The national debt–now at $34 trillion or so by latest estimates–is a scary, attention-grabbing number too big ignore, but in this post I will make the case for why investors ought to. It’s so big, it almost defies comprehension. Someone on Twitter posted a graphic to try to visualize it:

The United States is $34,000,000,000,000.00 in debt.

Here is $1 Trillion visualized in $100 bills.

The National debt is 34X this.

When does this actually start to become a massive problem? Will it be next year? Five years from now? 10 years from now? 20 years from now? Why… pic.twitter.com/aXxFHgCNnq

— Brian Krassenstein (@krassenstein) January 9, 2024

Deficits tend to surge regardless of which team is in power, theatrics about the debt ceiling notwithstanding (which is always raised in the the eleventh hour after negotiations stall). Or inevitably-doomed promises to ‘rein in spending’. The national debt has long been a fixation of pundits who may otherwise care little about economics. For ordinary people, who are not glued to social media 24-7 about the latest outrage or crisis, life goes on.

As far as investors are concerned, surging deficits and high inflation does not mean stocks cannot generate real returns. The Nasdaq gained over 50% for 2023, which is well in excess of 5% gains for CPI. Same for the S&P 500, which including dividends gained 25-percent. Unless all of one’s discretionary spending is for food, anyone who stayed invested saw substantial, real gains of net worth and purchasing power despite high inflation and debt.

By basic macroeconomic assumptions, government spending (running a deficit) goes into the private sector (a surplus), which is pure top-line growth for large companies and is thus good for stocks. [0] If a publicly-traded company is generating double-digit profit margins, this is money that must go to shareholders either in the form of dividends, buybacks, or retained earnings regardless of the national debt, sluggish GDP, ‘the great stagnation’, inflation, or other headwinds. This can explain how stocks can post such large returns when the economy otherwise feels weak.

When things seem at their worst, that’s when you got to hold your nose and buy the dips instead of sitting on the sidelines for the crisis that may never come, or for the second shoe to drop that never does. The Fed and Congress can be counted on during crisis to bail out the investor-class without fail, like in 2008 or 2020. When the housing marked dipped in 2020 due to Covid, those who sat on the sidelines expecting a repeat of the 2006-2010 crash, will likely never be able buy homes at those same low prices ever again. People who wait, all too often, end up waiting forever or buying back in at a much higher price.

Same for the risk of dollar collapse. For Americans, the relative strength or weakness of the dollar is not that important. This is because global wealth is implicitly benchmarked to the dollar, such as the Forbes 400 list. I see no evidence for this to change. Indeed, the dollar is only 10% off recent highs in spite of endless pronouncements over the past 14 years by Peter Schiff and others of an impending dollar collapse:

The dollar falling relative to the Euro, Yen, Pound etc. does not make Americans poorer, compared to the converse for Britons, Germans, Japanese, Turks, etc. when their respective currencies fall relative to the dollar. This asymmetry works to America’s advantage. Sure it may cost more to travel overseas if the dollar falls, but this is trivial relative to household expenses and net worth. Your personal wealth, like the value of your home, is unaffected and is always fixed in dollars. Same for other investments.

The US can inflate its own debts away, as the amount owed is always fixed, by growing GDP relative to the debt. Yes, rising interests rates does make newly issued debt more expensive, but the amount already borrowed/owed is fixed, as it’s always pegged to the dollar, not another currency. Thus, US can literally print money to cover its debts, without affecting the amount owed or hurting credit-worthiness much.

Conversely, for ex-US markets–especially emerging markets–the debtor country’s currency falling increases the amount owed, which can lead to hyperinflation and wealth destruction as the currency keeps falling, like Germany during the ’20s, the 2000s currency collapses of Venezuela and Zimbabwe, Russia in 1998 or 2014, or the 1997 Asian financial crisis. Thus, Zero Hedge is technically is right about the risk of debt spiral, but this does not apply to America as it does elsewhere.

During recession or crisis, Congress embarks on expansionary fiscal policy (such as stimulus or tax cuts), in theory, to boost aggregate demand. This is followed by recovery (whether the recovery is causal from the money printing is also debated), and GDP making new highs, typically 1-3 years later, completing the business cycle. Because the economy has grown, the debt burden is lessened even if there is more debt, as existing debts are ‘inflated away’.

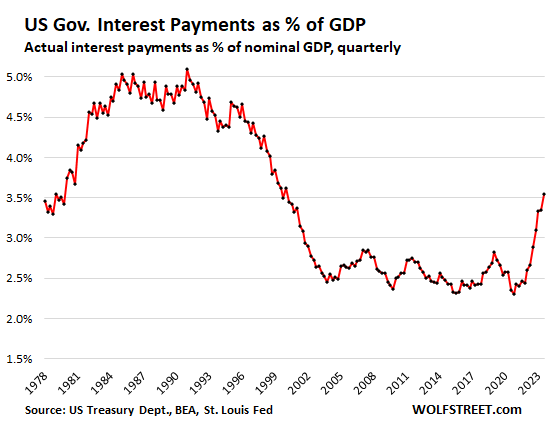

In spite of the surge of inflation and interest rates from 2021-2023, interest payments as a percentage of GDP is still well below that of the ’90s, which was as a period of strong economic growth and stock market gains:

Moreover, during crisis or recession, such as Covid, Treasury yields plunge and the dollar surges (the so-called ‘flight to safety trade’), making it easier for Congress to print money to prime the economy.

But unlike countries with reserve currencies, emerging markets have the opposite problem of recession and crisis causing local currencies to fall and bond yields to surge in panic, making it infeasibly expensive for governments and central banks to coordinate to contain the damage and restore confidence with the same efficacy as the US does.

The fiscal hawks are right, technically, that the debt does matter, but such rules does not apply to the US, which is where they are wrong. The US is truly exceptional in the sense that it can avail itself of way more options to smooth out business cycles and keep recessions infrequent and brief, that other countries lack. How long this is sustainable is up to debate and unknown, but it has worked for the past century, so I would not want to bet against it either.

[0] Whether this leads to a net-gain in growth over the long-run, or the existence of the so-called multiplier effect, is debated. The theory of the ‘crowding out’ effect is that government spending takes away from private investment.