I saw this article going viral Why has college gotten so expensive in the last 30 years? Probably because the government handed them a blank check in 1993.

This is a perfect example of how easy it is to deceive with data. The author, Andrew, attributes the surge in college tuition costs to the Omnibus Budget Reconciliation Act of 1993, writing:

Up until 1993, the federal government merely guaranteed/backed student loans that private lenders gave. This meant that only in the case of someone defaulting on their loan would the government be on the hook, stepping in and paying the college what’s owed.

This amendment completely overhauled that system, making it so that for the vast majority of student loans, the federal government directly made the loans to students. More specifically, the federal government pays the universities/colleges up front, and the student then owes the government that money.

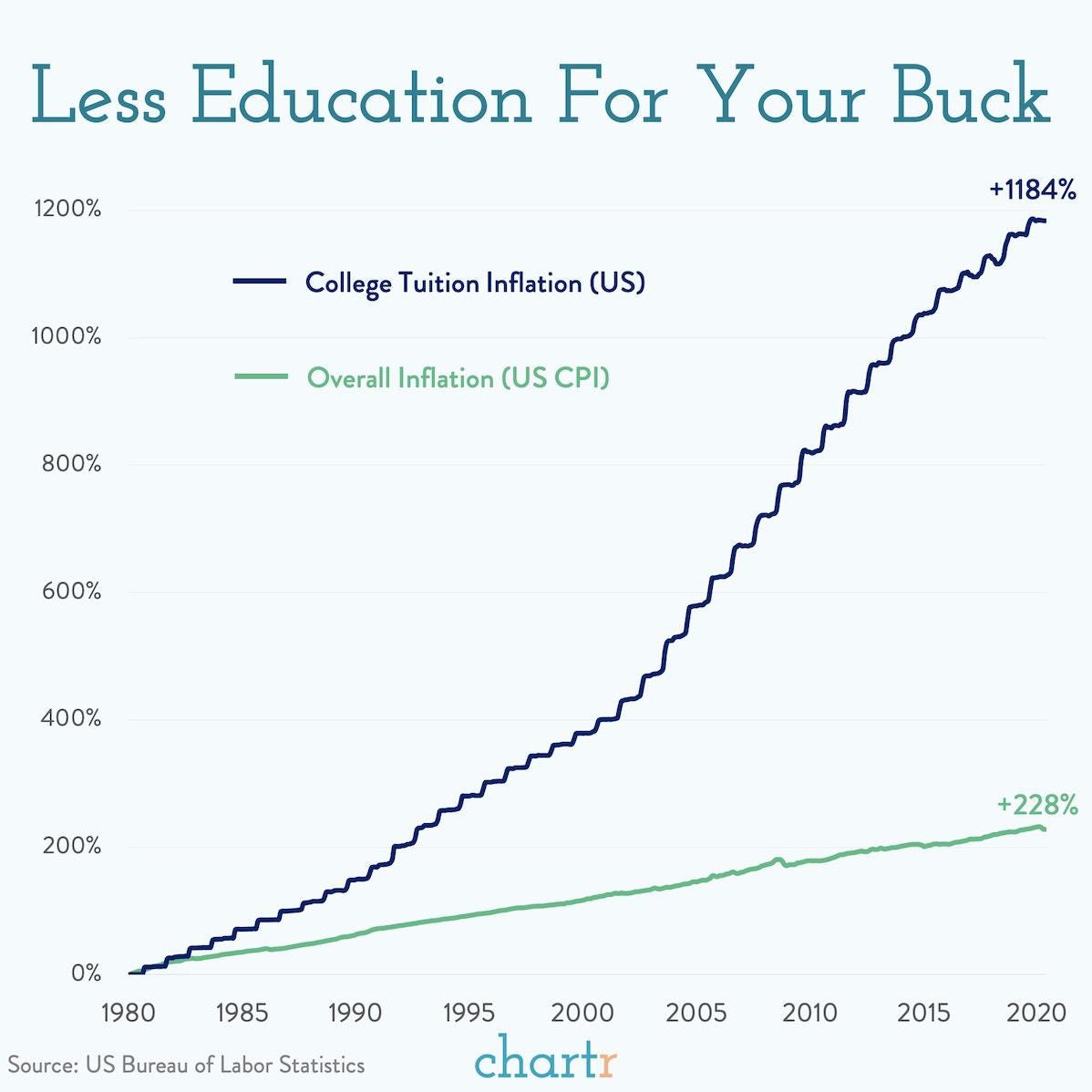

He also supplies the chart below, which looks convincing enough:

I don’t doubt that the amendment played some role, although not as much as other factors. But it’s hardly sufficient to establish causality. Looking at the above chart, it’s evident that the trend began in 1980, not 1993. Using a linear chart instead of a log chart is especially deceptive, because it makes the earlier data appear compressed and linear, not exponential. But it is exponential.

So if we index tuition in 1980 at $1, a 1,200% gain by 2020 corresponds to $13. Eyeballing it, the cost of tuition rose 175% from 1980 to 1993. This works out to an annual growth rate of 8%. From 1993 to 2020, tuition rose 4.75x, which is a growth rate of only 5.9%. So the exact opposite as predicted by the author’s thesis. It’s not like there was anything special about 1993: the trend was already firmly in place.

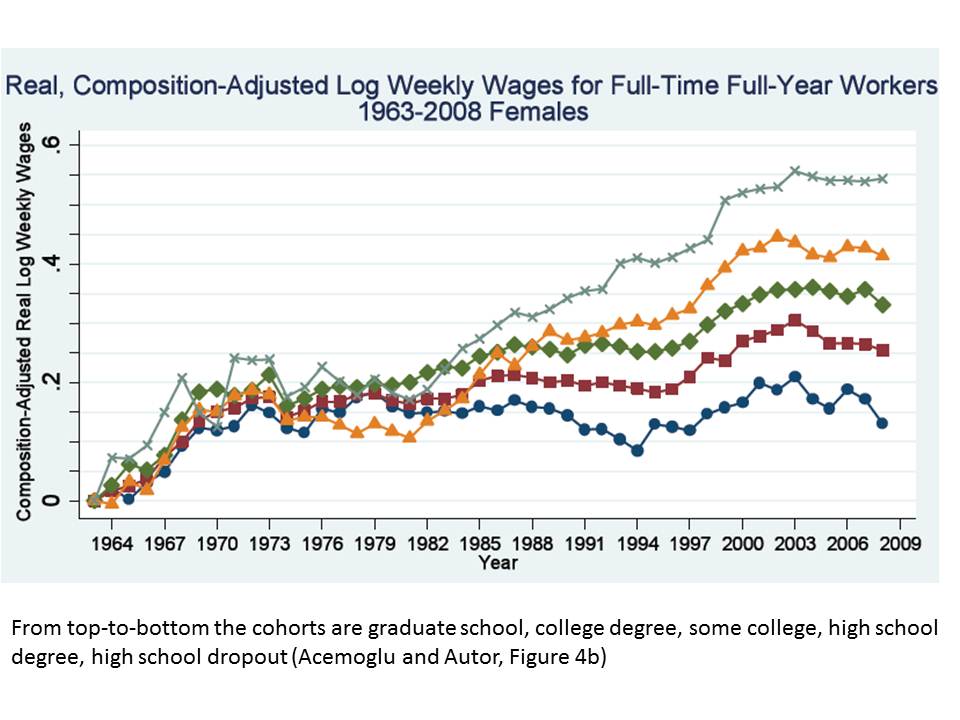

The big question is, what happened in the early 80s? There were two key developments: first, interest rates began to plunge, after peaking in 1980. This made student loans more affordable, so colleges responded by raising prices in response to increased demand. Second, the college wage premium began to kick in around 1983 or so, and has continued to widen ever since, creating more demand for college and thus higher tuition:

Even now the premium is the widest it has ever been and shows no sign of narrowing. The math works out in such a way that in spite of tens of thousands of dollars of debt/student, the interest payments relative to wages are small enough that grads still earn a lot more money compared to non-grads. Rather then paying off the debt, many grads make the minimum monthly payment at a low yield, of around 5%/year, and instead invest in the stock market or real estate, which has far greater returns. If interest rates were to surge, then this would make student loans more expensive relative to wages and probably reduce demand.

Online, I keep seeing the usual hair-brained solutions to the student debt crisis (e.g., forgive all debts, make college free, etc.) that don’t at all address the root of the problem [0]. I think the solution is going to have to come from employers, in the end. If employers stopped requiring degrees for everything, the premium would shrink and attendance would evaporate, bankrupting many colleges in the process, and the problem would fix itself in a few generations. Another possible solution is to raise standards for high school, so that a high school diploma means more. Or the increased adoption of cognitive/IQ-like tests.

Also, the sticker price is seldom paid in full. From what I have read, the amount actually paid is 50% of the MSRP after factoring in aid and scholarships. From NPR, “At private universities, almost no one pays full price. Even at the high end of the income spectrum, the net price is significantly less than the sticker price. It’s the opposite at public schools. In public schools, net price often meets sticker price at the high end.”

As others have noted, colleges today have many more amenities, such as mental health services, nice dining, and smaller class sizes, compared to 30+ years ago. People’s expectations of college have increased. Education is secondary to the overall college experience, particularly for private colleges. So this is factored into the price, too. Some private colleges are effectively vacation resorts at this point.

[0] This is why ‘free college’ is sorta a red herring, because once you strip out all of the amenities, college becomes much cheaper. Germany for example has very low tuition, but room and board, transportation, and other services are not covered. By ‘free college’ what they really mean is they want all expenses paid at the private 4-year institution of their choice (plus grad school).