A few days ago Elon Musk changed his mind about Bitcoin, discontinuing it as a payment method for Tesla after suddenly becoming aware of the environmental impact of Bitcoin. Consequently, Bitcoin crashed on the news falling from $57k to $49k. That seems to be a recurring pattern for Bitcoin: big, frequent drops..it sure seems to spend a lot of time falling. Few people who invest in Bitcoin have actually made money…just a lot of losses, hype about a technology that for over a decade has held promise of changing the world yet is still hard to use, and whipsaw. But didn’t it surge from $10k to $50k? Yes, but Bitcoin still sucks, even though and I was wrong and failed to foresee that. But I has only half wrong in that I recommended selling Bitcoin and buying tech stocks, the latter which have done very well, so I and others who heeded this advice did quite well despite not owning Bitcoin.

Bitcoin is a lot like Linux or Tor in that it has a lot of supporters and devotees online, but as soon as you use it, it becomes obvious how inferior it is compared to Windows and Chrome (or in the case of Bitcoin, credit cards and cash) and how even the simplest stuff is a chore. Tor’s privacy comes at the cost of it being near-useless for non-onion sites. Windows works so well (at least most of the time) in part because it took decades to develop and billions of dollars of research by thousands of engineers at Microsoft; likewise, cash and credit cards have worked well for decades too. They don’t need fixing. Just because they occasionally fail does not mean they need to be replaced by something that is otherwise demonstrably inferior at everything but a few specific applications.

Collectibles, commodities, and crypto are similar in that they do not generate cash flows and therefore their value is entirely a function of supply and demand and the whims of the market, as opposed to something more tangible like income, intellectual property, cash, or return on capital. Second, unlike stocks, the supply is not fixed. As the price of collectibles rises, more supply tends to enter the market. Same for crypto: more coins being created means existing holders get diluted. This depresses prices and causes inferior returns and high volatility.

On Reddit, as evidence of the inferiority of crypto as an investment compared to stocks, compare how much money the /r/wallstreetbets people are making compared to crypto people. Yeah, /r/wallstreetbets is famous for big losses, but there are pages upon pages of people with six-figure or even higher returns with stock options or buy and hold. With crpyto, maybe some people have made a lot, but big wins are few and far between based on what I have observed (it is mostly people posting news or personal stories of having turned $100 on Coinbase into $1,000, which is not an exactly a life-changing amount of money, or paying the rent with Ethereum gains (whereas many /r/wallstreetbets people have enough to buy a home outright)). It’s evident that the stock speculators, as a whole, are more successful than the crypto speculators.

Crypto is a lot like wrestling, poker, or professional sports in this regard: a lot more people are fans of it and follow it, than actually do it or make money with it. The stock market is one of the few things in which participants can stand a good shot of making money even if they have zero skills (by buying and holding index funds).

So what about quantifiable data?

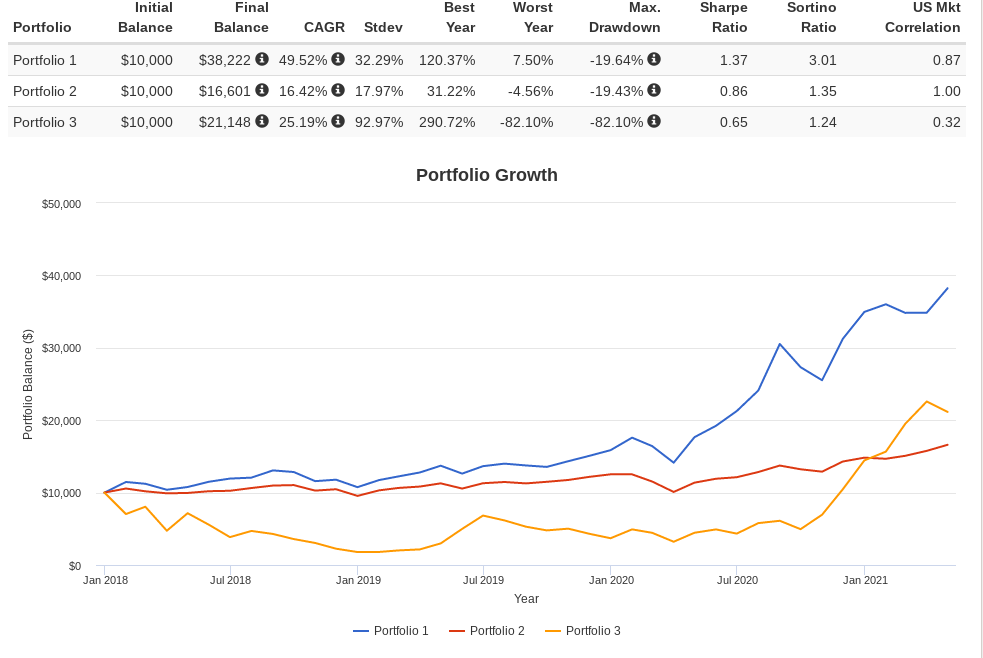

I compared the performance of GBTC (a proxy for Bitcoin) with a large cap tech portfolio and the S&P 500 since January 2018. The FAANG portfolio, in blue, which I have recommended and own, has a 40-50% annual return and a Sharpe ratio of around 1.4. This far surpasses Bitcoin, in yellow, which has a Sharpe of .65, which is way worse (higher numbers are better). This means much more volatility relative to returns. A good hedge fund has a Sharpe of at least 1.1 or so. The 1.4-1.5 Sharpe for the tech portfolio would be among the best in the industry. Bitcoin’s performance metrics are worse than even the worst hedge funds, and anyone who manages money and has such a poor risk vs. return profile would soon be out of a job or have no money to manage.

Another reason Bitcoin sucks: low probability of making money. This is related to the Sharpe ratio, but it means is, if you buy an investment and hold for time interval ‘x_1-x_0’, what are the odds that it will have risen y_1 > y_0? In the case of bitcoin, the odds are way lower than the large cap tech portfolio or the the S&P 500. Bitcoin spends a lot of time falling or doing nothing, but not much time actually going up. The S&P 500 and the Nasdaq have much smoother, more consistent gains. Bitcoin lost 70% of its value in 2018. And then took 3 years to make new highs. With the stocks and ETFs I recommend, even with Covid, new highs are made at least every 3-6 or so months. Had you bought Bitcoin 3 months ago, in spite of all the hype about crypto, you would have made no money.

Probability of making money is an important but otherwise completely ignored variable for investing. Imagine a hypothetical investment that on day 1 goes from a penny to $1 (100x return), and then spends the next 10 years doing nothing. Your compounded-annual-return would be almost 60%, which looks good on paper, but your probability of making money, given that all the returns were compressed into just a single day, would be horrible. That is sorta like bitcoin: all the gains were from 2010-2013, 2017, and a little from late 2020 to early 2021. 2010-2013 bitcoin was tiny , but now the crypto market is $2 trillion, so the amount of new money is probably running out. With stocks, recurring revenues and retained cash provide a constantly rising ‘floor’ for prices, but no such floor exists for crypto…it needs constant new outside money to keep the price from falling, because it cannot generate any value intrinsically.

Many years ago I tried to create an Excel program that would calculate such probabilities and sort tickers by highest probabilities given a time interval, but never got around to finishing it. Now you have a business idea. No one afik has done this even though it seems obvious.

Meanwhile, the S&P 500, the Dow Jones, and the Nasdaq keep making new highs every week, to no end. I would prefer smaller absolute returns but a higher probability of making money, compared to higher theoretical returns but a lower probability. Stock returns can be magnified with leverage strategies, which I plan to discuss in more detail later. A high Sharpe ratio means that leverage is more effective.

Although Bitcoin does better in other intervals, such as from 2020 or from 2021, it still has way too much volatility relative to its returns.

Do you have any opinion on pet stocks with the trend toward less kids?

I.e chewy, perdo, etc