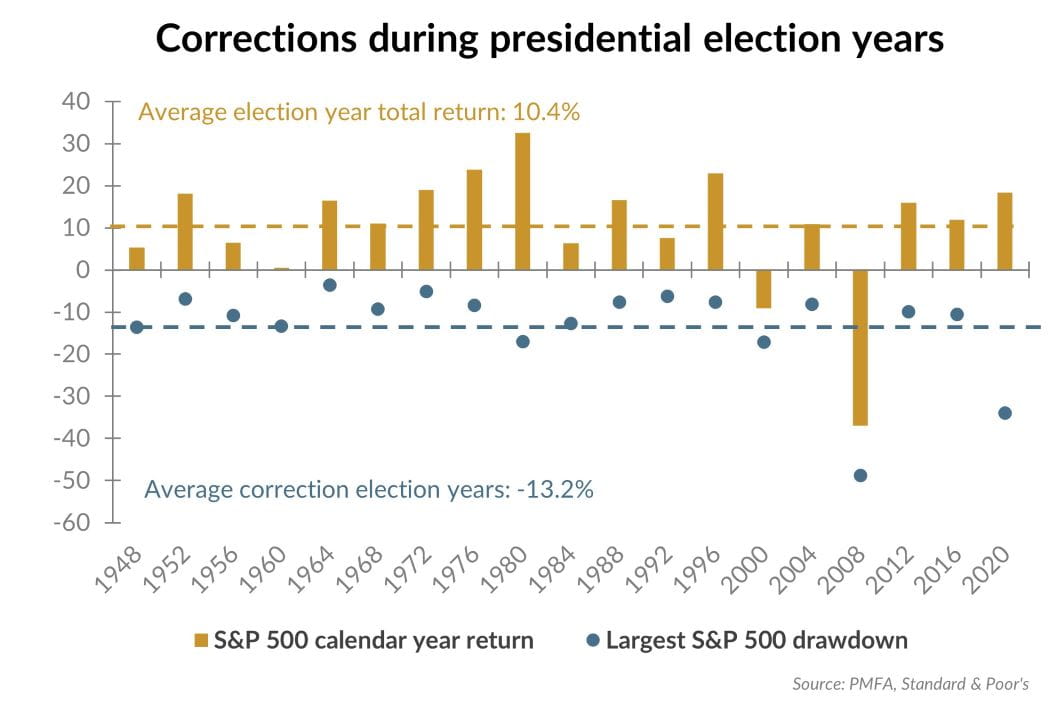

Election years are bullish for stocks, with few exceptions like 2008:

If Trump wins–which the evidence suggests he will given Biden’s sub-40% approval rating, which is unusually bad for a Democratic incumbent–expect tons of stimulus, even more tax cuts, and deregulation. All of this is good for stocks. In 2016 stocks surged immediately after Trump won, before he was inaugurated, and in 2017, in anticipation of massive stimulus, tax cuts, and other deficit spending.

As to be expected, the national debt will go up even more, but predictably many of the loudest voices warning of a debt crisis will go quiet, as they did in 2016-2020 too.

Many Silicon Valley CEOs and VCs are on board with Trump, compared to pre-Covid being much more skeptical of Trump and conservatives in general. They learned, albeit late, that ‘the left’ wants forced-diversity, such as DEI, at the cost of competence. Democrats’ softness on crime has made Bay Area cities and other ‘tech hubs’ less safe.

The onerous Covid-era lockdowns, restrictions, and vaccine and mask mandates was the first domino to fall in terms of the left losing support of Silicon Valley. Rich people, even those who support Democratic social causes, have a strong aversion to being told what to or what to believe. One of the benefits of being rich is the personal freedom. The Democrats messed up in a fundamental way: by losing support of the upper-middle SES-strata, who have the most clout too, like on social media.