Looks like Lobos Motl is at it again with yet another critical Tesla post.

Tesla can raise any amount of money it needs at a very low cost, which a position very few companies are fortunate enough to be in. Just yesterday, Tesla raised $2 billion in a secondary offer, and the stock went up 4%. Let that sink in: Tesla stock went up despite diluting itself, which virtually never happens. That’s like being paid to borrow money, which give you an idea of how advantageous of a position Tesla is in.

Just goes to show how media keeps being wrong about Tesla running out money being a concern. In theory they can raise as much money as they want and the price won’t go down.

Meanwhile, Tesla is traded at $240 per stock or so (after setting a 2-year low at $231.13 on Friday – the huge margin call could occur near $213, a new guess), about 37% below the all time high of $380.

If you look at the 10-year chart, Tesla is very volatile. Such large swings are very common. It’s not uncommon for a stock to seem like it’s going to die, only for it to come roaring back to life when least expected. Tesla can easily surge $100 in a few months, as it has done in past. In 2018, Facebook stock fell from $200 to $140 on the overblown, media-generated privacy concerns, only for it to surge back to 190 in less than 3 months.

Lots of new bulls are added every day – currently about 150,000 have long Tesla positions on Robinhood. If and when the company goes bust, these people should lose tens of billions of dollars in total and I became certain that virtually all of them deserve it. The world would – and hopefully will – become a substantially better place when the people of this kind, a violent herd that is never willing to listen to any rational arguments let alone numbers, gets significantly poorer.

I have observed that when there’s as much enthusiasm and intense media coverage about a company as there is with Tesla, this enthusiasm is often not entirely misplaced. I think it’s when the media stops talking about a stock, then you’re in trouble, not because the media is propping up the stock as commonly and mistakenly assumed and is a confusion of cause and effect, but because the company is no longer as relevant in the public psyche, just as the media no longer talks about Myspace. It’s similar to the enthusiasm over Facebook, Apple, Netflix, and Amazon (the so-called FANG stocks) that you see on /r/wallstreetbets, all of which have been top-performing stocks. The people on /r/wallstreetbets and on Robinhood have a sort of ‘knack’ for knowing which stocks will have the highest performance and gravitate towards those. And this is not only in hindsight, given that /r/wallstreetbets and Robinhood have been enthusiastic about these stocks for a very long time, as far back as 2015, and had one invested in them at the time would have easily beat the S&P 500. This is suggestive of actual skill at picking stocks, than merely choosing stocks that have done well in the past.

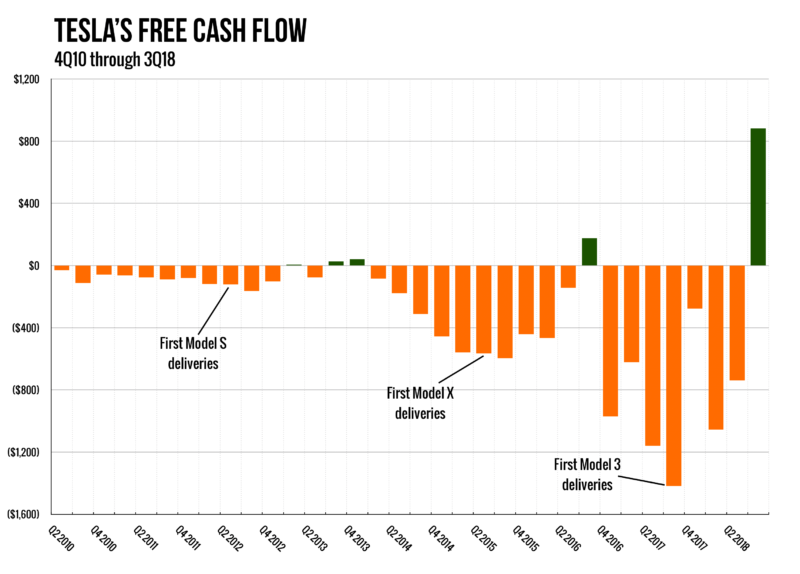

Furthermore, Tesla has demonstrated profitability, and such profits are from operations due to being cash-flow positive (as the excellent article Why almost everyone was wrong about Tesla’s cash flow situation explains), not one-time events:

As soon as Tesla cuts their cap-ex spending, they will be very profitable, similar to Amazon. As someone in the comments notes “These are the same people who thought Amazon would never be profitable and would go bankrupt any day now for DECADES until Amazon started posting huge profits and now they are nowhere to be found.”

Let’s hope that this ecosystem of people – who have been increasingly nasty in their treatment of the smart or rational people, the “infidels” – will at least see the remaining $40 billion evaporate from the Tesla value soon. Such a bankruptcy wouldn’t be a universal cure for all diseases of the contemporary mankind. But it would be a nontrivial addition, a welcome dietary supplement. Note that Soros owns $8 billion because the extra $32 billion belongs to the Open Society Foundation, no longer under his control.

We’ll see who’s right. I don’t think it will be him.