This went viral: The discreet terror of the American bourgeoisie

A common theme by pundits is that Brexit and Trump represent a sort of transformational repudiation against elites and that elites are ‘shaking and scared’ of this ‘new status quo’. The evidence, however, as discussed in the post The Permanent Ascendance of ‘Bobos’ suggests the opposite, that elites are doing better than ever, and although the election of Trump may have had symbolic significance, has not actually lessened the power of global elites or moved the needle much. Although elites would have preferred Clinton, they are not losing much sleep over Trump. There are several explanations for this: Trump is hamstrung by Congress and other factors, Trump is indifferent, elites are too powerful, elites have infiltrated the administration, etc. But also, the private sector runs parallel to the public one. A large but weak government gives the private sector nearly free reign. There is truth to the ‘black pill’ argument that politics is pointless.

But back to the article, the author writes:

But there was a flaw in this thinking. America’s elites have stored more wealth than they can consume. This creates three problems for everyone else. First, elites invest their surpluses in replicating their advantages. Kids raised in poorer neighbourhoods with mediocre schools stand little chance. Their parents cannot match the social capital of their wealthier peers. The drawbridge is rising. The gap between the self image of meritocratic openness and reality is wide. Psychologists call this “self-discrepancy”. Economists call it barriers to entry.

The author makes an implicit assumption that wealth is fixed and that elites are consuming this fixed and finite resource. However, total global wealth has surged since the early 2000’s:

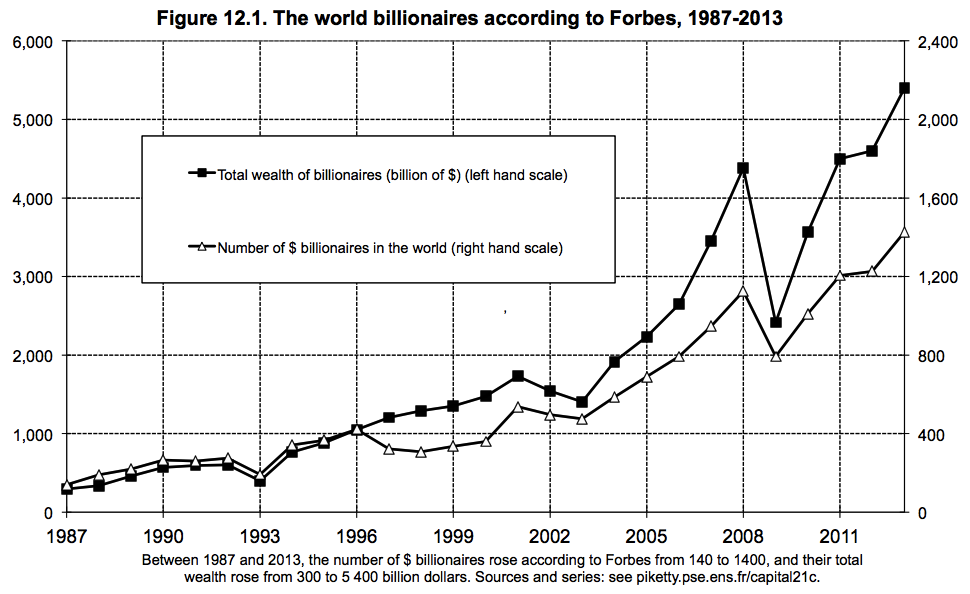

And not only has the total wealth held by billionaires grown, so too have the number of billionaires:

Of the Forbes 400 list, over 70% of are self-made.

When one looks at the fortunes made in Silicon Valley over the past two decades, it’s evident that upward mobility is possible, at least for high-IQ people in tech. But maybe not so much for everyone else. When one stratifies by IQ, one finds that there are two nations: a nation that is thriving (populated by individuals with IQs above 120 or so) and a nation that is just ‘getting by’ (populated by individuals with IQs less than 120). This is a common theme of Charles Murray’s books. Some put the IQ demarcation separating the ‘winners from the losers’ at 100, but as technology and other factors become more pervasive, the threshold will likely keep rising. Because the tails of a bell curve flatten exponentially (by a factor of \(e^\left( -x^2/2\right) \)), this means more and more people relative to the overall population size will be excluded. The difference between an IQ of 120 and 145 is 1/20 rarity vs. 1/400 rarity, which is a factor of 20. Given a US population size of 300 million people, a 120 IQ threshold means 15 million people can be winners. But a 145 threshold limits it to just 750,000. When one takes the log of individual net worth (assets minus liabilities), one finds it follows roughly the same bell-shaped curve as IQ (but technically, a log-normal distribution is not a bell curve, but it has very similar right-tailed properties as one) [2].

Regarding poor children and poor neighborhoods, the evidence, again, suggests that IQ is the best predictor of upward mobility. Low-income children who complete college (if college completion is used as a proxy for above-average IQ) are more likely to enter the middle class than high school dropouts from wealthier households. From the post IQ, Education, and Upward Mobility:

…a higher percentage of children born into the lowest quintile of family wealth but complete college are more likely to advance to the top quintile, than the percentage of dropouts who are born into the top quintile and then stay in the top quintile as adults.

As shown below, college graduates born into the second quintile have a 37% chance of entering the top quintile, whereas high school graduates born into the top quintile have only a 25% chance of staying there as adults:

Dr. Jordan Peterson in his videos mentions several times that being born with a 3-standard deviation IQ (>145) is better than being born in a family with a 3-standard deviation wealth, but unfortunately, given the video format, he does not cite sources. The ability to easily cite sources is one of the advantages of writing, versus making videos. He’s probably right up to point, depending on how one defines wealth.

The third challenge is the hardest to fix. Since there is too much capital chasing too few investment opportunities — what Lawrence Summers, former US Treasury secretary, calls “secular stagnation” — today’s America is cursed by an educational arms race. The jobs available do not match the qualifications millennials are acquiring. There is nothing relaxing about being a member of today’s aspiring classes. Kids must study harder and for longer than their parents to find jobs that do not often repay the effort.

The children of the wealthiest do not need student loans and live off their parents’ capital. The rest are struggling to justify the expense. It is as though they were led up to the promised land at sundown. The ratio of effort to outcome is rising. The more people study, the lower the returns to education. You always need more credentials, which most cannot afford. Instead of capital, losers accumulate frustration.

This is the crescendo of the article. The reality is, in spite of a strong stock market, low unemployment, and steady GDP growth, millions of Americans are struggling. Due to immigration, automation, oversupply of labor vs. demand, and other factors, the labor market has never been more competitive and cut-throat, even for low-income positions. A common example I give is that during a 2011 McDonald’s ‘hiring day’, 1 million people applied for just 50,000 openings–an acceptance rate as low as Harvard. Although millions of jobs were created in the post-2009 recovery, the majority of these jobs were in the low-paying service sector. Even STEM graduates are having a hard time due to competition from foreign workers who can do the same job for less money. But the move to contractual/freelance work, as part of the rise of the ‘gig economy’, is another salvo against the middle and lower classes. Stories of contractors and freelancers not getting paid, for arbitrary/Kafkaesque reasons, are not uncommon. It’s bad enough having a low-paying job, but the possibly of not even getting paid makes it much worse.

But to make matters worse, you have a hyper-competitive labor market combined with nose-bleed costs for student loans, rent, healthcare, insurance, and other necessities. Yeah, if have rich parents and are a coding whiz with a STEM degree, yeah, entering the middle class should be easy, but not for the typical college graduate who is as equally indebted as their parents. Even though IQ matters, there is no question inherited wealth plays a major factor in terms of attainability of the middle class and providing a safety-net. Everything has become so saturated…in a world of over-abundance (education, stimulus, information, entertainment, etc.), the marginal returns become less and less. Thirty years ago, a high-school diploma was good enough, but now you need a college degree for those same jobs, in order to stand out among the millions of people who are also applying for those same jobs and likely also have degrees. The race to the top in terms of more education is really just a race to the bottom in terms of more debt.

Neoliberalism is a common target. Even if neoliberalism is a net-positive in terms of higher standards of living, meritocracy (as opposed to nepotism), and more choices, a criticism is that it paints over the losers of such policy, or that the abundance promised by neoliberalism still excludes many. Neoliberalism may be great for the cognitively gifted who can take full advantage of free markets, technology, and a competitive economic environment, but maybe not so much for the ‘fat middle’ of the bell curve. From The Western Elite from a Chinese Perspective:

America, more so than anywhere else in the world, rewards high IQ, which is why it’s a magnet for the ‘best and brightest’ from all over the world, who apply to America’s most prestigious universities and companies and buy real estate in America’s most expensive neighborhoods…But at the same time, a lot of Americans feel like second-class citizens of their own country, falling between the cracks and weighed down by medical expenses, little to no retirement savings, lots of debt, and overall uncertainty. Studies have shown that half of Americans cannot come up with $2,000 for an emergency. The neoliberal message of optimism and opportunity may overlook these people. Neoliberalism makes the generous assumption that everyone is as smart and rational as those who espouse neoliberalism, and some are, but many aren’t, which,for example, why the lottery is so popular despite having a negative expected return for playing.

One sees the contradiction between the juxtaposition of the optimism expressed in Jordan Peterson’s videos regarding American exceptionalism and ‘people lifted out of poverty’, but combined with the pessimism of biological determinism and how low IQs possible render a sizable percentage of the U.S. population permanently unemployable.

[2] One can derive a relationship between log-wealth and IQ:

$10,000,000 IQ 120

$1,000,000 IQ 110

$100,000 IQ 100

$10,000 IQ 90

There are 11-15 million millionaires in America, which is the same as the number of people with IQs above 120. 90% of millionaires in America are men, and the vast majority of millionaires are adults. There are roughly 125 million adult males in the U.S., so 12 million adult male millionaires in the U.S. out of a population of 125 million is about the same rarity as a 110 IQ (~1/10).