The biggest problem with the college tuition debate is that it does not sufficiently address the root of the problem. My argument has always been that the student loan debt ‘problem’ won’t be fixed until either the alternatives to college improve–and or–the returns to college worsen. But I don’t see any hope of either of these changing on the horizon.

As far as wealth creation goes, it’s hard to beat the college-to-career pipeline. What are you going to do…gamble on $dog_shit_coin and lose all your money, either as the price goes to zero or customer’s funds are secretly siphoned off to bail out the CEO’s insolvent hedge fund? Or flip burgers or wait tables to earn wages that persistently lag inflation. Or enroll in ‘Hustle University’ learn how to to resell Hustle University courses a dwindling supply of new suckers. Or a race to the bottom to resell shoes and trinkets on Etsy or Shopify, along with hundreds of other people competing to sell that exact same brand of shoe? The fact that the major selling point of the ‘creator economy’ is low costs and low barriers to entry, only means way more competition.

In late 2021/early 2022 crypto was vaunted as a new paradigm of wealth creation for the masses, until that went belly up and bang in the hot summer sun. It’s hard to overstate how big the crypto obsession had become. Ads for crypto were blanketing TV and radio, with even NBA superstar Seth Curry, apparently not content with only making millions playing basketball, shilling the soon-to-be defunct exchange FTX. There was not one but two cryptocurrency ads for the 2022 Superbowl. I’d click people’s Reddit profiles on topics entirely unrelated to crypto, such as politics, and not uncommonly see posts asking about ‘Coinbase’ or ‘Ledger wallets’. Yet again, like all bubbles, the general population of late adopters got hosed after the rug was pulled [0], but VCs and promoters still escaped with their bank accounts and reputations mostly unscathed.

In the past, manufacturing and agriculture provided stable, good-paying jobs for all levels of educational attainment, but those have been replaced by service sector jobs, which tend to not pay as well:

But it’s not all bleak. Purchasing power for many consumer goods has increased, such as electronics and food. A decent TV or computer costs just hundreds of dollars, not thousands of dollars like a couple of decades ago.

To go off on a tangent a bit, I think the main issue is low and middle-income Americans being priced out home ownership, not the unaffordability of consumer goods. Home ownership is now considered a necessity to building long-term wealth, compared to pissing it away on rent. Covid and the 2008 crisis only put a temporary dent in the otherwise unstoppable march of home prices. So although home ownership is more lucrative than ever before, home ownership is possibly less attainable, especially for high-income metro areas. It makes sense how these are at odds with each other: for something to be a good investment implies that its returns exceed some benchmark, such as inflation or GDP. Salaries for high school grads tend to only track or lag inflation whereas for college grads it exceeds it, which over decades can have a significant compounding effect even if the annual difference is not that great.

The price of Bitcoin cannot possibly go high enough to ensure that everyone without a college degree who invests will become rich, or even just middle class. And even if it did, the ensuing hyperinflation would negate any increase of purchasing power anyway. If money is to mean anything, it necessitates that there must be some scarcity. We all cannot make it, brah.

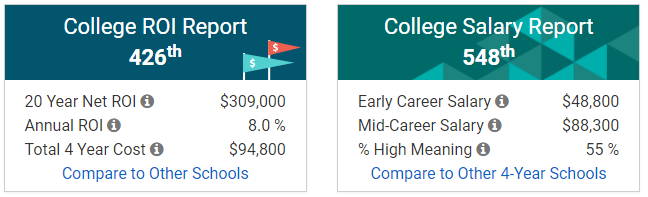

But the data still shows that the college-to-career pathway is still the best shot at entering the ‘middle class’, including home ownership, as this excellent article The Bermuda Triangle of Wealth, by Conrad Bastable, explicates so well. College in America is sorta analogous to Chinese civil service system, but by earning a diploma instead of passing an exam. Adjusted for inflation and student loan debt, college grads before in ’70s earned $10,000 less than grads today. Being a doctor was not that lucrative in the ’60s, compared to the mid-six figure salaries seen today, and even more for specialists. As the above link shows, college has a positive ROI for the lowest of ranking institutions, even for ‘useless’ degrees:

This is why PMC/white collar jobs are so good despite the ‘bullshit jobs’ meme. Short-term pain is worth long-term gains and financial independence, as many have done following the ‘FIRE lifestyle‘. Yeah, the boss is earning more, but how many opportunities are there in life to make solid 6-figures while someone else takes the risk; all you have to do is show up? Sure beats crypto gambling, Shoppify, and shit like that which is marketed as an alternative, which has way more risk and most people make nothing. As soul-sucking as corporate jobs sometimes are, as satirized by Dilbert, most service sector jobs are also equally soul-sucking, but with much less pay. And instead of pointy-haired bosses, you are dealing with ‘Karen’ customers. Moreover, white collar jobs tend to be much more impervious to economic cycles, as was made obvious during Covid and in 2008, in which low-skilled jobs were among the first to go.

It didn’t used to be this way, or at least not as bad. The 6-figure managerial job didn’t really exist until the ’90s, during the Clinton economic boom, which saw the rise of the so-called “FIRE economy” and conversely the decline of manufacturing jobs. The college wage gap really widened after 2008 as Wall St. recovered. College grads, especially in professional sectors, pulled way ahead and never looked back. The shallow economic populism of Trump didn’t put a dent in the college wage premium either, nor did Covid, which was predicted to be economically disruptive but only saw old trends reassert themselves. Same for bromides about ‘essential workers,’ whose essentiality faded with the memory of the pandemic.

Bootcamps are often touted as a cheaper alternative to college, but are not actually that cheap. Bootcamps typically cost $10-15k for a 6-month course, which is comparable to college tuition. But whereas college students can take advantage of generous financial aid, repayment plans, and scholarships, bootcamps, being wholly private entities and generally unregulated and unaccredited, have far fewer payment options. Moreover, a degree is a universally valued credential in the eyes of employers; a certificate is not. Bootcamps are also notorious for greatly inflating the success rates and competency of their graduates, which is probably why employers don’t look too highly upon them.

A few years ago tech giants like Google made headlines by announcing they do not require degrees. The media keeps getting this wrong…they want applicants whose skills are commensurate with college-educated applicants, but without a degree. I am sure such people exist but I would not stake my hopes on being one of them. Nonetheless, it’s a good a start though, and more companies should adopt this.

Fixing this problem requires a major overhaul or restructuring of how society, particularly corporate America, functions. Maybe we need more ways of creating wealth or upward mobility that does not require a degree, or isn’t a get-rich-quick scheme that preys on the desperate, gullible, or untalented. For most people, wealth is created by producing economic value–that is, providing a service or goods that people find useful enough to be willing to pay for–not trying to ‘get in early’ and then ‘selling at the top’, which history has shown time and time again, tends to end badly for most participants.

Conservatives are overly inclined to blame credentialism on the government subsidizing student loans. Or ‘disparate impact’ [1]. True, these are factors, but I don’t think they are the major ones. Degrees, unlike IQ tests, also signal agreeableness, conscientiousness, diligence, among other other desirable traits in workers, besides just intelligence.

Disagree. Education's business is selling a credential you need to keep out of the ZMP pool of riskier (non)hires, and no amount of AI teaching has anything to do with certifying that you did a lot of boring work without ever getting kicked out of school. https://t.co/UpM9uhICbc

— Eliezer Yudkowsky (@ESYudkowsky) December 7, 2022

‘Returning jobs to America’ is a catchy slogan both sides can agree on, yet decades later, remains just that, an empty promise. Large companies, especially, are hellbent on efficiently and risk aversion, hence why the 4-year degree is still the gold standard, student loan debt notwithstanding. Ultimately, the dispassionate, impersonal process of filtering resumes needs to be replaced by more holistic alternatives. Just as the beatings will continue until the morale improves, the student loan debt problem will continue until the alternatives improve.

[0] The ‘rug pull’ is the terminal outcome of any promised or overhyped shortcut to wealth that reaches peak saturation–be it Beanie Babies and tech stocks in 2000, home flipping in 2007, self-publishing on Amazon in 2011, fracking/rig jobs in 2015, or cryptocurrency in 2021. Notably, it has low barriers to entry, which makes it quickly become saturated.

[1] Companies mitigate legal risk by requiring degrees instead of possibly more biased filtering methods, such as IQ tests, although individuals and groups who score low on TQ tests tend to also have among the lowest rates of college completion.