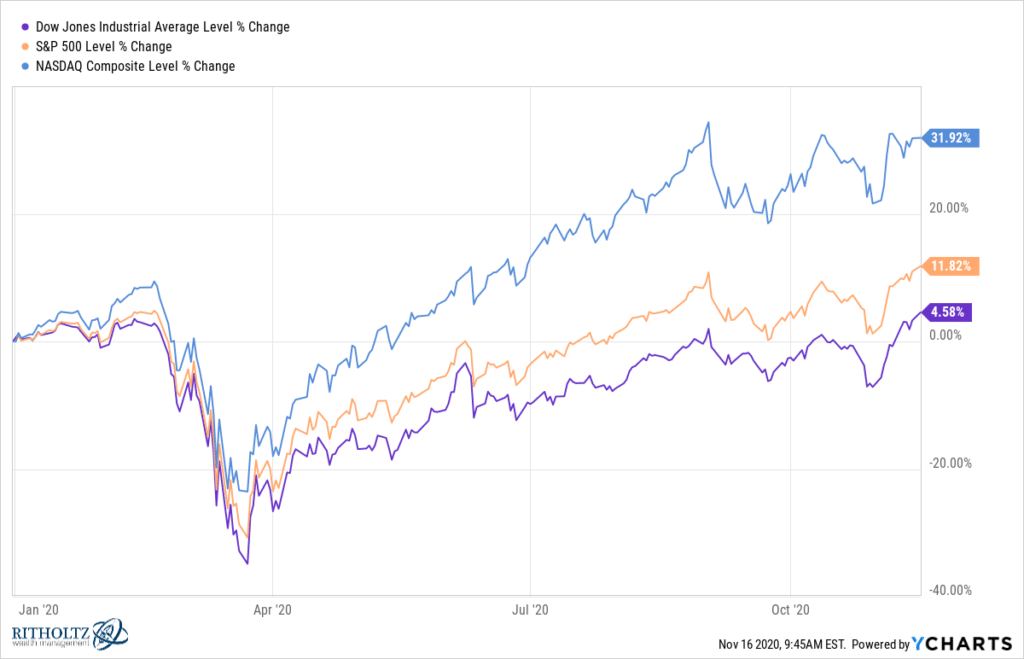

This is pretty amazing…the S&P 500, after being down as much as 30% in March, has not only recovered all its losses but has also gained 10% for the year.

Mind-blowing. If anything, despite my optimism about the market, I was not optimistic enough. How many people predicted such a huge, v-shaped recovery? Besides myself and one other person, probably no one. The assumption was, as the death and case count rose-and also due to the shutdowns and high unemployment rate–that it would be years before the economy and stock market would recover. But I correctly observed and surmised months ago that the Covid deaths and cases mostly affected low-productive/low-average IQ groups, and thus the impact on economic growth, GDP, stock market gains, and other metrics, would be brief and limited, in spite of the high unemployment, business closures, sicknesses, and deaths. AFIK, no one else made this HBD connection, yet my understanding of HBD allowed me to figure this out. This shows that the applications and social consequences of HBD are vast and applicable to investing and economic forecasting.

HBD also played a role in how quickly economies recovered from Covid, with low-IQ countries such as Brazil, India, Turkey, Italy, Spain, UAE, Venezuela, etc. significantly lagging high-IQ regions ( US [1], China, Japan, Norway, Sweden, Germany, etc.) in terms of dollar-adjusted stock market gains and GDP growth.

A year ago from today, so-called ‘patient zero’ had fallen ill, presumably in Wuhan, and it would be another two months before the virus would receive wider media coverage. Four months later, the crowded streets of Milan, thousands of miles away, would be empty, and then not long after, New York, as the panic rippled around the world. Like most crisis, almost everyone is oblivious, until everyone becomes aware at once..it is not a gradual process.

Whether you call it ‘the new normal,’ ‘the great reset,’ or ‘the new economy,’ regardless of whether Trump or Biden wins (and I think this point we can reasonably assume it is going to be Biden), this ‘new era’ which we find ourselves in, is not going away. Similar to the aftermath of 911, politicians will continue to evoke the spectre of crisis to compel Americans to gradually and willingly forfeit their rights in the promise of public safety. A vaccine will hardly put a dent in this given that it may not only be many months before the vaccine is even released, assuming it ever is, but that administering it will take considerably longer, and will not magically reduce the case count.

Similar to the aftermath of the 2008 crisis, interest rates will remain rock-bottom long after the economy, corporate profits, and the stock market have recovered. There will be tons of stimulus even if it seems most of that money is being squandered on bureaucracy and bailouts for big businesses (such as Boeing), and as I correctly observed, amounts to a handout for Amazon and Walmart. Thus, similar to 2008-2009, we are in an era of public socialism and privatized profits, but for ‘big tech’ and ‘big retail’ instead of the financial sector.

[1] Given America’s great size and racial diversity, it is useful to break it up into high-IQ and average/low-IQ populations and regions. Given the massive performance of tech stock since Covid, as shown above in comparing the Nasdaq vs. the S%P 500, if Seattle , New York City, and the Silicon Valley were a separate country, it would be the biggest winner by far, in agreement with the HBD thesis. Low-IQ populations, industries, and economies were hit much harder by Covid and did not recover, such as retail and cruise ships.