Taleb and Gladwell had literary success in the early to mid 2000s arguing that outliers or the unpredictable are underestimated, which led people astray in the expectation of a new paradigm or the hope of easy riches by betting on tail events or underdogs, when in reality the big get bigger and more dominant–whether in politics, geopolitically, economically, business, or investing.

People tend think there is more money by betting on unpredictable events or on underdogs. This means there is a systematic bias of tail bets being overpriced. But because the integral of a probability distribution must equal one, such overpricing of the tails implies the rest of the distribution must be underpriced. I had so much success over the past decade running on the assumption or thesis that the world is more predictable than commonly assumed, and that the economic status quo will prevail (betting on the middle instead of the tails).

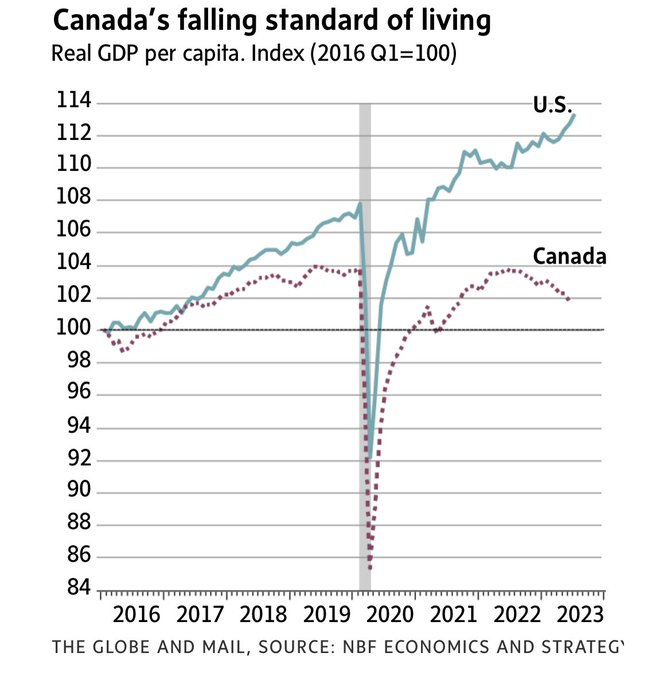

For example, the US economy increasingly pulling ahead of the rest of the world since 2010 and especially post-Covid, or the dominance of big tech companies, or the ever-widening of college wage premium, etc. For example, Canada lagging the US in per-capita GDP post-Covid:

Or Hollywood. Whereas there is the occasional outlier like Titanic or Avatar, the top-grossing movies are franchises of some form.

Same for the The Big Short. Michael Burry became rich and famous by betting against the housing market in 2007. But his subsequent performance has been terrible, with billion-dollar losses by betting against the S&P 500 and Tesla.

Or viral stories of wealthy nonagenarians or centenarians, such as a 96-year-old secretary who donated $8.2 million. This is inspiring, but how often does this happen?

The only reason why something is newsworthy is because it’s rare or unusual, not because it’s reproducible or practical. This is why underdog stories are useless or even harmful, because they are just stories of survivorship bias and mess with our minds. No one is going to write a NYTs bestseller or make a blockbuster about someone who gets rich with index funds even though that is a far superior strategy compared to the long-shot of betting against the housing market.

Recency bias, similar to the hot hand fallacy, describes the tendency to overestimate the odds of an event reoccurring because it recently happened, even though they are statistically independent events. For example, insurance premiums rise after a disaster even though the odds of a subsequent disaster are lessened due to efforts to prevent or mitigate further ones. Profits can be realized by selling these inflated odds, like during 2008 or Covid, in which people were certain things would get worse, but the economy quickly stabilized. Covid proved to be far less lethal than originally feared, and the economy and people moved on despite later variants in 2021-2022.

For foreign policy, I would say Pinker’s “The Better Angels of Our Nature” has proved correct in predicting peace and stability compared to books by Taleb or Turchin. Same for Fukuyama, who was also correct despite criticism. A common rebuttal is that the recent unrest in Ukraine and Gaza invalidates Fukuyama and Pinker’s thesis, but they never promised a world free from some conflict. Compared to the autocracies and deaths of the first half of the 20th century in which 3% of the world perished from genocide, famine, disease, or war, the 2020s are a drop in the bucket, as bad as Covid was:

Also, during the ’90s and early 2000s there was considerable ethnic conflict, like in the Balkans, the Middle East, and in Africa. 800,000 civilians died in the Rwanda genocide of 1994, which adjusted for world population is about 3-4x the casualty count of the 2022- Ukraine-Russia war.

This is not to say profits cannot be realized by betting on disruption or change. Meta, Uber, and Tesla are obvious examples, but this must be done judiciously. And a bunch of factors must align. Like a lot of things in life, the answer is ‘it depends’. But even if you miss out on the first wave, like investing in Facebook in 2014 instead of 2005 when it was a tiny dorm start-up as Peter Thiel had done, substantial profits can still be realized by betting on a disruptive technology becoming the status quo and staying that way, like Google, whereas the public and ‘conventional wisdom’ overestimates the odds of the technology failing or being a fad. This is why so many otherwise smart people lost money betting against Uber or Tesla as being fads.

Both Titanic and Avatar are James Cameron production, and Cameron already was well known as the creator of the Terminator series so it is kind of a franchise too.