[Closed my #BTC short. No reason. Will think abt it later]

— Nassim Nicholas Taleb (@nntaleb) October 17, 2022

Talk about bad timing, BTC is down 2% since he covered his position yesterday (because when you cover a short position, you expect the price to go up). He has said multiple times that it’s worthless, which I agree to some extent (maybe not worthless, but a lot lower), so why cover? He’s leaving a lot of profit on the table. Unless he thinks it is going to make a major bounce, but I doubt it. BTC struggles to go up even as the stock market surges, and indeed the Nasdaq is up over 3% over the past 2 days but BTC is flat over that same period (down 2% today).

Given that BTC is going to zero, yet BTC is highly correlated with the stock market to the downside, he should short BTC and go long stocks to profit from BTC going to zero and the tendency of stocks to go up in the long-run.

I would never make such a mistake. I stick with the the plan (unless something better comes along, such as swapping out some bonds on dad’s retirement account with the fund JEPI. Long story.). But clearly, the BTC trend is lower. Why cover?

To reiterate, Crypto is a scam and a bad investment. Yes, one can argue that crypto is just a bad investment , not a scam, but there are so many scams, it’s hard for me to tell the difference. Hedge funds, pretend experts, and VCs steered their combined millions of followers to their financial destruction while enriching themselves. Everyone blames bankers for the 2008 crisis, such as Goldman Sachs selling financial instruments it knew were worthless to its clients, yet where is the blame for the hedge funds and VCs for also duping investors? At least Goldman’s clients are accredited investors, who can afford to lose the money, not average retail investors. Front-running and insider trading is as rampant, if not worse, with crypto compared to the stock market.

At the peak in 2021 Chamath’s Twitter account was getting tens of thousands of likes per tweet, compared to just a hundred now. Probably thousands of his followers lost money following his advice. Same for Cathie Wood, who had a similar fall from grace. It’s amazing how quickly things fell apart, in a little under year. I can name at least a dozen well-known people who bear some responsibility. Sure, people lost money with stocks too, but stocks have a 100-year history of recovering. Crypto? Who knows. It only goes back a decade.

Crypto losses likely exceed the losses of the 2008 crisis. At its peak in November 2021 crypto was worth $3 trillion, now $1 trillion (but about 30% of that is stable coins). This is more than the market value of Goldman Sachs, AIG, Lehman Brothers, Bear Sterns, Freddie Mac, and others combined in 2007.

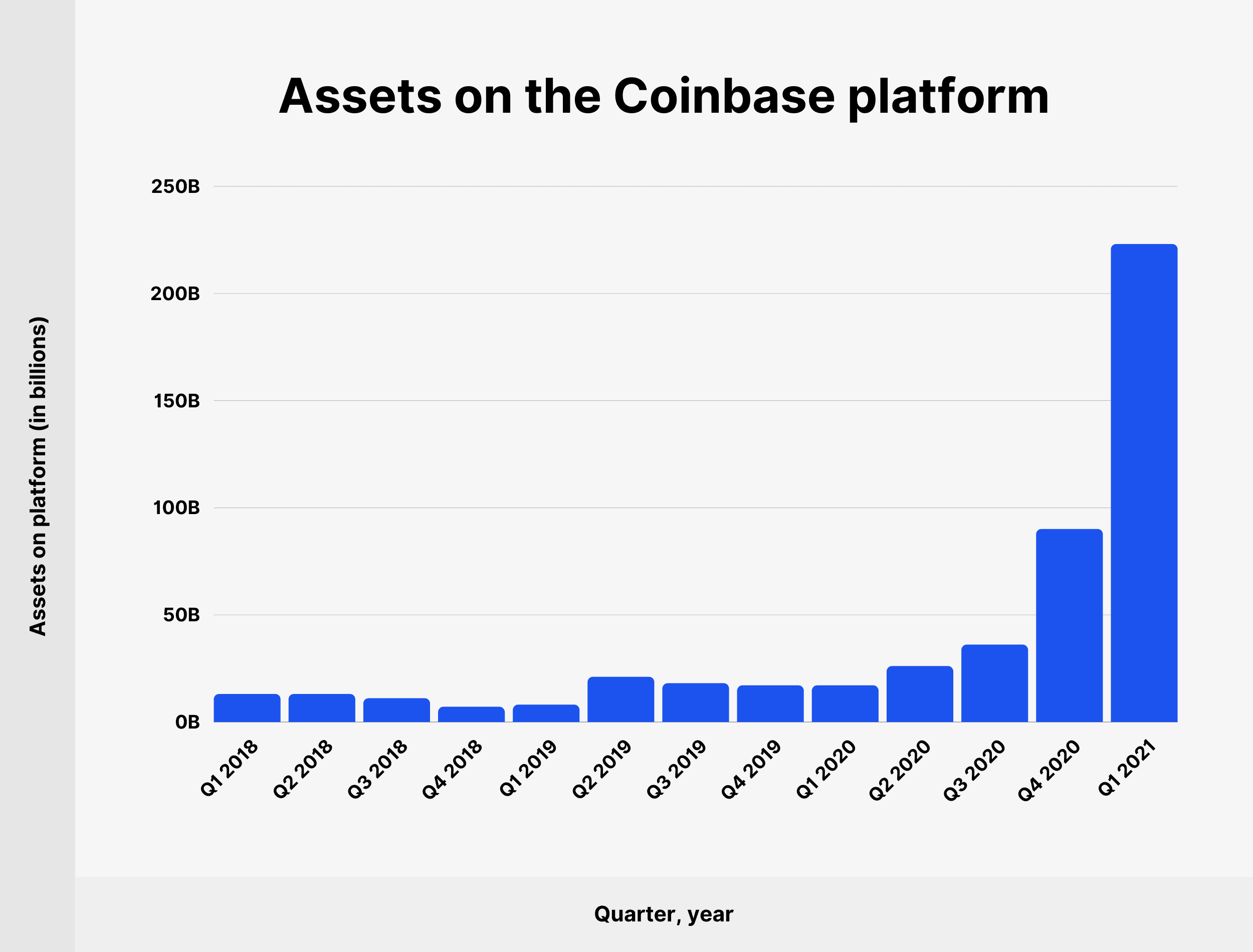

Retail investors in the US alone probably lost a quarter of a trillion dollars combined , which is way more than Enron, at just $70 billion. Or Madoff ($20 billion), which is 1/3 the size of the Luna fraud alone. Coinbase has 68 million accounts, most of them opened in the past 2 years. Coinbase assets surged in 2021, at the very peak of the market. Most of these individuals and positions are probably underwater a lot, maybe 50-80% or more:

Binance chain was hacked for $500 million last week. It’s hard for me to wrap my mind around these kind of numbers. $500 millions puts it in the top 10 largest frauds in US history, yet in crypto it seems like this is a routine occurrence.