All over the internet, people are asking if the economy has peaked or when to sell their stocks, especially given the unprecedented duration and magnitude of the post-2009 economic expansion and stock market boom, which as of 2018 has surpassed all prior records. Given that interest rates are so low , I think this wealth expansion has much further to go. Typically, economic cycles peak when interest rates surpass 6 percent, because risk-free cash becomes too attractive relative to riskier assets such as stocks, real estate, and corporate debt. But right now interest rates are at just 2% and expected to fall further, and this in a growing economy. It’s unusual for the fed to cut rates in such a strong economic expansion, and the last this occurred, towards the end of 1995, the S&P 500 doubled over the next four years. America is awash with cheap, abundant capital. There is so much wealth being created that to sit and wait for the collapse or crisis that will likely never happen seems counterproductive.

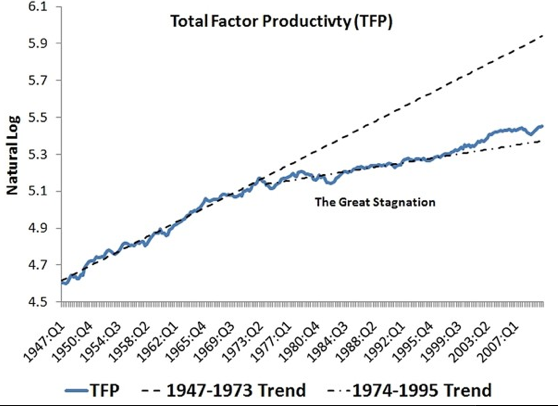

How about falling productivity, as shown below? Doesn’t that prove there is stagnation. No it doesn’t.

Earlier I discussed in response to a post by Tyler Cowen regarding why I’m not concerned about supposed stagnation and declining productivity, but I want to expound on these reasons and provide additional ones.

Productivity is still rising, but jut at a slower rater than decades ago, and any amount greater than zero when compounded is still exponential. The only difference is that the second derivative is negative at certain points. But growth is still growth, nonetheless.

The paradox of recurring revenues. An economy that is increasingly dominated by recurring revenues such as services, licenses, and intellectual property may have low capital investment but high returns on capital even if GDP growth and productivity growth are low. A hugely profitable company such as Google, Facebook, or Microsoft can generate 10-30% returns to investors annually just from profits without having to grow earnings at all or invest in research and development. Such shareholder returns can be in the form of buybacks, dividends, or from increased shareholder equity. The reason why it’s paradoxical is because although the economy is not growing and neither is productivity, investors are still able to reap substantial real returns. This is why tobacco stocks have been such great investments for so long, not because of huge growth, but from huge recurring revenues that are passed to shareholders in the form of dividends that can be reinvested.

Another common argument for stagnation is how services have such as education and healthcare have gotten more expensive. This is true…some services have become more expensive, but one must take into account:

-Individual consumer preferences. If consumers deem their health to be more important now than in the past, they will spend more on healthcare, which increases demand, prices, and salaries. Nowadays, unlike 100 years ago, there are specialists for everything to meet this demand. Oncologists didn’t exist 50 years ago for example. Same for MRI and CT scanning. You have to take into account what someone in the past would pay if they had access to modern healthcare, even if healthcare in the past was cheaper on a real basis. Yeah, healthcare would be very cheap if limited to aspirin and Tylenol but also very poor.

-What people actually pay versus the MSRP (As I discuss here, as it turns out, what people actually pay is way less than the quoted price. An expensive hip replacement for example can be negotiated to a much lower price by the insurer and the patient pays only a small fraction of the quoted price.)

I think some of the hype about student loan debt is overblown, and for all the doom and gloom about student loans, at the individual level, it’s better than consumer debt and credit cards, which have higher interest rates and far fewer payment plans. Also consumer goods depreciate whereas a college degree gains value in terms of higher inflation adjusted wages, and also consumer goods can be repossessed but an education cannot. Auto and credit card debt are the worst because of high interest rates, terrible terms, and lack of negotiating power.

Although student loan debt cannot be discharged in court, consumer debt is also very hard to discharge due to 2005 reforms to the bankruptcy law and carries severe consequences.

As I discuss in more detail here, regarding student loans, you cannot compare credit card debt versus student loan debt for a 17-year-old, because a typical 17-year-old, unless he or she has wealthy parents, would not be able to get a $100k credit line. So the comparison is $20-100k in student loans versus nothing, which makes student loans a more attractive proposition, especially when one considers that college grads over a lifetime earn vastly more than non-grads.

-Increased utility from services. Services such as Netflix and Uber are are chapter and have more utility than alternatives such as VHS players. The increased cost of some services is offset by increased utility and decreased cost of others, but also changes in consumer preferences.

A service does not mean a person is necessarily involved, but can also be a subscription. If stagnation is strictly defined to mean falling rate of total factor productivity growth (a negative second derivative), then there is stagnation, but there is so much more evidence that there is not stagnation.