There are a plethora of stories of how hard millennials’ lives are and how they are the ‘poorest generation’. However, I think many of these studies and stories have methodological errors that overstate the severity of the problem.

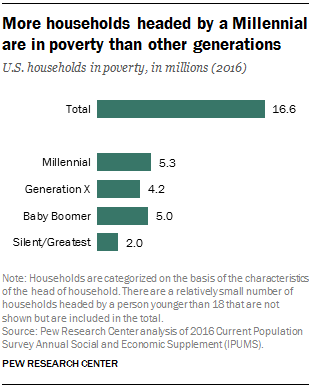

From Pew Research, More Millennial households are in poverty than households headed by any other generation:

In 2016, an estimated 5.3 million of the nearly 17 million U.S. households living in poverty were headed by a Millennial, compared with 4.2 million headed by a Gen Xer and 5.0 million headed by a Baby Boomer. The relatively high number of Millennial households in poverty partly reflects the fact that the poverty rate among households headed by a young adult has been rising over the past half century while dramatically declining among households headed by those 65 and older. In addition, Millennials are more racially and ethnically diverse than the other adult generations, and a greater share of Millennial households are headed by minorities, who tend to have higher poverty rates. Millennial heads of households are also more likely to be unmarried, which is associated with higher poverty.

Is it really that high? The accompanying chart shows that although millennials have the highest rate of poverty of all generations, it’s by a tiny margin (5.3% vs. 5% for baby boomers):

Furthermore, millennials are much younger than boomers and so we would expect a higher rate of poverty because they have less job experience and less time to accumulate savings and credit, so I’m actually surprised the poverty rate is not higher.

From the Credit Suisse 2018 wealth of nations (PDF):

Female millennials Last year, the Global Wealth Report looked at the wealth of the millennials. This generation, who came of age after the year 2000, had a more difficult time than previous generations due to a variety of factors including the global financial crisis, the economic slump that followed, technological change, and high house prices. As a result, its rate of wealth accumulation has been slower than earlier generations at the same age.

From what I have seen on Reddit on subs such as r/financialindependence, /r/investing,and r/personalfinance, many millennials seem to be doing pretty well. A lot of young people have homes, decent-paying jobs, stock accounts, savings, etc., despite student loan debt. On /r/wallstreetbets, it’s not uncommon to see young people dropping $10,000 or more on single option trade, so obviously the money is coming from somewhere. But Reddit is not a representative sample of all millennials. Maybe the ones who are worse off are not posting online.

Millennials may have more debt and a worse job market, but have access to new technologies and entertainment such as video games and Netflix, that earlier generations did not have, which saves money in the long-run. For example, instead of having to buy movies individually, a single Netflix subscription can suffice. Amazon Kindle saves money instead of having to buy books individually. MP3 players and the iPhone replaced record collections. In 1985, a personal computer easily cost $5,000, but a new computer only costs $600 and is much better. Boomers had a lower standard of living; for example, having to choose between buying a computer or buying a TV, whereas nowadays one can easily buy both for under $1,000.

What about debt? Studies that purport negative net-worth for millennials are misleading and portray the situation as worse than it actually is.. As shown below, due to student loan debt, many millennials have a negative net-worth:

However, the big mistake pundits make is they treat student loan debt as indistinguishable from any other type of debt, such as car loan debt or credit card debt, when it is not. Although student loan debt is hard to discharge in bankruptcy, there are generous deferment plans and the interest rate is much lower than credit card debt. Also, due to the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005, credit card debt is much harder to discharge, so although student loans cannot be forgiven easily, neither can credit card debt. Crucially, the difference is that a degree gains value but durable goods and automobiles are depreciating. Furthermore, despite the protestations over student loan debt, the college wage premium shows no sign of narrowing: according to a study, individuals with a bachelor’s degree now make 84 percent more over a lifetime than those with only a high school diploma, up from 75 percent in 1999. Today, bachelor’s degree holders can expect median lifetime earnings approaching $2.3 million, and earning power grows with increasingly advanced degrees:

Not surprisingly, prestigious universes have the highest ROI, but even the worst-ranked university has a positive ROI:

Wayne State University ranks in at #223, losing the seven-way-tie for Worst Ranked University in North America thanks to the Alphabet. In-state tuition is apparently $13,278 (plus all the other costs associated with being a student, housing, food, books, etc). The average salary for graduates with <5 years of experience is $48,800, rising to $88,300 for graduates with 10+ years of experience. And this is the WORST university we give a ranking to? A $309,000 estimated return on investment, not-adjusted-for-major. You have to visit Payscale, click “See Full List”, and scroll past 1,752 colleges before you find one that doesn’t have a positive RoI — not-adjusted-for-major.

Due to increased lifetime earnings, student loan debt is more akin to debt financing, much like taking out debt to open a McDonald’s franchise, than splurging on a sports car or a luxury cruise. Costs are initially high due to interest, but the franchise eventually pays for itself and is eventually very profitable. Rather than student loan borrowers having a negative net-worth, especially for borrowers with STEM degrees and from highly-ranked universities, actually have a lot of wealth when a 10x yearly earnings multiple is used. So if someone takes out $100k of loans for a STEM degree and pays $15k/year in interest but makes $80k after taxes, that is $65k net. Give that a 10x multiple and you have $650,000 even though his net-worth is technically, by conventional metrics, -$100,000. This explains why Tesla stock is so valuable despite having a lot of debt, because although the debt is high and costs a lot to service, the earnings potential is even greater.