For the past year or so I have been predicting that Bitcoin would lag Tesla and tech leveraged ETFs.

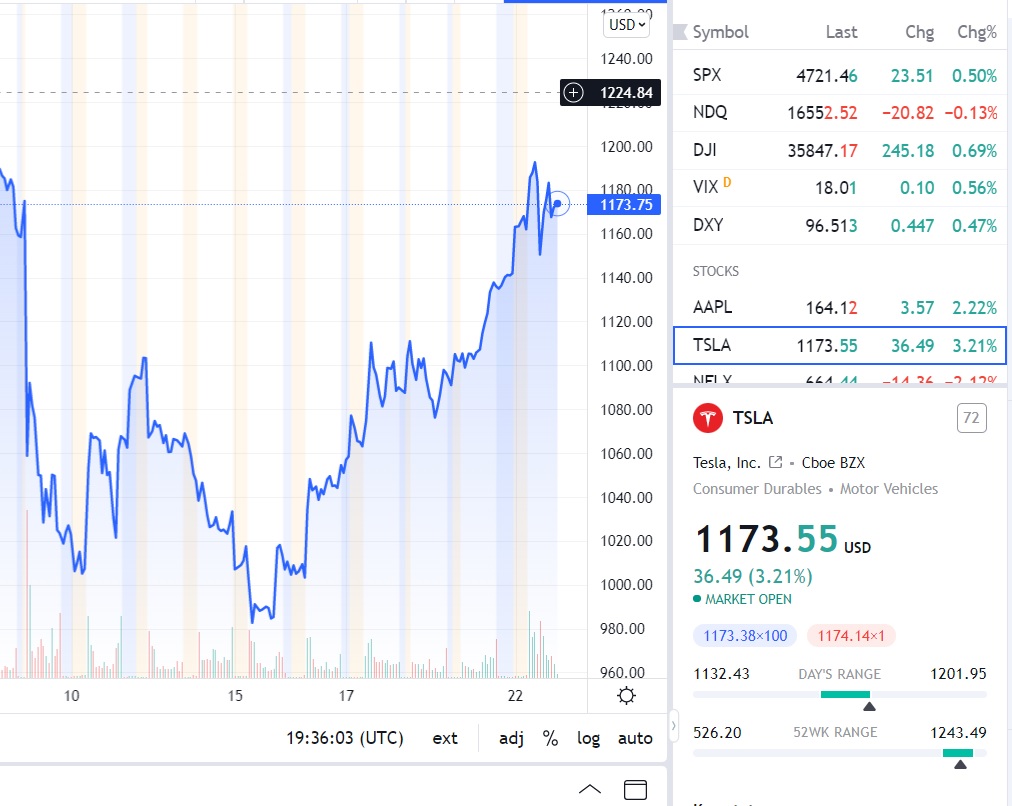

Sure enough, as of publishing this post, Tesla has almost recovered all its recent losses and is almost at $1,200/share again, as I said it would.

Elon selling a couple billions dollars worth of shares for tax reasons is immaterial despite all the doom and gloom by the media. We’re talking .2% of the total market cap of Tesla, just noise.

Second, the S&P 500 made new highs at 4720, as I also as predicted.

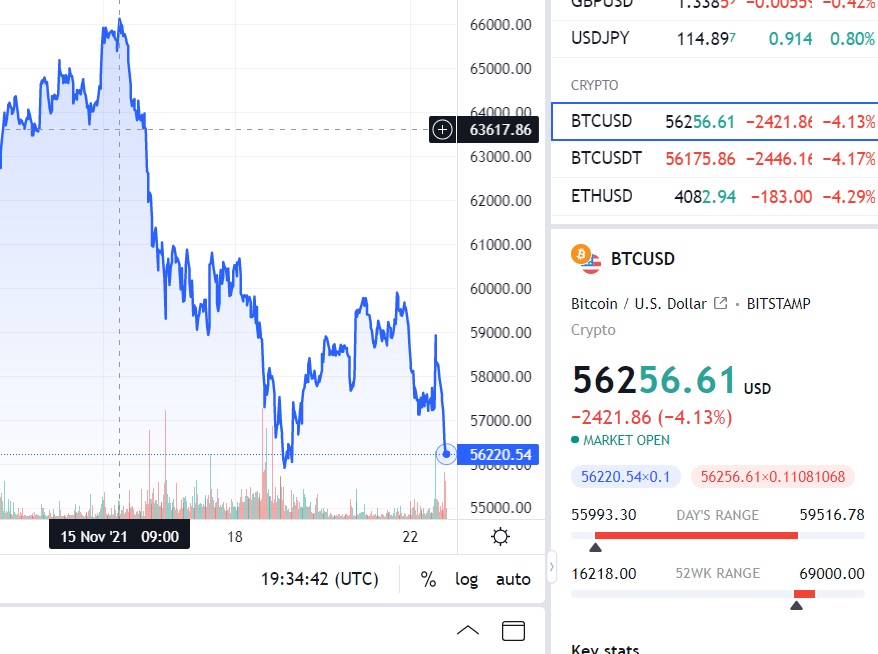

But Bitcoin keeps falling, and the performance gap between Bitcoin and the S&P 500, Nasdaq, and Tesla keeps widening.

The past decade can be characterized as a flight-to-safety/quality in overdrive, or what some likened to the so-called ‘financial singularity’, in which an increasingly large percentage of capital is chasing a shrinking number of assets, those being safest, biggest, strongest of assets among all alternatives, that are at the intersection of market dominance, growth, and macro-immunity (such as to recession or Covid, which is why Amazon, Uber Eats, Walmart, Google, and Microsoft boomed despite small brick-and-mortar retail stores doing poorly).

Once an asset class or company is marked as inferior, because of such winner-take-all effects, it is doomed to underperform, all while superior asset classes and companies keep outperforming. This can be unforgiving, as being stuck in an inferior asset means missing out even as the S&P 500 and Nasdaq keep going up, and the only sign is that your investment persistently underperforms a specific benchmark/index, like the S&P 500: there is otherwise no obvious signal that your asset has been marked as inferior.

On the flip side, by simply choosing the biggest of companies–by taking advantage of the post-2009 ‘bigger is better’ , ‘winner take all’ macro backdrop–one can outperform almost all funds and active managers while taking on less risk and with very little effort and no market timing involved. Since 2009, a passive portfolio of the 10 largest tech companies, or some combination of large tech and payment processors, would have outperformed probably 99.5% of active managers. So once you figure out the rule (or what I call a ‘system’), investing becomes very easy.

Inferior assets:

Commodities

Commodity, retail, and energy sectors (with few exceptions, as mentioned below). Such sectors are very vulnerable to macro conditions, unlike big tech.

Value stocks

Bitcoin, Ethereum, and other cryptos (this is because they share very similar properties as commodities)

Foreign stock markets, foreign currencies (except the Yen)

Most collectibles (except ultra-rare MtG cards (Alpha, Beta, and Unlimited editions) and other exceptions)

Junk bonds, particularly in energy and commodities

The Russell 2000 (an index composed of 2000 small companies, worse performance compared to Nasdaq and S&P 500, which is composed of very large companies)

Superior assets:

Bay Area, Manhattan, Seattle, and Vancouver real estate

Tesla, Walmart, Disney, Nike (dominant tangibles-based consumer stocks)

Uber (despite losing money, it has dominance and growth) , Airbnb

FAANG stocks, including Microsoft

The U.S. Dollar (Peter Schiff wrong as always: despite rising CPI, the dollar continues to trounce foreign currencies)

Treasury bonds (also doing well despite high CPI)

Investment-grade corporate bonds

PayPal, Visa, Square, and Mastercard (payment processing is a very strong sector)

S&P 500, DJIA, and Nasdaq (and leveraged versions of them)

Of course, there is a lot that cannot be classified as either, but returns are maximized by focusing on the latter, which is what I have been doing.

But isn’t this just looking in the rear view? Not necessarily. The performance gap between superior vs inferior assets has been so enduring as to suggest it’s permanent. Value stocks have have been lagging the broader indexes for over a decade. Same for energy and commodity stocks. Same for emerging markets. The Turkish Lira has been in freefall for a decade. It’s not like these things get better.

This suggests long-term, secular changes based on changing investor preferences (so-called capitalism getting ‘smarter’ and choosing only ‘the best’ and discarding ‘the rest’) [1], changing structural macro econ factors (such as low interest rates, Covid, flight-to safety due to global uncertainty and unrest), and changing micro econ factors–winner-take-all markets (Amazon, Nike, and Walmart and the so-called ‘retail apocalypse’), high profit margins (most large tech companies), reliable recurring revenues such as ad revenue (Facebook and Google), intellectual property licensing (Windows and Office), moats and high barriers to entry (most large tech companies and social networks), and network effects–not just a cycle. Such changes can be likened to the industrial, marginal, and information tech revolutions…they are not things that just go away.

And also more risk aversion. Investors are not going to waste their time and money trying to find ‘the next Nike’ or ‘the next Google, they will just buy Nike and Google stock and settle on 20-30% annual returns instead. Just focusing on the biggest and most dominant of companies/sectors/investments, generates superior risk-adjusted returns compared to more speculative bets even after accounting for the fatness of the right-tail of speculative returns. This is another example of capitalism becoming smarter, by making this realization and investors adapting accordingly. If some companies are preordained to dominate and succeed, why take the risk on smaller stuff, especially in light of such winner-take-all effects?

Investors are always looking for the perfect hedge, whether against inflation or uncertainty. In the so-called ‘financial singularity’ in which all capital converges to a handful of assets, this means the odds of making a mistake or being left out have never been higher, because so few assets are participating. An index fund like the S&P 500, Nasdaq , or DJIA is probably still your best bet of not only hedging inflation but not being left behind in the singularity.

It sounds anti-climatic to recommend index funds instead of something more exciting, but no amount of wishful thinking will make an unfavored asset become favored. [Edit: Bitcoin crashed last week from $57k to $48k now despite the S&P 500 and Nasdaq removing its losses from Omicron, in agreement with the thesis of this post] However, returns can be magnified by using 3x versions of index funds and certain rolling put option hedging strategies, for a forthcoming post, a strategy which since 2018 has utterly crushed Bitcoin.

Over a period of over 100 years, the S&P 500 has proven to generate real returns in a wide variety of macro environments, which cannot be said for most investments. There is really no need to try to overcomplicate things, which increases the odds of accidently buying an inferior asset (or an asset that will later become inferior), and not only only failing to hedge inflation but losing money.

[1] Much like how baseball was permanently changed by sabermetrics, investing is undergoing a similar revolution, which means that optimal strategies will win out over suboptimal ones, resulting in fewer viable strategies overall and an increasingly repetitive and fickle investing environment in which the same strategies and assets keep dominating and sub-optimal ones are ruthlessly discarded, like how sabermetrics has made baseball more predictable.