From Time Stocks Are Recovering While the Economy Collapses.

Related to the link above, a question that keeps coming on on forums and news articles is, why has the stock market seemingly diverged from the economy.

The answer is, the the stock market is not the economy. When you buy stocks, you are not investing in ‘unemployment stats’ or GDP, but rather in companies. As long as companies can generate profits, which in spite of the virus many large companies are still profitable, stocks will tend to do well over the long-run.

It’s not a mystery as to why the market has done so well and will continue to do well. Corporate profit margins, especially in the tech sector, are at near record highs, much higher than during the 90s. Companies like Walmart are printing cash, and that money goes into buybacks, dividends, or shareholder equity. Either way, shareholders benefit and this is magnified by very low inflation, so the real return is even higher than it was compared to the ’80s and ’90s. If huge, multinational companies generate 20-30% profits or cash flow, that is capital that will go to shareholders one way or another either through dividends, buybacks, or share price appreciation.

As a consequence of Covid, the US economy has been accelerated into the future, to a more efficient and productive state.

An increasingly large percent of the economy is concentrated in a handful of highly profitable, efficient tech companies and multinationals such as Walmart, Microsoft, Amazon, Google, and Facebook. Jobs that were unnecessary or redundant before the virus, have been lost, some permanently. There is no need for hundreds of thousands of barely-profitable retail stores and low-paying retail jobs when a handful highly efficient, highly profitable companies such as Amazon, Costco, Best Buy, and Walmart can serve those functions. Stimulus money is pure bottom line growth for these huge companies as smaller businesses close.

Also, there huge growth in business to business commerce, bypassing consumer spending altogether: Facebook and Google selling ad space to other big businesses such as IBM, Microsoft, Nike, or Proctor and Gamble. Also, the wealthy are more impervious to economic weakens than the lower classes, and consumer spending growth from the top 10% is enough to offset loses in the bottom 90%. A single millionaire buying a Tesla or remodeling his home is equal to probably equal dozens of unemployed people in terms of consumer spending. In invoking the Pareto principle, 80% of economic activity is from 20% of individuals, companies. The ‘creative class’ and professionals such as doctors, consultants, lawyers, tech workers, etc., not only earn the most but were mostly unscathed during the crisis.

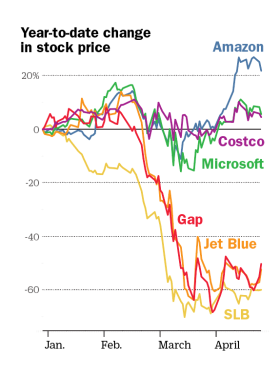

The top 5 largest tech companies are 20% of the S&P 500, the largest share ever. The difference of performance between these huge tech and big-box retail companies, versus other stocks and sectors, is obvious:

But because these tech companies are so big, the gains of a few tech stocks is enough to offset the losses of dozens or even hundreds of less profitable companies in sectors such as retail or energy. The top five tech companies–Apple, Facebook, Amazon, Microsoft, and Google– are worth roughly a combined $5.2 trillion. By comparison, Carnival Cruise is worth $12 billion and The Gap is worth $3.3 billion. Amazon stock rising 10% , or about $120 billion, just alone is equal to equal to 10 Carnival Cruises going out of business.