IQ, race/HBD (human bio-diversity), economics, and education. These ‘four horsemen’ are indispensable, inseparable, inescapable and are more relevant than ever in the 21st century. For example, trying to fix education boils down to understanding that the IQ gap between individuals or different groups is a possible contributing factor to the achievement gap. Education ties in with economics because the individuals most adversely affected by the 2008 recession are those without a college degree. This ties into IQ because individuals with an IQ of less than a certain threshold are less likely to obtain an advanced degree; furthermore, those with an even higher IQ will advance further in their studies, possibly obtaining a master’s or a doctorate, which correlates with an even higher income. Thus, to understand why so many individuals have permanently fallen between the cracks in an otherwise strong economy necessitates a study of biology, in addition to economics and sociology.

Neal Ferguson’s science fiction book Double Helix Fall describes a society where a person’s status is determined by in utero readings taken before their birth. We find ourselves in a similar situation today, especially after the cataclysmic events of 2008, where a person’s status is determined largely by IQ, which most experts agree has a significant biological component.

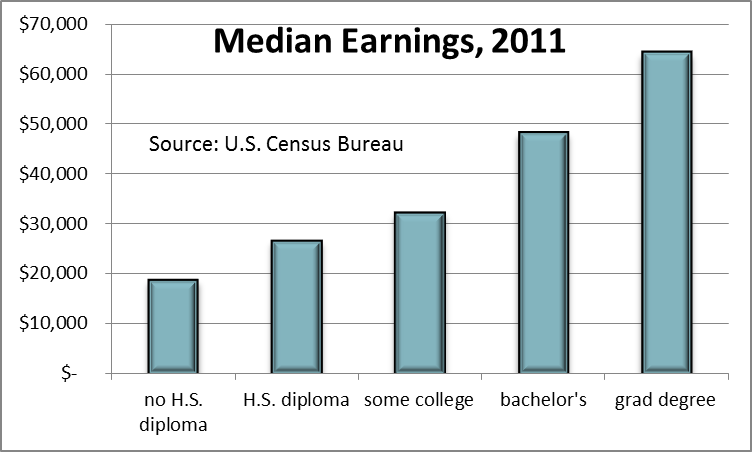

As shown below, level of educational attainment is positively correlated with income and employment:

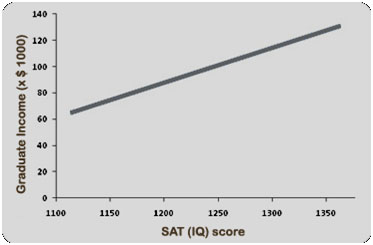

Also, SAT scores (a proxy for IQ) is positivity correlated with income:

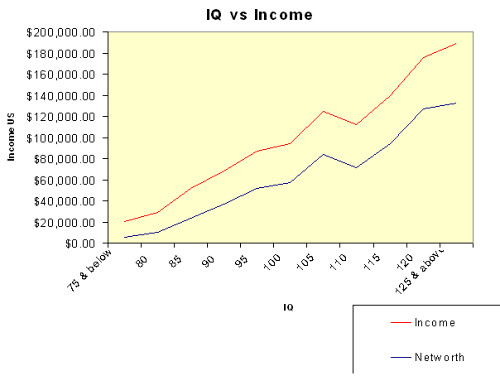

And IQ and income:

In his controversial but prophetic 1995 book The Bell Curve, Charles Murray attributes wealth inequality to cognitive stratification and the difficulties that the increasing complexities of modern life present to low IQ individuals, resulting in the delamination of society into a cognitive elite (which we call smarties) and everyone else. This couldn’t be more relevant today. Never before have the socioeconomic benefits of being smart and rich have been so great, or the disadvantages of merely being below-average been so grave and intractable. Perhaps we should take heed or at least acknowledge the prescience of Murray’s writings, instead of being so quick to dismiss it as ‘racist’.

The ramifications of the cognitive differences between individuals are magnified by today’s winner-take-all economy. Decades ago, there were enough jobs for everyone at any intellectual or educational level; today not so much. The U.S. economy is growing, especially compared to Europe, but the growth is much more unequal. Smarties, or the top 1% in terms of IQ, are reaping the most of the returns of the economic boom in terms of things like rising real wages, surging stock prices and real estate. Smartism – the preeminence of IQ in all aspects of society, erroneously dismissed in Gladwell’s Outliers, is more important than ever as simple jobs are rapidly being supplanted by more technical jobs, outsourced, or eliminated all together. Smartism is one cause of economic inequality, as Dr. Murray explains:

In 2008, many experts predicted the crisis would be a catalyst to replace the old status quo with a more egalitarian one; instead, we got a more cut-throat one, one that has fed on its success of rewarding merit with obscene windfalls and offering little in return for most. 2008 was a phase transition of a staid, lackadaisical economy to an accelerating, hyper-competitive, over-productive one. The amount of information, technology, wealth, liquidity, and riches created in the past five years alone is greater than any prior five-year period of human history. For example, as evidenced by the multi-billion dollar valuations of overnight successes such as Snapchat, Pinterest, Airbnb and Dropbox, anyone with an idea and some coding can be a millionaire overnight and a multi-billioniare in a couple years. America has become a meritocracy in overdrive – an era of of limitless wealth creation and acclaim, if only for a few.

We’re also becoming a drop-out nation. Adults moving back in with their parents, delaying marriage, leaving the workforce and dropping out of college saddled with debt they have no hope of paying off. Although a college degree is an important factor for lifetime success, not everyone is suited for higher education. Misguided policy by well-intentioned individuals has encumbered millions of low-aptitude students with debt and little hope of graduating.

Nowadays, economic value is created through passive consumption such as streaming Netflix, uploading pictures to Facebook, tweeting, or taking selfies with Instagram and Snapchat. Other are becoming wealthy through real estate, buying stocks, speculation, and web 2.0. If capitalism is defined as an economic system where those who possess capital have precedent over those those who don’t then, without equivocation, capitalism is thriving in America, and capital has obviously triumphed over labor. The chasm between the haves and the have-nots will keep widening, but our prediction is that while record inequality doesn’t improve our national image, it doesn’t pose a threat to the economy. For years, doom and gloomers predicted there would be uprising in the U.S. in retaliation to perceived injustices by the elite, but instead the rioting is overseas in countries that have more redistributive policy and more equitable wealth distributions.

High-salaried tech employees have drastically driven up rents, especially in San Francisco. Gentrification has accelerated in the smartist era. The Bay Area housing market is booming, but it’s not a bubble. Instead, prices are surging due to limited supply and huge demand from newly-rich high-IQ tech workers, high-IQ immigrants and private equity firms run by IQ-high people. Stocks are at near record highs while valuations remain low. Profits and earnings for multinationals keep rising. In just the same way the 1% percent in intelligence are thriving, so are the 1% in terms of size. Large cap corporate yields are also near historic lows and treasuries keep rallying, indicating insatiable demand for safe, U.S. debt and big multinational debt. Meanwhile, yields for smaller economies like Turkey have rallied, such as in the wake of the recent mine disaster. When there’s a disaster in the U.S. the opposite happens: people flock to our debt. In keeping with the bigger is better theme, since the start of the year, U.S. large caps have vastly outperformed the small cap Russell 2000. We anticipate all these trends to continue – a Mathew Effect in overdrive as the big and rich become bigger and richer, forming enclaves of prosperity surrounded by the masses that share the same number of chromosomes, but different values, experiences, and possibly even different genes. Two different worlds on one planet.