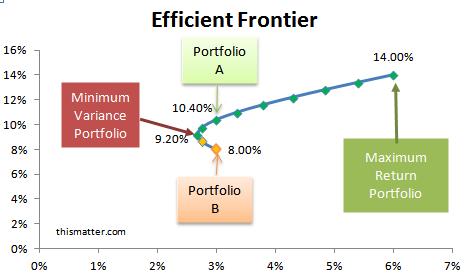

Some people bristle at the suggestion that one should not own foreign stocks in an investment/retirement portfolio. After all, if the market is random and market timing is impossible, then excluding foreign stocks is the same as timing and therefore disadvantageous. This reflects a common misunderstanding about the stock market, which is that the inability to time the market (and also the superior performance of index funds relative to stock pickers) implies that the market is random like a coin flip, or that these are the same. Randomness and timing are not interchangeable. The stock market is not like a coin flip game, yet market timing and stock picking is generally a futile endeavor (yet some such as Warren Buffett seem to demonstrate skill in this regard). If one looks at the performance of the S&P 500 over the past century, it’s plainly obvious to see that over the long-rung (many decades) it has a positive expected value. If it were like a coin flip game, then it would be flat because the expected value would be zero. Therefore, one should seek investments that have a long history of providing good returns, while at the same time minimizing volatility. The trade-off between volatility and returns is visualized by the ‘efficient frontier curve’:

Modern portfolio theory stipulates that one can maximize risk vs. returns by choosing a mix of assets that are negatively correlated yet have positive or flat expected values in such a way that the weak assets cancel out the strong ones. If bonds are perfectly negatively correlated with stocks, then a portfolio of 50% bonds and 50% stocks can act as perfect hedge against all downside risk. When the S&P 500 is down 50%, the bond portfolio will be up 50%. When the S&P 500 is up 50%, the bond portfolio is flat or only down a little. Therefore, combining these creates superior risk-adjusted performance as shown by the frontier curve. However, this is a contrived example. Bonds do not perfectly hedge stocks.

So going back to foreign stocks, although the efficient frontier curve shows that a mix of U.S. and foreign stocks can slightly boost risk-adjusted returns, I would not bother with foreign stocks at all, and they have no place in a portfolio (foreign bonds may be a different matter, but for this post I am just focusing on stocks). Much of excess returns of foreign stocks are from the mid 80’s due to Japan’s asset bubble, and it’s unlikely this will ever repeat. When one compares foreign performance vs. U.S. performance, over long time frames, foreign stocks have slightly worse annualized returns and higher volatility, therefore making it an inferior investment compared to U.S. stocks. Foreign stocks do not diversify-away risk, because they are highly correlated with U.S. stocks. This is especially true since 2011. When foreign stocks outperformed in 2002-2007, such gains were negated by the crash of 2008 and again when they crashed in 2011. Foreign stocks lagged the S&P 500 considerably from 2013-2016.

Here we see, going as far back as 1969, that foreign stocks (in blue) have more volatility and weaker performance than U.S equities:

Combining them offers no benefit.

When one goes as far back as the 1930’s, again, foreign stocks are inferior:

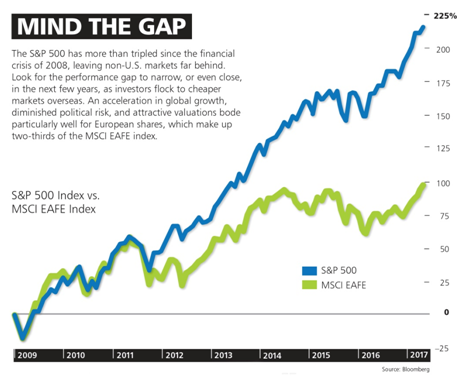

The performance gap between U.S. and foreign stocks has especially widened since 2009:

In agreement with my HBD investing thesis, I predict this gap will only widen in coming years.

Economically and from an HBD perspective, with the possible exception of high-IQ countires such as China and Singapore, foreign countries are typically inferior to the U.S. in every way. They have higher inflation, weaker currencies, poorer growth, more corruption, and ‘brain drains’ which hurt innovation, and so on. Even when national IQs are similar, such as Japan or Europe vs. the U.S., the U.S. is still vastly superior in terms of innovation and being conducive to capitalism, and therefore has higher stock market returns. In the past two decades alone, nearly $2 trillion of wealth has been created in silicon Valley due to Web 2.0 start-ups and tech giants such as Amazon and Facebook; no foreign country (with the possible exception of China) has such an equivalent. That’s why U.S. tech sector, which is high IQ, has done so well relative to everything else, and the strength of the tech sector is a major contributing factor for the huge performance of the S&P 500 since 2009.

Why would anyone knowingly and willingly invest in inferior stuff. If given a choice between a 5-foot-tall basketball player and a 6-foot-tall one, the latter is virtually always a better pick. And similar to the impossibly of an adult growing a foot, the trend (with the possible exception again of China and Singapore) is for weak countries to remain weak. Cultures and national IQs don’t change. Brazil’s low IQ population and culture of corruption and ineptness is not going to change overnight, if ever. The U.K., unlike the Silicon Valley or Shanghai, is not going to become a ‘mecca’ for tech. Same for Germany, which due to ingrained social and cultural factors, will never become as economically competitive and innovative as the United States. Even when foreign countries have growth spurts, the gains are always given back during recession or crisis, whereas the U.S. economy keeps its gains. Low-IQ regions are dependent on exporting natural resources, which tend to more volatile, for economic growth, as opposed to intellectual property, which requires a high IQ but is more stable. Brazil and other Latin American countries had growth in the 2000’s due to the oil boom, but all of those gains were erased due to commodity prices falling and corruption in the decade that followed. Same for Russia and Turkey. They do well for 5-10 years and then collapse like a house of cards and do not recover.

Overall, by including foreign stocks in your portfolio all you’re doing is increasing volatility and lessening returns.