I’m sure many have seen the below barchart in the context of debate about IQ vs success, as evidence of how high-IQ does not matter that much for career success or income given the considerable IQ overlap between high-paying and low-paying professions:

I’ve seen this posted many times over the years on blogs, Quora, and on Reddit. Somehow it’s supposed to be convincing that IQ does not matter that much. Me thinks not so much. As the The Princess Bride meme says, to paraphrase, “this word does not mean what you think it does,” but replace ‘word’ with ‘study’.

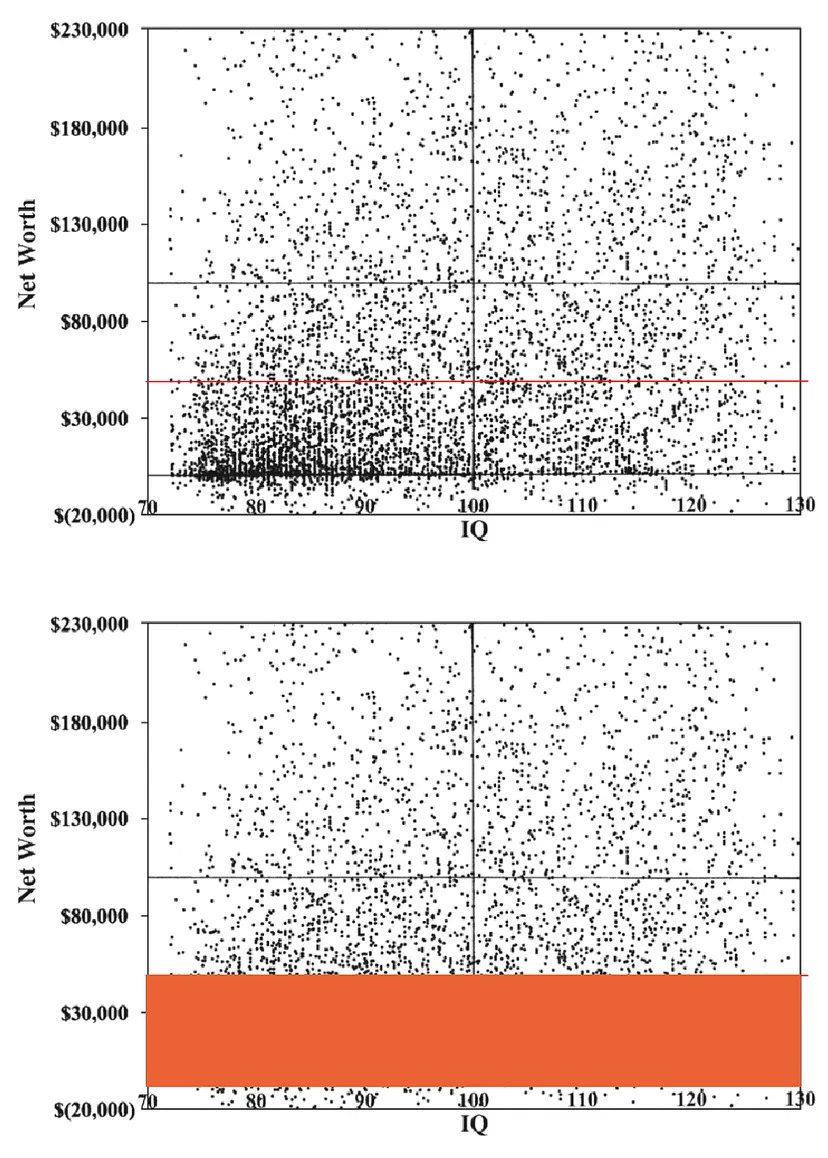

Or how about the below scatterplot from the super-viral 2019 article by Nassim Taleb, “IQ is largely a pseudoscientific swindle”?

The first plot is from Hauser, Robert M. 2002, “Meritocracy, cognitive ability, and the sources of occupational success.” The full text can be read here. The second plot is from Zagorsky, 2007, “Do you have to be smart to be rich? The impact of IQ on wealth, income and financial distress,” which can be found here.

The Hauser paper looked at “occupation vs scores on Henmon-Nelson Test of Mental ability in relationship to three jobs: First, full-time civilian job after leaving school for the last time; current or last job in 1975; and current or last job in 1992-94.”

So we’re talking data that is anywhere from almost 30-50 years old. The Zagorsky paper followed cohorts from 1979-2004. So the midpoint of data is from 30 years ago.

Or what about that viral Swedish study from a year ago about the diminishing returns of IQ vs income? Again, old data. [0] And Sweden is not like the US, which has less wealth inequality and a thinner ‘tail end’ of income and wealth distribution compared to the US. There is no Google, Facebook/Meta, or Goldman Sachs equivalent in Sweden.

This may seem dismissive, but 30-year-old data is not representative of today’s economy. A lot has changed since the early 90s: new technologies (e.g. the ‘information age’, ‘big data’, AI, etc. ), demographic change, outsourcing/NAFTA, etc.

At the high-end of ability, recent trends generally favor smarter people, such as due to the rise of high-paying white collar jobs (especially since 2010), competitive college admissions, winner-take-all markets, aggressive recruiting for top talent, etc.

Since the ’80s the top quintiles have pulled away from the bottom quintiles in terms of real income growth, especially during the ’90s, when data collection ended for the aforementioned studies:

30+ years ago, adjusted for inflation, a competitive white collar job in technology or finance paid $80k-100k, not the fat mid-six figures + comp seen today in FAANG-SWE or in finance. Popular ‘FIRE’ and investing Reddit subs are full of people in their 30s or even 20s with 7-figure net-worth from a miscellany of tech jobs or other white-collar work. Obviously this sample is biased (Reddit is not representative of the ‘general US population’), but even adjusted for inflation and population growth, in the ’80s and ’90s this was much less common.

Maybe in the ’80s bond traders earned that much, as dramatized by the works of Michael Lewis and Tom Wolfe, but nowadays it’s AI, ‘front end’, or machine learning, and many more people and the display of wealth much less conspicuous, but it’s there. Instead of obvious signifiers of wealth such as fancy cars and watches, the wealthy are more inclined to splurge on private retreats, elective medical procedures and off-label drugs, private schools, personal chefs and coaches, and VIP-entertainment–the emphasis being on self-improvement, refining one’s social circle, and lifestyle-optimization, rather than indulgence or showing off. So at the tail-end, at least, we see much greater returns to IQ compared to decades ago.

Moreover, more pre-employment screening, personality inventories, background checks, automated resume filtering, drug tests, private data brokers, Wonderlic, credentialism, etc. These did not exist 30 years ago or were more limited and tend to hurt less intelligent applicants. Background checks, which can be done automated at scale thanks to technology, are an indirect IQ filter. Employers today have access to huge troves of information that employers of decades ago could have never conceived of. Instead of just a name on a resume, it’s possible to create an entire profile of the applicant based on social media and other information.

Second, Taleb does not control for individual preferences: not all smart people aspire to high-paying careers. Taleb’s argument is that IQ and individual net-worth are uncorrected at the high-end of IQ, but highly correlated at the low-end of IQ (the part shaded over in orange), but this can be explained by individual preferences. Smarter people tend to have more career choices overall, not all of which may be high paying, such as the arts, media, academia, or non-profits.

Regarding Hauser, being a programmer or working with computers in the ’80s or early ’90s was different, likely easier relative to pay, compared to today. The type of tech jobs that would have commanded $80k-100k salaries in the ’80s adjusted for inflation, have possibly been outsourced, automated, or don’t exist anymore. Given the huge post 2010s surge of temp/o-Desk workers, it’s hard to overstate how big this trend has become. This again raises the IQ bar. Even IT is being outsourced.

Also, the aforementioned studies doesn’t account for the role of compounding wealth via the stock market and real estate returns. The past 40 years, compared to the ’70s, has been a period of unprecedented real returns for stocks and real estate thanks to accommodative fiscal and monetary policy, cheap mortgages, and speculation (and also stock buybacks and globalization (the “giant sucking sound” notwithstanding)). This benefits higher-IQ workers, who are able to earn enough money to take advantage of these recent macro trends. Less intelligent workers may be priced out of home ownership or investing and unable to compound wealth in this manner.

Home ownership yielded negative or flat real returns for much of the post-war era, compared to the past 30 years, in which homes have become yet another ‘asset class’ instead of merely shelter. Fiscal and monetary policy is increasingly designed with home owners in mind, as homes are a major source of wealth, and home equity is converted to consumer spending. Same for the stock market, which since 2010 has posted among the strongest returns ever (>15-20% annual for the S&P 500 and >20% for the Nasdaq) while inflation stayed at around 1-2%/year, until only in 2022-2023 spiking, breaking the multi-decade trend of falling long-term yields.

On the other hand, in agreement with Hauser–given that as of September 2023 the US labor force stands at 168 million people, of which 156 million have an IQ of at least 90 [1]–we would expect an IQ overlap across a wide range of professions, such as schoolteachers, policemen, clerks, or accountants (although due to the above factors, the IQ range is likely narrower, with the lower-end (<85) being truncated compared to the ’80s).

Overall, it’s not so much that the studies are wrong, but I don’t think the results mean what people hope they mean. In the context of debate online, such as Scott’s viral 2017 article Against Individual IQ Worries, people are not worried about only being in the middle like teachers–they aspire to be among the outliers at the top, like coders and other high-status, high-paying professions. In this case, such studies are not really applicable: the evidence suggests IQ does matter a lot, and more than it did 30 years ago at least for the highest-end of jobs.

It’s not like you need a high IQ to watch a movie, to read a comic book, or to enjoy the company of friends and family, etc. There are many things in life in which high IQ confers no obvious advantage. But for things which are competitive, rank-ordered, and that do confer pay and status, IQ seems to matter a lot more. And those are important, too. It’s not like healthcare, homes, or good schools are becoming more affordable. People need all the income they can get. And having status is nice, too.

[0] Link to study. The median of the study is 1993, or a full 30 years ago: “Our analysis includes men who joined the labour force between 1991 and 2003 (median 1993). In total, 670,203 men, aged 18–60, entered the labour market in this period to be fully employed for at least 1 year.”

[1] FRED data shows 208 million Americans of working age, which is defined as between 15-64. Simple math shows about 75% have an IQ above 90, or about 156 million people.