I saw this going viral : Baby boomers are becoming homeless at a rate ‘not seen since the Great Depression’ — here’s what’s driving this terrible trend. And from WSJ: Why More Baby Boomers Are Sliding Into Homelessness.

Let me get out my little violin. But in all seriousness, this agrees with my earlier post Boomers had it easier? It depends:

So much for boomers having it easy or always being wealthier. Sure some are, but there is considerable generational overlap, as expected when comparing large groups of people. Boomers and gen-x not uncommonly fill the ranks of the lowest-paying of service sector jobs (although some of this is for benefits such as healthcare). It’s like, “Why are not you not conforming to the media narrative of being so much better off? Why are you not drawing equity off the home you bought for the cost of a postage stamp, instead of scanning items at Costco?”

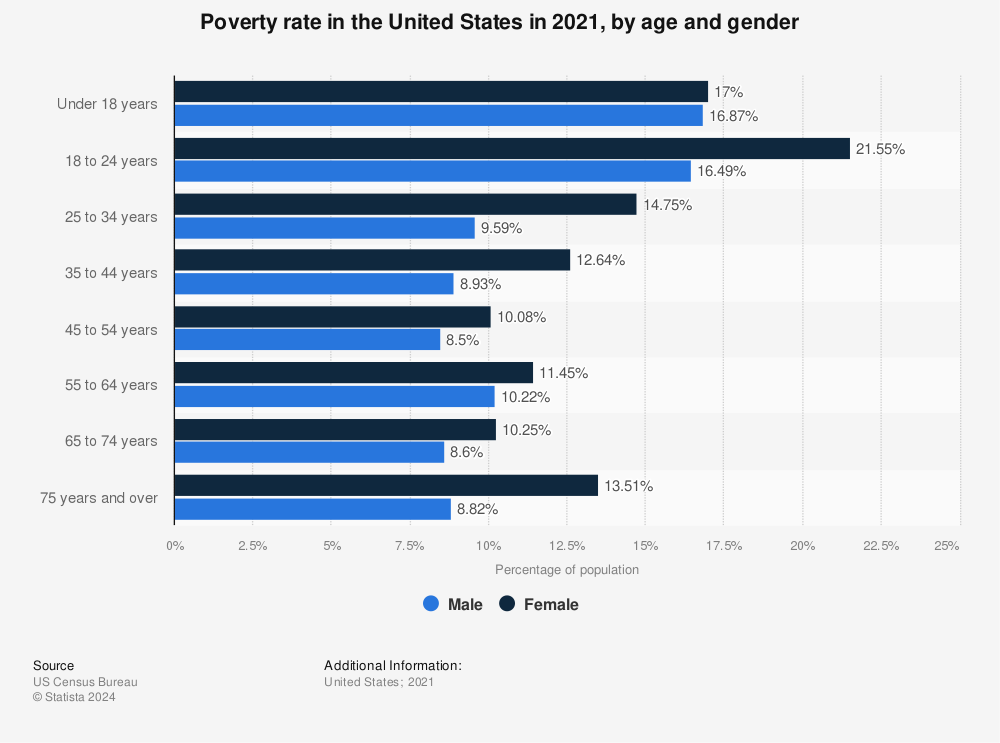

This assumption that all boomers are sitting on mountains of home equity as younger generations slave away to afford rent, let alone a home, is one of the enduring myths that refuses to die. Sure, boomers as a generation are collectively wealthier compared to millennials or gen-z, but a lot of boomers are poor, similar to later generations. As of 2021, boomers and ‘silents’ have roughly the same poverty rate as millennials, at around 10%:

Regarding housing affordability and ownership rates, again, we see that boomers did not have it especially easier. Despite the popular meme of the ‘good old days’ when anyone could afford a home in the ’70s, the evidence suggests this was not the case.

As boomers were transitioning to adulthood and getting jobs in the ’70s and 80’s, they faced similar affordability problems as young people do today. Homes were much cheaper, obviously, but wages were much lower too, and there were fewer borrowing or financing options. It’s not like boomers in the ’70s had access to 30-year mortgages.

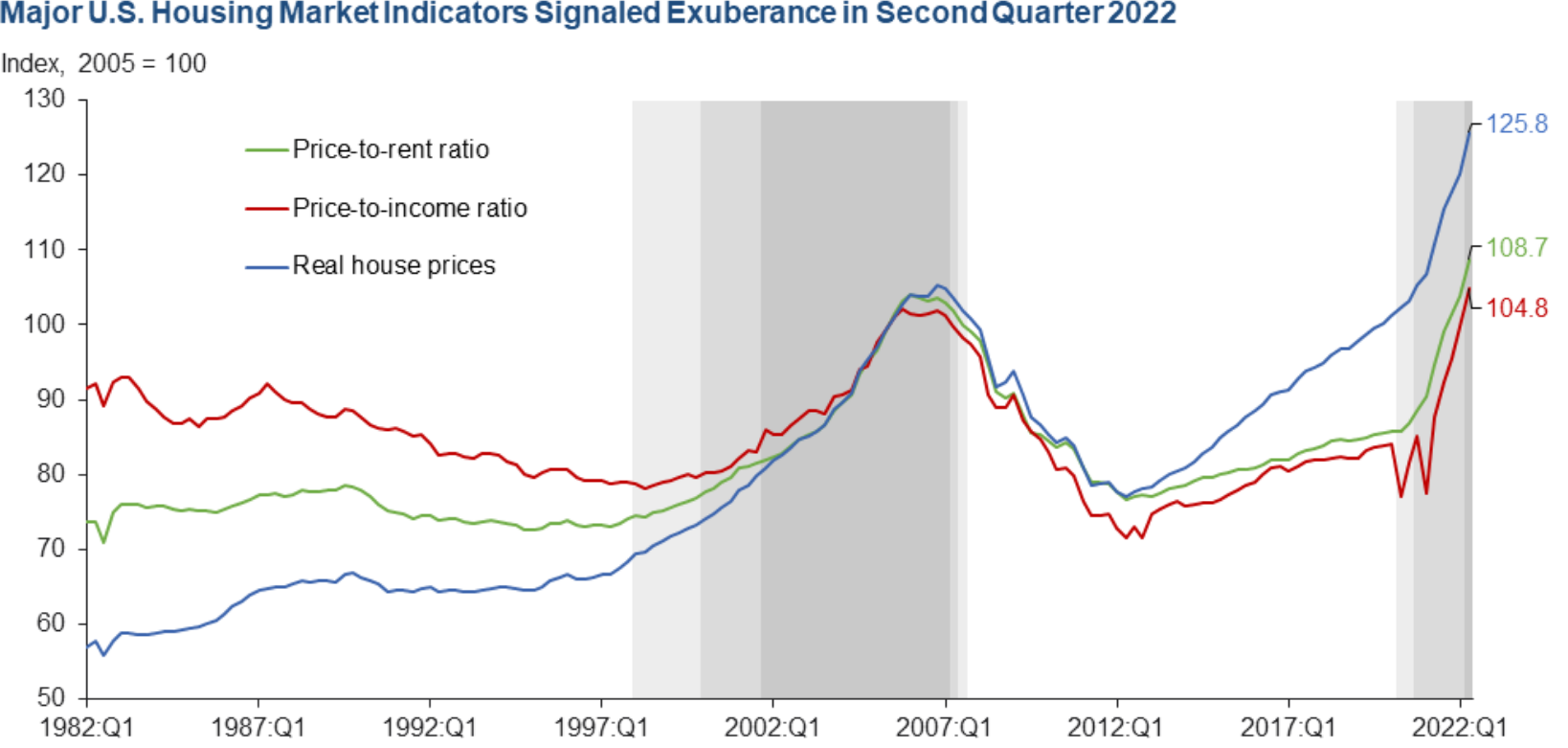

The media tends to only latch onto the price aspect of housing and overlooks the importance of wages. Even after a record surge in interest rates, housing affordability is only a little worse compared to the ’80s and ’90s:

Same for price-to-income ratio:

Notably, the US home ownership rate is still higher compared to in the ’70s, back when boomers supposedly had it so easy:

Also, the assumption that boomers are siting on mountains of home equity also assumes they didn’t sell or borrow earlier. How many boomers can this possibly be? Many boomers in the 90s and 2000s used their homes as personal ATMs. This also assumes boomers have stable jobs and seldom need to move and can live in the same home they bought in the ’70s, ’80s, or early ’90s, which again, maybe only applies to a very small percentage of boomers. Boomers get fired and face financial hardship and need to move and rent, like other generations too.

Also, although college was more affordable, unlike gen-z and millennials, wages for professional jobs were much lower. Boomers in the ’70s and ’80s and with advanced degrees earned about the equivalent of $50-80k today, not the fat mid-six-figure salaries commonly seen today in law, tech, consulting, finance, etc. The difference between today and 30-50 years ago is a much thicker right-sided tail for the top 5% of earners in terms of wage growth:

This can explain how on popular Reddit ‘FIRE’ and investing subs there is a sizable cohort of young people who have substantial net worth despite the media narrative of how all young or middle-aged people are broke or struggling.

Overall, whether it’s homeownership rates, home affordability, or poverty, we clearly see that the media narrative of boomers either ‘having it easier’ or being wealthy is incomplete or wrong. Wealthy boomers with large nest eggs and substantial home equity are not representative of boomers as a whole.