite burning through billions of dollars of VC cash for a decade, pivoted during Covid to a successful delivery business, and the stock has subsequently doubled since its 2019 IPO. Amazon defied many predictions during the early to mid 2000s of its demise, in part by pivoting to business infrastructure (e.g. cloud hosting) with much success. Same for Tesla. Many chronically unprofitable companies have a recurring tendency of raising capital or somehow defying the odds, although many do become near-worthless or eventually bankrupt (e.g. We Work). But the problem here is that analysts have no reliable way of knowing which money-losing companies are going to eventually succeed or not. Projections of cashflows into the future are not as useful as often assumed when businesses can either unexpectedly pivot or macro conditions can suddenly change, like during Covid.

Goldman Sachs recently put out a notice calling AI “overhyped, unreliable, and expensive” which went viral. But again, but so what? Someone could have said the same about the World Wide Web in 1995-1999. Sure, the internet at the time seemed overhyped, AOL was famously unreliable, and tech stocks were indeed expensive, but in hindsight it was just the beginning. Or social media in 2008-2011 as Facebook was taking off; Facebook/Meta would go on to be worth over a $1 trillion and one of the most successful and profitable companies in existence. Or Google’s buyout of YouTube in 2005 for $1.65 billion, which was widely cited as a harbinger of another tech bubble, but in hindsight a brilliant move. Same for Facebook’s 2012 buyout of Instagram for $1 billion, again, called a bubble by the media.

Conversely, wearable cameras (e.g. Go Pro) were overhyped around 2014-2015 and soon fizzled as camera phones became cheap and powerful. But delivery apps had staying power well after Covid, such as Uber and Door Dash. However, Peloton, whose exercise bikes surged in popularity during the pandemic when the gyms were closed, struggled after the pandemic ended as inventory piled up and the stock subsequently lost 95% of its value from its peak during Covid. Same for Zoom, a Wall Street pandemic-era favorite, which eventually lost out to Telegram, WhatsApp, and Signal. VR has been on the cusp of breaking out for decades now–always falling short of prime time–but LLM-powered chatbots took the world by storm seemingly overnight. Textboxes were the future, not clunky VR helmets and eyewear.

The lesson here is something being overhyped and expensive now does not inform us of the future. Maybe no one knows.

Some of these people are not analysts at a financial firm per se, but are CEOs, whose inevitably-wrong predictions are broadcast by the financial media in spite of the obvious conflict of interest and the impossibility of objectivity of someone whose business stands to profit greatly if said prediction comes true, which it almost never does.

For example, here is JP Morgan CEO Jamie Dimon a few days ago warning of a “looming crisis worse than recession”:

If this sounds familiar, it’s because he makes this same prediction every month, and the financial media continues to lap it up:

I have no idea why anyone takes this overpaid clown seriously anymore. But I guess it’s good for clicks.

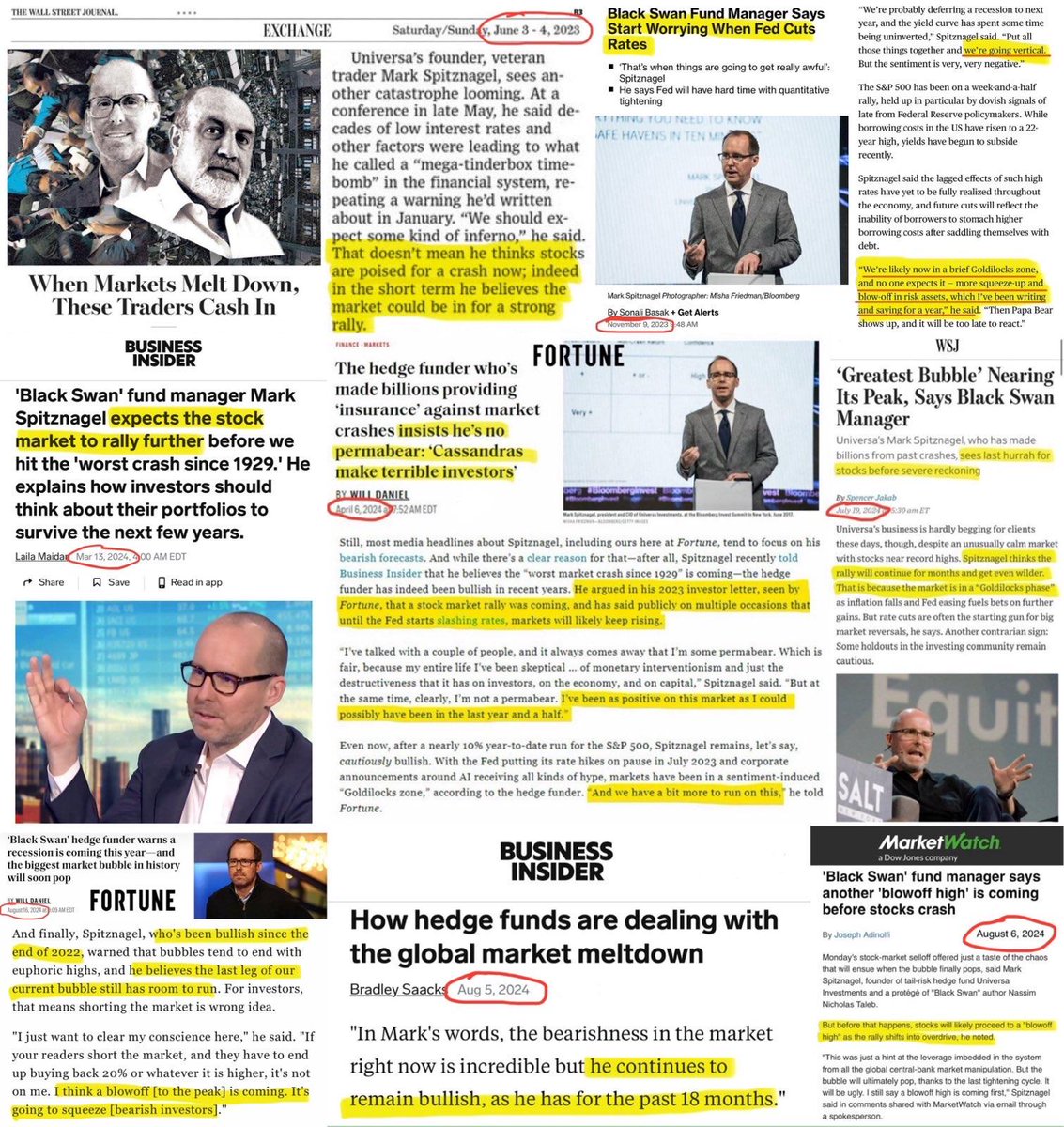

Another one is Mark Spitznagel of Universa, a ‘tail hedging’ hedge fund with ties to Nassim Taleb, whose forecasts of economic crisis have gotten mainstream coverage over the past few years:

Meanwhile, the S&P 500 was up 24% in 2023 and is up 15% so far for 2024. What you have to understand is it’s a symbiotic relationship: the financial media gets content by passing these forecasts off as news which means ad revenue and virality, and these firms in return get free coverage/marketing.

Hundreds of individuals and firms have predicted Bitcoin would be at $100k by now after the halving and the ETF approval; instead, the price has languished between $55-$70k. Six-figure Bitcoin, let alone a million dollars, is looking increasingly out of reach.

For example, Tom Lee (if at first you don’t succeed, try again):

Other examples include Michael Saylor of MicroStrategy and Cathie Wood of Ark Investments, both of whom for years have promised that $1 million per Bitcoin was ‘just around the corner’, only for prices to crash like in 2022. As far as they are concerned, it doesn’t matter what Bitcoin does. Any media coverage amounts to free advertising, which is always welcome even if those who heed said advice lose money.

Perhaps I’m painting with too broad of a brush, but I have yet to see anyone who is good at the profession. These people are being paid a lot of money on the assumption that their insights or perspectives are superior enough to justify their salaries, and I don’t see it. There are good doctors, good engineers, but no good analysts. I’m not just talking predicting the future, but also interpreting what the data means on a more practical level, such as the implications of slightly-weaker-than-expected GDP. When analysis conflicts, like bullish and bearish forecasts for the same company, then this only compounds the ambiguity. May as well just toss a coin.

Overall, the U.S. economy is remarkably adaptable. Consumers are resilient and quickly bounce back from adversity, as we saw during Covid when stimulus money flooded the economy and Americans rushed to the stores after the lockdowns were lifted. Corporate profits also tend to be rather well-insulated from macro factors such as inflation, or the threat of war or tariffs. Maybe investors ought to just ignore such forecasts, as not only are they of little to no actionable value, but also likely inconsequential to the market. It’s time for these analysts to give it a rest. These people who well-paid to provide expertise are clearly failing at that, spreading only fear or uncertainty instead.