This excellent chart by Richard Hanania also explains why the student loan debt crisis is so intractable:

Your typical worker in Japan is smarter and probably harder working than those in any other country. But they earn less than other nations, because they have an inflexible labor market. Picking “ job security” over dynamism, and unions, make nations poor. https://t.co/0qvY0VfzEL pic.twitter.com/hL2CIoIkzx

— Richard Hanania (@RichardHanania) March 28, 2023

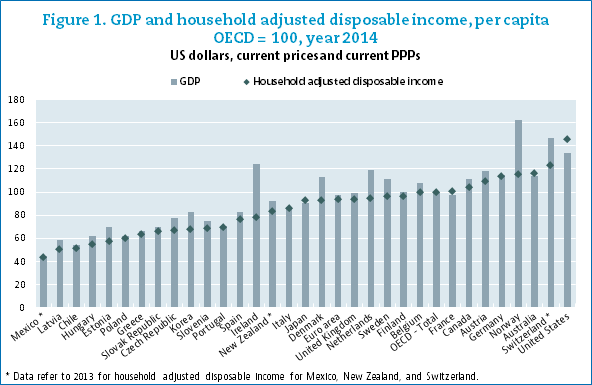

Americans earn a lot of money, way above and beyond the second-place developed country, Germany. Moreover, this is magnified by Americans having among the lowest income taxes in the developed world, which when combined with high wages means considerable discretionary income and among the highest standards of living in the world:

Which is sorta remarkable given America’s huge population. The only other countries that come close are tiny, like Switzerland or Luxembourg.

This segues into the debate about student loan debt. A recent WSJ article went viral More students are turning away from college and toward apprenticeships . Conservatives and liberals seem to be in agreement that there is too much student loan debt. Both sides also seem to be in agreement that ‘the trades’ are a panacea to this problem, which it’s not.

I think it’s wrong or at least symptomatic of something broken in society that young people, who are in their peak productive years, have to go tens of thousands of dollars into debt and set aside four years, delaying family formation in the process, for what is effectively a piece of paper for entry into the middle class, but we’re stuck because the alternatives are worse, and defection is disadvantageous at an individual level. Yes, there is value of higher ed for non-monetary reasons, but according to surveys most people go to college to make more money.

It goes without saying there is a lot of student loan debt, to the tune of $1.6 trillion as of 2023, but again, as the chart above shows, Americans earn a lot of money, especially college graduates. This aspect is often ignored in the student loan debate, which focusses mostly on sticker price. Would young American adults choose to forgo college if it meant a major pay downgrade (or having to earn the equivalent of Japan’s wages)? I think not.

After factoring in scholarships and other discounts, the typical federal student loan balance is $37,000, not six-figures as often hyped by the media. At 6% interest for a 10 year loan on $40,000 of student loans, a borrower would pay about $9,600 in interest throughout 10 years. That’s about $3,600/year in payments for the loan plus interest, which is small relative to the college wage premium ($10k-$20k/year typical for starting, and the delta increases over time). Plus, a much lower unemployment rate (2-3% for collage grads vs 6-8% for high school grads), which negates the alleged ‘4-year head start’ from foregoing college: what good is having a ‘head start’ if you cannot find work, or what work you can find pays so poorly?

Pundits tout ‘the trades’ as a cheaper, better alternative to college, but such cheapness is debatable, and I don’t think the case is as ‘slam dunk’ as often assumed. Or coding bootcamps, which are expensive and notorious for vastly inflating the promised job prospects and competence of graduates.

People think trades are cheaper or are ‘free’–hardly. Trade school costs on average $33k. This sounds like a good deal compared to $120k for a 4-year degree, but this ignores scholarships and other discounts. The net price, which is actually paid, is not uncommonly discounted significantly from the sticker price:

It does not help that the media only focusses on the sticker price and ignores the net price. I cannot blame them for choosing the higher, scarier number if the goal is to profit from fear. That’s not to say that the net price is cheap, but it’s just another example of how context and nuance is often missing from these debates and media coverage. Also, the average annual tuition and fees for a public, in-state school is just $10k/year, which is comparable to trades.

Also student loan debt, being federal instead of private, has way more payment options, lower interest rates, and forgiveness compared to trades debt or bootcamp debt. As a 20-year-old with no credit history there is no way in hell you will be able to borrow $50,000 at 6% for 10 years from any private borrower without cosigning. Additionally, you incur an opportunity cost from not finding work as easily, and time spent training, which may be unpaid. Not to mention, fewer healthcare or other benefits, erratic/unpredictable pay, higher rates of occupational injury, worse tax structure, no sick leave, etc. compared to white collar work.

Others like to show outliers, like how a construction site manager or Walmart manager can earn more than an office worker, but this is not an apples to apples comparison. It’s not like you start out as a manager, and the office job equivalent in terms of seniority would be something like a senior engineer, who may earn hundreds of thousands of dollars/year.

Incentives matter too: the system rewards the short-term accumulation of debt for a lifetime of higher wages. The compounding effect really starts to kick in after a few decades of working, not just higher wages and bigger raises, but by investing said wages in the stock market and or real estate, which also compound. This creates very little incentive to want to fix the problem, in part because the people who are in a position to fix it, like employers, voters, or politicians, are already so well off from having benefited from the system, even if the system is broken.

It’s a certain prisoner’s dilemma problem, or as Scott calls a ‘Molochian’ system, in which rational actors acting out of self-interest makes things worse for everyone. Forgoing college at an individual level makes you worse-off in the job market; it’s only neutral if everyone defects, which is not going to happen as long as incentive structures exist as they are.