It’s been a year since Meta was supposed to be dead according to the experts, whose viral videos and articles racked up millions of views proclaiming the end for Meta:

How poorly those have aged. [1] Meta stock has since almost tripled from its 2022/2023 lows, making an all-time high at $400 as of writing this:

Last week Meta joined the trillion-dollar club, one of six U.S. companies to do so. This represents $750 billion of shareholder value creation since the 2022/2023 lows. This is $50 billion more than the Treasury authorized in 2008 for TARP, which at the time was considered an unprecedented amount of money, to bailout the banking and housing sectors. Yet that is how much money Meta shareholders made in a year alone. Of course, this is is not an apples to apples comparison, but it’s like the finance-equivalent of an elephant doing a backflip. The last thing anyone would expect is a company which was already valued around $250 billion at its lows in 2022/2023 to 4x that in a single year. Usually such gains are for speculative penny stocks or biotech, not quarter-trillion-dollar companies.

Yes, Nvidia also surged in 2023, but it’s interesting the contrast between Nvidia and Meta. Nvidia is on the frontier of tech, such as AI, LLMs, and GPUs, whereas Meta’s core business–advertising (albeit, online ads)–is seemingly pedestrian. But that is not a bad thing. I think Meta is analogous to Renaissance Technologies, widely regarded as the most successful and profitable hedge funds ever. Like Renaissance, which makes money from billions of trades in which it ekes out a tiny profit but it adds up to a lot of money, Meta also makes a small amount of profit on each ad impression or click on one of its platforms, but now multiply this by billions of impressions and millions of clicks everyday. The result is a revenue stream that has little variance, compared to the ‘old’ tech companies like IBM which depended on contracts for such things as mainframes, which is a more lumpy or discrete revenue source and hence not as smooth or stable.

To bring this back, the narrative in late 2022 to early 2023 was that the confluence of spiraling Metaverse losses, a slowdown of online ad spending, high inflation, and loss of dominance to competing platforms such as TikTok, would be Meta’s undoing. This never made sense. The verdict of the success or failure of the Metaverse is still out, but it was inconceivable that its failure would doom the entire company. At worst, the plug would be pulled and the loss would be a one-time expense, but the rest of Meta would be unscathed. Meta generated $30 billion in profits annually; Metaverse spending was still only a fraction of this, as shown below:

The large dip in 2022 in net income was from Metaverse losses, which have since been mostly contained. This is not to sugarcoat the situation. Since 2019, when Meta began its branch into VR, losses have totaled $47 billion. But the fact Meta has otherwise done so well is a testament to the strength of its core business, that being online ads, that it can withstand this.

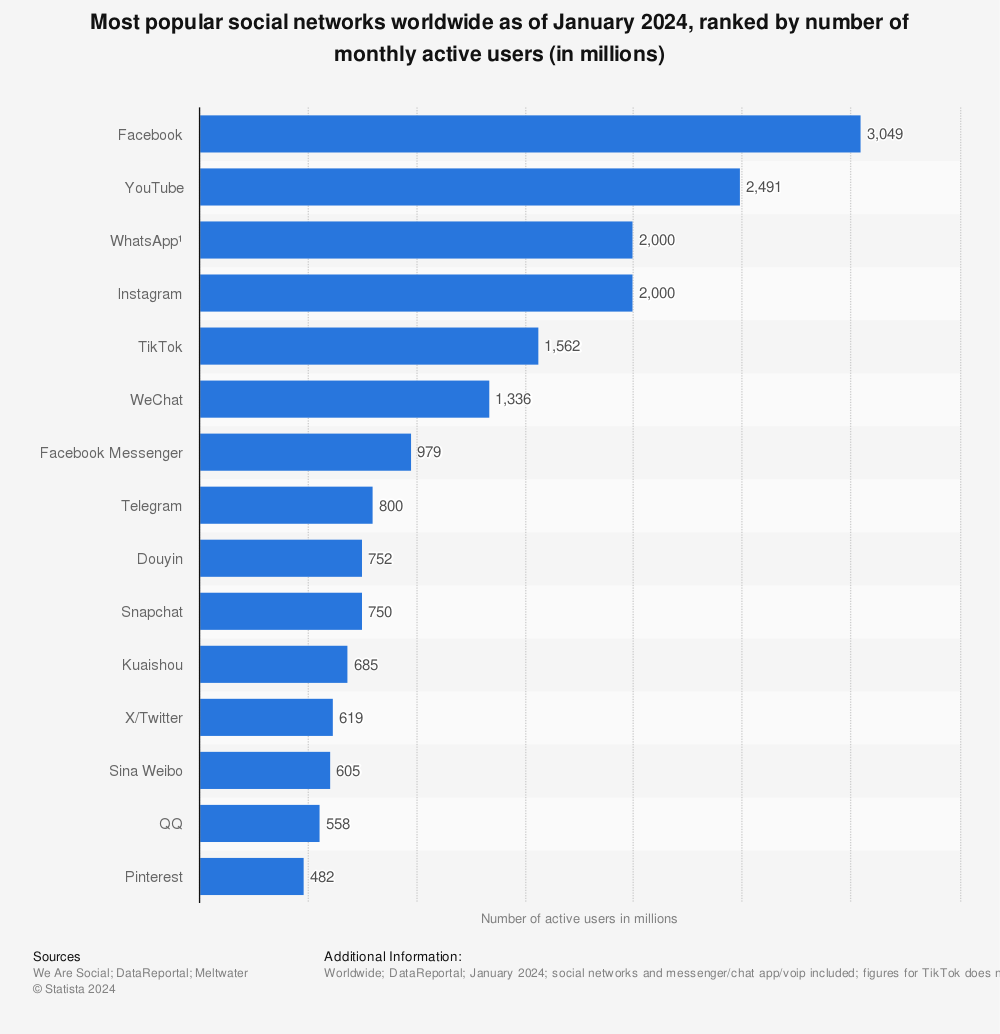

Regarding loss of market share to competing platforms, again, the evidence suggests otherwise. Meta-run platforms–those being Facebook, Instagram, and WhatsApp–dominate the top 5 of social media usage as of October 2023. The rest, save for YouTube, do not come anywhere close:

About inflation concerns, such fears were overblown. Indeed, one can clearly see in the above chart that Meta income did not fall in 2022-2023 despite abnormally high inflation. Unlike consumers, who are sensitive to pricing changes (so-called sticker shock), for business-to-business spending, inflation is a shifting of the y-axis in algebra. Companies simply bid more on the ads, and those costs are passed on to business customers either in the form of higher prices or more subtle means like shrinkflation for retail consumers. If inflation was to get bad enough, it’s possible that falling consumer spending could ripple to online ad spending, but this would also have to require that real wages fall too. From Treasury.gov, despite high inflation, real wages have gown in the 12 months ending in Dec. 2023:

Real wages have risen since before the pandemic across the income distribution. In particular, middle-income and lower-income households have seen their real earnings rise especially fast. And in the past 12 months, real wages overall have grown faster than they did in the pre-pandemic expansion.

Online ad spending is expected to keep rising in 2024 after a bumpy 2022/2023:

Ad spending growth is widely forecast to accelerate in 2024, after a bumpy start to 2023 stemming from macro uncertainty as growth forecasts were pulled lower mid-year. The market looks to be cheering on a return to higher growth in 2024, along with new synergies from generative AI advertising offerings from Big Tech and pockets of stronger growth in digital and retail media ad spend.

Controversially, the layoffs and other drastic cost-cutting measures helped too, but cannot account for the entire recovery as commonly assumed. Over 10,000 Meta employees have been let go over the past two years, of over 23,000 total layoffs among 85 tech companies. A common argument I saw in early 2023, when Meta stock began its surge, was that the share price recovery was due to the layoffs and would be temporary. This again did not make sense to me. The money saved with layoffs alone cannot create such a huge gain of shareholder value. If 10,000 Meta employees each being paid $300,000/year were laid off, this would free up $3 billion. At a 10x multiple, maybe this would be worth an additional $30 billion of market cap appreciation, yet Meta stock gained hundreds of billions of dollars of valuation. Also, this was certainty not the case during the 2007-2009 crisis, when companies had major layoffs and still their share prices went to zero. Layoffs alone cannot upright an otherwise sunk business.

The lesson here: Predicting is hard. Be skeptical or at least question experts or ‘reputable sources’-don’t take their word as gospel. Do your own research and seek many views/perspectives. ColdFusion is one of the more reputable mini-documentary YouTubers out there, yet his video aged horribly (my advice: wait for the company to actually die before writing the postmortem). If something is widely known to the public, like Metaverse losses, then it’s likely already priced into the market.

[1] Disclosure: Author owns FBL, which is a 1.5x leveraged ETF version of Meta.