There are dozens or even hundreds of variables the affect stock prices, but it can be reduced to just two: fundamentals and noise. For brevity, we’ll assume fundamentals are measured by inflation adjusted earnings and is a long-term driver of stock and index prices, a process that I call ‘fundamental drift’. The second noise; this is everything that isn’t earnings, such as foreign tensions, politics, investor sentiment, headline risk, buy & sell recommendations, etc. To understand this process, consider the S&P 500 has a constant PE ratio of 20. If inflation adjusted earnings rise 3%, the index (prices) must rise 3% for the PE ratio to be constant. This is the drift. It doesn’t always move in lockstep, but the relationship between earnings and prices is pretty strong:

The smart investors ignore the noise and focus on the fundamentals, profiting from this ‘drift’. Everyone else focuses on the noise, losing sleep over headline risks, conspiracies, and other distractions. The noise is the inherent choppiness or volatility of stocks.

So not all drift is equal, and the best investors find ways to capture the most upside. The key is to focus on what is already working, not falling for value traps. Often, when a long-term underperforming asset class is falling fools will rush in to buy the dips. An example of this is buying the dips on emerging markets, commodities, and energy stocks – asset classes that have been losers since 2008, but people keep buying the dips anyway in the hope of capturing the bottom, to no avail. The inexperienced are enticed by the growth prospects of emerging markets, but fail to take into account the high inflation and other risks. Adjusted for inflation, the US economy has better growth than most emerging markets. Commodities & energy have too much volatility relative to returns, – a high risk/reward ratio. Smart, high-IQ investors, unlike the masses of idiots that fill the investing forums, choose maybe a couple dozen stocks and strategies that offer the the best risk adjusted return and ‘fundamental drift’ out of a pool of thousands of inferior strategies and stocks. To capture the most ‘fundamental drift’ they choose stocks like Apple, Google, Priceline, Visa, Mastercard, and Facebook – companies that have a long history of sustainable long-term growth, price stability, and few – if any- viable competitors. There are only a dozen or so stocks like this out of over 5,000 on the NYSE, and this whittling process is a similar strategy Warren Buffet uses to beat the market; he hones in on companies that meet the aforementioned criteria, ignoring the rest. So once you have your selection narrowed down, these high-IQ investors buy aggressive call options on the dips, reaping enormous returns when their stocks rebound (which they always do because of superior fundamental drift). It’s not uncommon to turn $1000 into $5,000-10,000 in a couple weeks doing this.

Smart traders don’t hate the fed – they use the fed to their advantage, going long equities during low rates environments such as the on we are in now (and will remain so for a very long time).

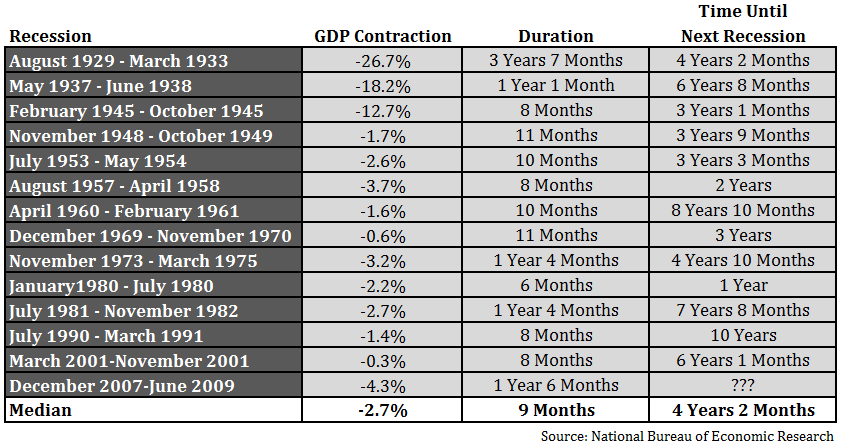

Despite all the whining about moral hazard, bubbles and debt, fed policy has been a resounding success at helping turn the boom-bust cycle into mostly a boom – with very brief recessions in-between. Going as far back as 75 years, I cannot recall a single instance of the stock market and economy crashing during a low interest rate environment like we are in now. Historically speaking, crashes are recessions tend to occur when interest rates are above 4%. This could be due to the flight to safety of investors getting skittish of stocks and putting their money into rich-yielding, short-term bonds. A risk-free 4-7% a year is better than many stocks, and there’s no volatility or risk.

Although the market is mostly efficient, there exist small pockets of inefficiencies that allow quantitative strategies to profit, sometimes substantially.

This year, Bridgewater’s performance has beaten most of its peers that invest across global markets based on economic themes. The firm’s Pure Alpha II fund rose 8.3 percent in January, compared with the 1.1 percent average return that macro funds posted, according to data compiled by Bloomberg, during a period when government debt rallied and oil slumped. The fund has gained an annualized 13 percent since inception in 1991.

Bridgewater’s 13% compounded performance is nearly double that of the S&P 500. Renaissance Technologies, run by math and physics PHDs, has historical returns in excess of 30%.

Later I’ll post a simple algo anyone can replicate to beat the market.