The secular stagnation theory has gained a lot of attention in the past few years. From Wikipedia:

Economists have asked whether the low economic growth rate in the developed world leading up to and following the subprime mortgage crisis of 2007-2008 was due to secular stagnation. For example, economist Paul Krugman wrote in September 2013: “[T]here is a case for believing that the problem of maintaining adequate aggregate demand is going to be very persistent – that we may face something like the ‘secular stagnation’ many economists feared after World War II.” Krugman wrote that fiscal policy stimulus and higher inflation (to achieve a negative real rate of interest necessary to achieve full employment) may be potential solutions.[7]

Economist Larry Summers presented his view during November 2013 that secular (long-term) stagnation may be a reason that U.S. growth is insufficient to reach full employment: “Suppose then that the short term real interest rate that was consistent with full employment [i.e., the “natural rate”] had fallen to negative two or negative three percent. Even with artificial stimulus to demand you wouldn`t see any excess demand. Even with a resumption in normal credit conditions you would have a lot of difficulty getting back to full employment.”

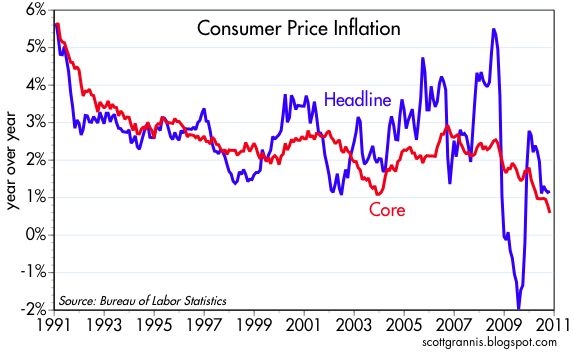

However, just as there is evidence of stagnation, there is also evidence that the U.S. economy is inflating, in refutation of stagnation. This is where the theory bifurcated inflation‘ come into play to reconcile the deflationary indicators with the inflationary ones. On the deflationary/stagnation side, labor force participation remains historically low as well as the CPI index, treasury yields, and lending. CPI is still at ‘crisis’ levels:

This chart shows the considerable shortfall of lending relative to deposits in American banks:

This PBS interview with former Fed economist Catherine Mann explains the situation in further detail:

The second channel through which quantitative easing is supposed to work is to provide additional liquidity to banks, and those banks are supposed to offer credit to businesses. Now that particular channel has not been very effective, precisely because the banks have not done much in the way of lending. Yes, there’s been some more lending for mortgages, commercial and residential, but there’s been very little additional lending for so-called “industrial loans” to small businesses, and to businesses in general, who do depend on banks in order to expand their inventory…

So lenders and borrowers have remained risk averse. This is is one of several deflationary indicators that proponents use to promulgate their stagnation theory.

We never bought into the whole stagnation hysteria because there are just too many counterexamples. Yes, the CPI is low but this is partially attributed to the flawed methodology of computing the housing component of the CPI, as Matthew Yglesias expounds in further detail. The rates for new renters is higher than long-time renters.

Look at someone in D.C. who’s been renting a house in Shaw in D.C. since 2006, and she is almost certainly getting an outrageously good deal from her landlord compared with what someone trying to move into the neighborhood in 2014 would pay. The landlord fears that if he tried to raise the rent all the way up to the current market price that he would (a) wind up with several months’ worth of vacancy and (b) run the risk of acquiring a problem tenant. Consequently, in an area where rents for new tenants are rising quickly the average rent paid will rise more slowly (and vice versa in a downturn).

Additionally, home prices in many areas are up 10-20 percent year-over-year, with some regions even surpassing their bubble highs:

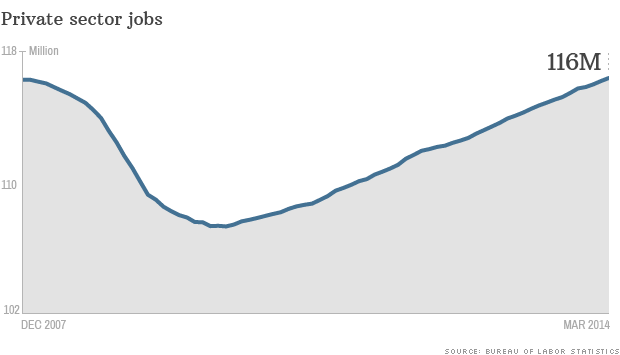

S&P 500 profits & earnings are at historic highs. Same for exports, consumer spending, and productivity. Private sector employment has recovered all the losses from the crisis:

GDP growth is back to ‘pre-crisis’ levels:

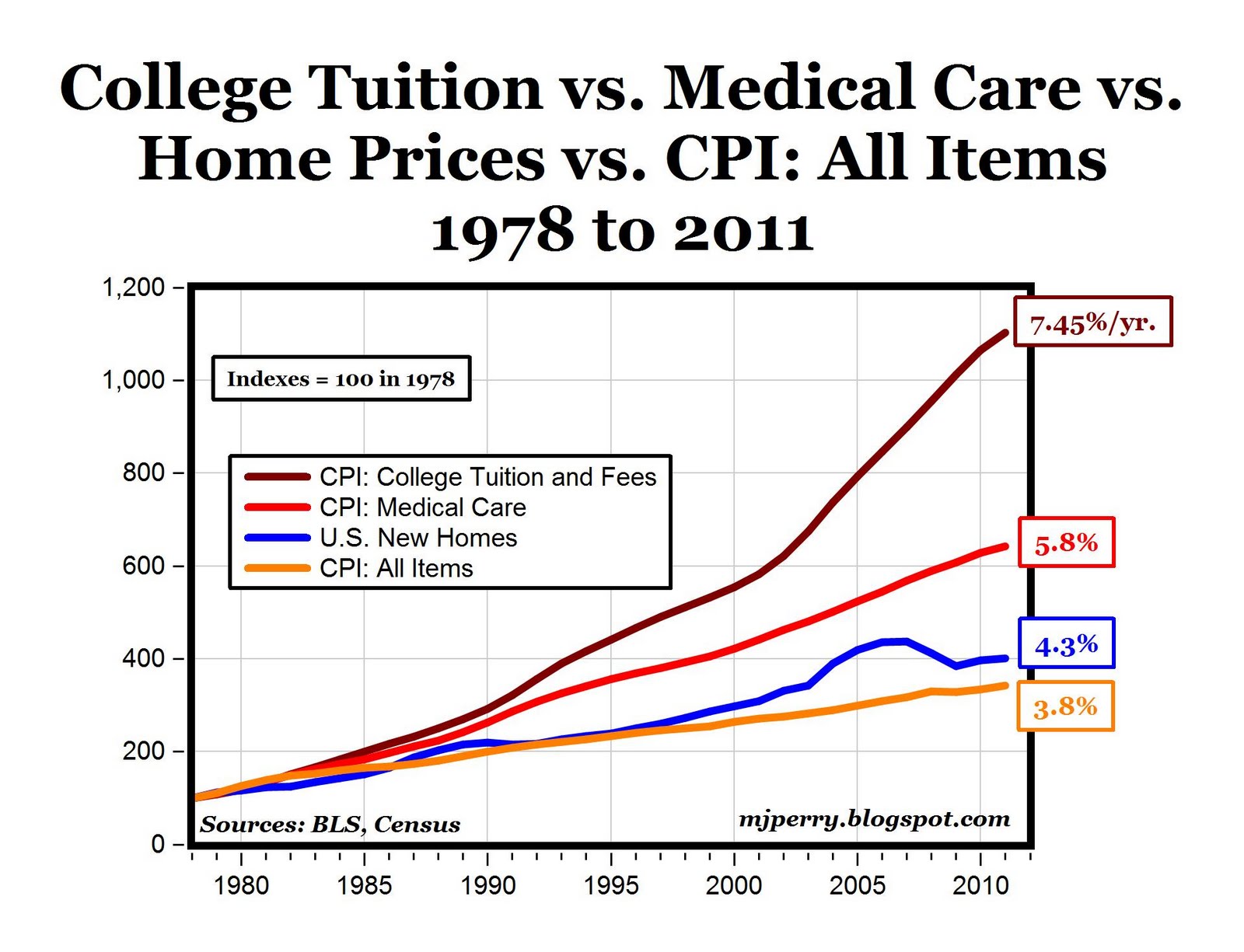

In agreement with our ‘bifurcated inflation’ theory, we’re seeing vastly higher real gains in stocks, real estate, healthcare, rentals, TV & internet service, air travel, food, gas, and tuition:

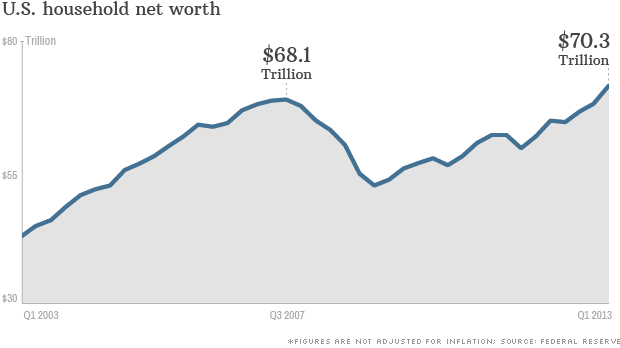

Why? Partly because people have lots of money to spend as evidenced by record high household net worth:

And record consumer credit:

As long a consumers have money to spend and their preferences to certain goods remain inelastic, prices will keep going up.

Secondly, the USA cannot deflate because prices are always rising by profit maximizing and colluding firms in order to extract every last penny out of consumer. Furthermore, sticky wages, aggressive monetary policy, productivity and the tendency of Americans to consume in good times and bad also provides inflationary pressure. In Japan, for example, consumer preferences are more elastic or companies are less inclined to habitually raise prices and ‘leave money on the table’ by not taking full advantage of the in-elasticity of consumer preferences to certain goods. Japan’s CPI has been close to negative. Less regulation in the hiring and firing process allows companies to quickly adjust labor during booms and busts, resulting in more efficiency and productivity. This could account for why labor force participation is low despite otherwise healthy economic and business indicators. Yeah, business lending is sluggish, but healthcare M&A activity is at record highs. It’s a confusing situation with conflicting signals. Yes, it’s cheap the buy a computer or a TV, but the subscriptions fees will exceed what you paid in just a year. So, while there’s evidence of stagnation, there’s just as much evidence of economic flourishing and above average inflation