Tyler Cowen ponders why inflation isn’t higher.

Since the liquidity trap is gone, and inflation remains well under control, the liquidity trap does not seem to be the reason why inflation did not explode post-2008, following the Fed’s stabilization measures.

In spite of substantial deficit spending under Trump, Bush, and Obama, the Trump tax cuts, military spending, Obamacare, and the strong post-2009 economic recovery, why does annual inflation just refuse to budge beyond 2.5% or so?

The low inflation (on a CPI basis) despite the tax cuts agrees with earlier posts I wrote in 2017 in which I predicted that Trump tax cuts would not be inflationary. So the low inflation comes as no surprise to me. I predicted this a year ago, 3 years ago, 6 years ago, etc. Zerohedge and other doom and gloom sites keep being wrong.

The low CPI is explained by:

–Insatiable demand for US debt and the US dollar, keeping bond yields low. This makes imports cheap.

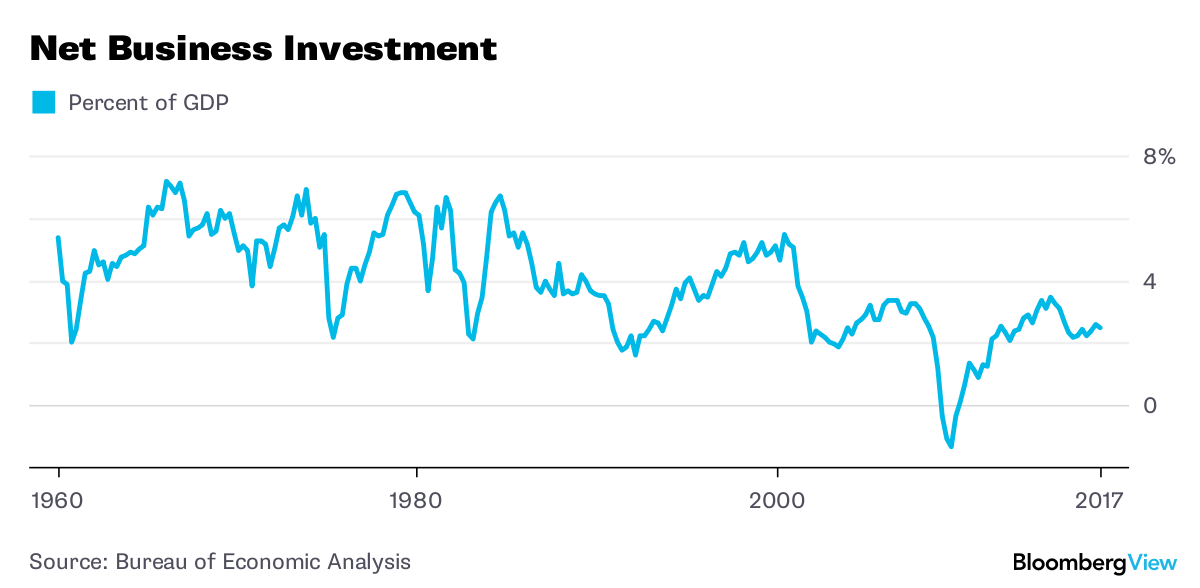

–Low business investment:

This suggests economic growth is becoming dominated by rents and services, rather than creating, building, and investing. Instead of building new factories, the same GDP growth can be achieved by Microsoft selling more licenses of Windows and Office, by Amazon selling more stuff, and by Google and Facebook displaying more ads.

–The transition from a tangibles-based economy to an economy dominated by intangibles, is possibly also deflationary, but this is offset to some extent by services and rents. So although computers and TVs are getting cheaper relative to the CPI, the cable, internet, and phone bill are more expensive.

In fact, from these rates there is significant pressure on emerging market currencies.

This is not true. Emerging market currencies did well from 2004-2007–a period characterized by high interest rates and high Treasury bonds rates of around 4-6%, versus just 2% today. The reason why they are falling is because these small economies are struggling due to high inflation, slow growth, corruption, and general ineptness, in agreement with the HBD investing thesis. No one wants to invest in these crappy, low-IQ countries, and that is why capital is flowing out of emerging markets into the safety, stability and growth of U.S. assets. This also agrees with how the post-America era many on the left predicted, never came. Ronan Farrow’s book is titled “War on Peace: The End of Diplomacy and the Decline of American Influence,” yet Trump has made America–economically, militarily, and politically–bigger, stronger, and more relevant and influential than ever. Trump is using tariffs and sanctions as a weapon against small countries that are deemed as hostile and or are not cooperating. Also, post 2008-capitalism is characterized by fewer but bigger winners (and lots of losers), as capital follows a gradient of optimal allocation.