I made some updates to my article yesterday , adding more regarding the rise and fall of pop behavioral psychology:

The period from around 2002-2012 or so saw considerable media, business, and public interest in behavioral economics and human psychology. Academics and journalists such as such as Dan Ariely (Predictably Irrational (2008), The Upside of Irrationality (2010)), Richard Thaler and Cass R. Sunstein (Nudge (2008)), Malcolm Gladwell (Outliers (2008), Blink (2005)), Steven Levitt, Stephen J. Dubner (Freakonomics (2005)), Nassim Taleb (The Black Swan (2007)), and Daniel Kahneman (Thinking Fast and Slow (2011)) saw a surge in popularity in the 2000s, along with the rise of TED talks. Entire publishing, consulting, speaking careers were built around proving how humans were irrational. The combination of the 2008 financial crisis and Great Recession, the Enron and WorldCom accounting scandals, 911, and the dotcom bubble, all compressed into just a decade, called into doubt many of the assumptions of rationality and human behavior that had been taken for granted and seemingly failed, so alternative explanations were sought.

But right now academia is fighting for relevance, due a combination of a backlash to CRT/wokeness, concerns about a student loan bubble/crisis, budget cuts, a shift away from the humanities and into STEM, and a replication crisis that threatens of undo decades of research, particularly pertaining to behavioral psychology (which a decade ago had given rise to so many careers and TED talks, but now the research appears to have been built on a foundation of sand). TED talks still exist, but they don’t seem to carry as much cultural currency compared to 8 years ago. People have grown cynical of pop psychology too (it would seem as if there is more criticism of Gladwell’s books, such as the so-called ‘10,000 hours rule’ he popularized in Outliers being wrong, than praise). With the 2008 crisis a distant memory and the post-2009 bull market, economic expansion, and housing boom the biggest and longest ever, it would seem as if the status quo has returned and alternative theories are not needed. The period from 2000-2010 can be treated as an outlier in the otherwise unstoppable march of capitalism and asset prices, not some fundamentally new paradigm shift that so many predicted would emerge.

In the aftermath of Enron and the the 2008 financial crisis, saw a huge demand for explanations of what just happened. Authors and academics such as Michael Lewis, Dan Ariely, and Malcolm Gladwell were sought to provide such explanations, telling convincing stories and citing studies about how human rationality had seemingly failed. Many people were convinced that modern capitalism was doomed and that there would be some new status quo of less wealth and greed, and a sort of downgrading of America’s place in the world. That did not happen.

Tesla reported another quarter of blowout earnings, as I predicted. These are insanely good numbers:

Tesla TSLA, -6.85% said it earned $2.3 billion, or $2.05 a share, in the fourth quarter, compared with 24 cents a share in the year-ago period. Adjusted for one-time items, the company earned $2.54 a share in the quarter.

Sales rose 65% to $17.7 billion, from $10.7 billion a year ago.

Tesla’s full-year GAAP profit rose to $5.5 billion from $721 million in 2020, while 2021 sales rose 71% to $53.8 billion, from $31.5 billion in 2020. Tesla said it ended the fourth quarter with $2.8 billion in free cash flow.

From 2018 to 2021, Tesla went from losing over $1 billion/year to now making $5.5 billion/year (for 2021). I guess that huge rally in 2019-2020, which the media called irrational or a bubble, in hindsight was not so irrational. Wall St., hedge funds saw that Tesla was becoming mainstream. I can confirm this as well: I see Teslas everywhere. Price action tends to precede fundamentals.

The loser media was expecting that Tesla stock would come crashing back to earth, wrong again.

Today in virtue signaling edition (two virtue signals in one tweet):

Respect for Neil Young.

— Nassim Nicholas Taleb (@nntaleb) January 27, 2022

Respect for a millionaire musician taking a stand against a comedian, who is also a millionaire, over bad things comedian said about bad virus. The next world war will be fought between millionaires and billionaires. I have to commend Spotify for not backing down despite the heap of criticism they have gotten over the past year about Rogan. It has been said many times already, but virtue signaling is the new American pastime. It’s a way for mediocre people like Taleb, who either have few demonstrable accomplishments or are otherwise irrelevant, to make themselves worthy and known. I am also surprised that virtue signaling still is so effective for getting media coverage given how transparent it is. Who is still falling for this.

Why don’t they take their own advice (that they are always telling conservatives who get banned from platforms): create your own Spotify and Rogan. Health authorities, ‘experts’ are used to being in environments where they are constantly affirmed for being right. Outside of this artificial environment, in the ‘marketplace of ideas’, it does not work that way. There is a sense of unearned entitlement that experts, by virtue of their expertise, should not have to compete for attention in this marketplace.

But the experts already had over a year to make their case, and were wrong about probably everything:

…overestimating the infection fatality rate (Covid is no wore than a cold or the flu for most people)

…overestimating the efficacy of lockdowns, masks, social distancing, and quarantines (Italy is a prime example of lockdowns being useless)

…overestimating the efficacy of vaccines at stopping the spread of Covid (a narrative I have seen is that omicron is good because it means herd immunity will be achieved sooner, and I am like “wasn’t the vaccines supposed to do this?”)

…underestimating how many vaccines and boosters would be needed (now it’s 4 boosters and 3 vaccines? cannot keep track)

…overestimating the threat of Covid to the economy (shutdowns hurt the economy, not Covid)

…the whole ‘flattening the curve’ nonsense (notice how they stopped talking about that by late 2020, early 2021?)

(also: school closures, chaos, stressed parents, increased suicide risk, stunted social development, etc.)

Even if you think Rogan is wrong, this does not mean the experts are ‘more correct’ either.

also

Misinformation is killing people.

Primum non nocere.

— Nassim Nicholas Taleb (@nntaleb) January 27, 2022

Do you know what the greatest risk factor for dying is? Being alive. 100% of living things will die. Someone should inform him of this. People are wondering what changed with Taleb, and nothing changed. Rather Covid has just revealed the inner SJW that was always there. Covid has made everyone more extreme and entrenched in their views: it made conservatives more conservative, libertarians more libertarian, liberals more liberal, extremists more extreme, centrists more centric.

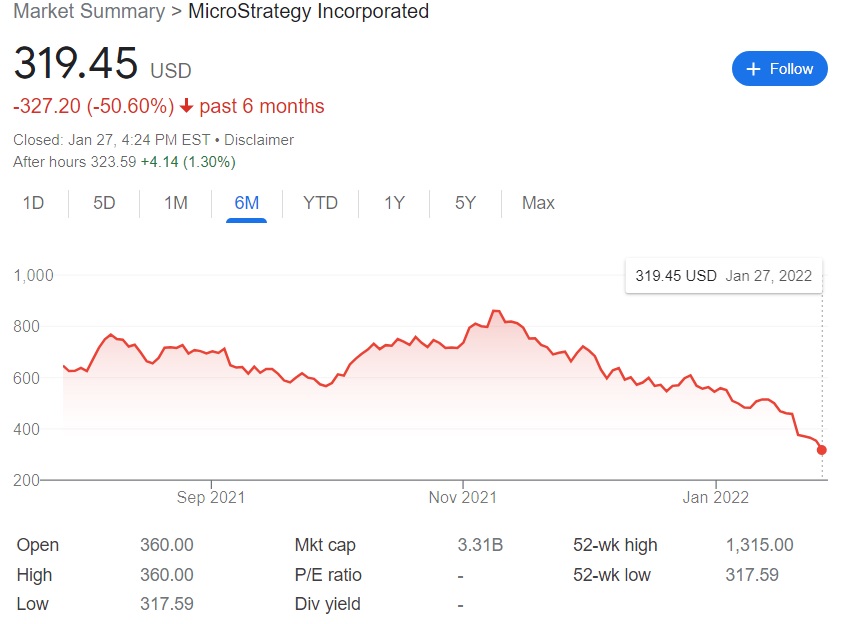

MicroStrategy continues to collapse along with Bitcoin, as I also predicted it would (disclosure: no position):

I have a theory that Twitter is promoting Bitcoin so hard, so that the people who they dislike politically, who tend to own Bitcoin or are enthusiasts of cryptocurrency, lose money. Same for YouTube, which allows cryptocurrency scam videos to run, so that their ideological enemies lose money. Rather than the SEC, FTC, and other agencies shutting down these scam videos and scam channels, are knowingly welcoming their political enemies (such as Trump supporters) being scammed. In the ’90s the FTC came down way harder on scammers, like informercial scammers or work-at-home scammers, because it was mostly baby boomer Clinton voters who were being scammed.

MSTR sub $100 soon, sub $20k bitcoin. I have never seen something go from a surefire thing to total despondency and disillusion like I have seen with Bitcoin. Just 3 month ago everyone was convinced they were going to get rich, and now it’s down almost 50%. Can it recover? Yes, in the sense that it’s possible, but this does not mean it’s probable. On Reddit, Twitter it’s nothing but people losing money (even though it is supposedly the best performing asset of all time). Consistently matters more than absolute gains. Something that goes up 20% a year with minimal volatility, like the S&P 500, is better than massive swings. This is why you don’t invest in overhyped garbage. Instead, buy Microsoft, which is up on also record earnings.