The post The Vampire Society by Vox Day went viral. It seems everyone hates the boomers; even boomers hate themselves. Boomers are blamed, by conservatives and liberals alike, for everything that is wrong with society. They are accused of being narcissistic and materialistic and being poor parents who outsourced their parenting duties to daycare so they could make more money and have more fun. They are also accused of being deaf, blissfully oblivious, and indifferent to the social and economic concerns facing later generations. How much of this is justified is hard to know, but I don’t think these complaints are totally without merit. Vox asserts, but without evidence, that by ‘pulling up the ladder’ the boomers did not allow future generations the same opportunities to succeed, hence later generations have less wealth than the boomers when matched for age.

Here is the sobering passage:

Indeed, at a median age of 35, Gen Xers owned just 9% of the nation’s wealth in 2008 — less than half what boomers had at that age. And millennials will have to triple their net worth in the next four years to catch up to Generation X at 35, and increase their wealth sevenfold to catch up to boomers at that age.

However as bad as things may seem for millennials and gen-z, the analysis fails to take into account the ways in which later generations may be better-off than their parents and grandparents when matched for age. You have to take into account mitigating variables such as:

Population size (the boomers are still the biggest generation). Having more people alive means they will naturally have a larger slice of the economic pie.

Delayed accumulation of wealth. Boomers had lower college attendance rates, and many young people stand to earn a a lot money after completing college and entering the workforce. Millennials and gen-z may hit their peak earnings years later in life compared to boomers, but it may be a higher peak and a longer one due to delayed retirement.

Low interest rates and lucrative investment opportunities for millennials and gen-z, compared to boomers, who had higher interest rates, which meant lower real returns. The post-2009 bull market in stocks, on an inflation-adjusted basis, is the biggest ever, surpassing even that of the 80s and 90s, and shows no hint of slowing, nor are interest rates going to go up. One needn’t look far to find many posts on Reddit and Hacker News of people in their 20s and 30s who have amassed substantial nest eggs in the stock market since the 2008 financial crisis. Look at all the posts on the popular Reddit subs /r/WallStreetBets and /r/investing of young people who are defying the media narrative of ‘young people being poorer than their parents or indebted due to student loans.’ Same also for the housing market which has also done very well since 2008. Even in spite of Covid, these trends have accelerated, with the S&P 500 rocketing above 4,000. Sure, Reddit is not representative of all gen-z and millennials, but it it at least is solid evidence against a well-worn media narrative that tries to generalize all young people as ‘poor and struggling.’ Yeah, some are, but many are not.

Lucrative non-traditional employment opportunities. A lot of young people are making substantial sums of money on platforms such as Instagram, Only Fans, Patreon, Twitter, trading options (such as on /r/WallStreetBets), selling shoes, etc., none of which existed 30-50 years ago. Although most people will not be able to make a living this way, it still nonetheless represents new opportunities that didn’t exist for earlier generations.

Lucrative jobs in tech, finance, and other professional work. On a real basis, salaries for such jobs are higher than boomers when matched by age. Being a doctor, a banker, a tech employee, a lawyer, a consultant, a quant, etc. just was not that lucrative 40 years ago compared to today even when adjusted for inflation and student loan debt. Even in spite of student loan debt, real wages for college grads are higher than they were for boomers. So even though college grads have more debt than ever, they are also making more money than earlier generations on a real basis, too.

Higher standards of living and technological progress. Millennials and gen-z have cheap and abundant entertainment in form of streaming services, iPhone, Xbox-live, etc. Boomers had rotary phones, bulky TVs with few channels, and clock radios. A single iPhone and Netflix subscription has more utility than a TV, cable, and record player combo entertainment system of a generation ago.

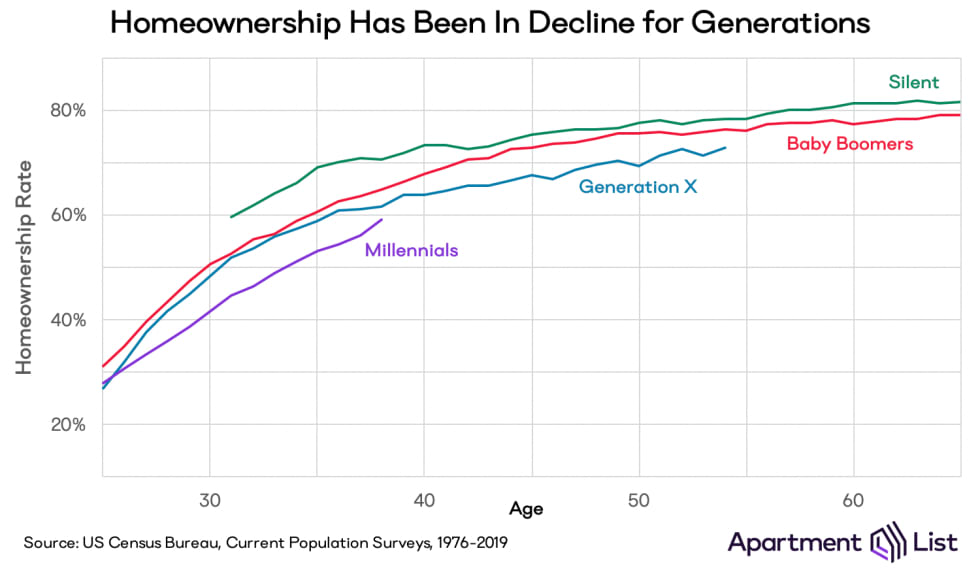

What about home ownership? Contrary to the media narrative of millennials not being able to afford homes, matched by age, millennials home ownership is only slightly lower than that of boomers:

But millennials have the added benefit of low interest rates, which means inexpensive mortgages, and also rapidly rising home prices on a real basis, which means more home equity and hence more wealth. Sure, homes were cheaper in the 70s and 80s, but interest rates were much higher and home prices didn’t rise nearly as much on a real basis as they do now. According to Zillow, prices in some areas in the US have more than doubled since 2010 on a real basis, whereas in the 70s and 80s prices were flat on a real basis.

Even in spite of the overhyped 2005-2008 housing crash which despite all the media hype was short-lived, prices have come roaring back and made new highs.

More variance of wealth. In spite of of lower wealth collectively, millennials and gen-z on the outliers–tech founders and VCs, social media stars, investment bankers, etc.–have more wealth when adjusted for age and inflation compared to boomers. The distribution of wealth for boomers had a thinner right-sided tail compared to later generations. Due to the above factors, smart, high-IQ millennials and gen-z have way more opportunities to accumulate wealth, compared to smart boomers of 40 years ago, whose opportunities were more limited. There was no boomer-equivalent of becoming an overnight IPO billionaire or multi-millionaire or having your 3-year-old app start-up acquired or valued at billions of dollars. Even the IPO of Microsoft , which made Bill Gate a multi-millioniare, was much smaller on an inflation-adjusted basis than today’s tech IPOs, such as Coinbase, which upon going public valued the company at $80 billion and making its foudner worth $14 billion. It would take Bill Gates over a decade after Microsfot going public to be come as wealthy. Same for the IPO of Airbnb, which made its foudners equally wealthy overnight.

My takeaway is, always be skeptical of media narratives. We learned this with the 2016 and 2020 presidential elections , in which two candidates who seemed inevitable and would win in landslides–one lost and the other just squeaked by. Same for Covid, in which the media narrative in early 2020 was that mandatory social distancing, quarantines, and masks would ‘flatten the curve’ and things would return to normal by fall/winter: a year later, things are hardly back to normal and many countries and regions are seeing second , third, or even fourth waves of infections. The narrative now, that all young people are broke, indebted, and struggling, especially compared to earlier generations, also needs to be scrutinized.