We’re still in a Goldilocks economy of modest economic growth, no deflation and low inflation. Macro economic conditions are more conducive for stock market gains than any time in recent history. Unlike in any prior decade, we have a confluence of low valuations, high profit margins, new markets from booming foreign economies, and permanently low interest rates.

Our economy is nothing like it was in the 1970s. In the late ’70s, the misery index, measured by adding the inflation and unemployment rates together, was at sixteen percent. The last years of the 1970s saw inflation rates of 10 percent, with high interest rates as well. The Federal Reserve responded by raising interest rates in order to lower inflation. This backfired by plunging the economy into a recession in the early 80’s.

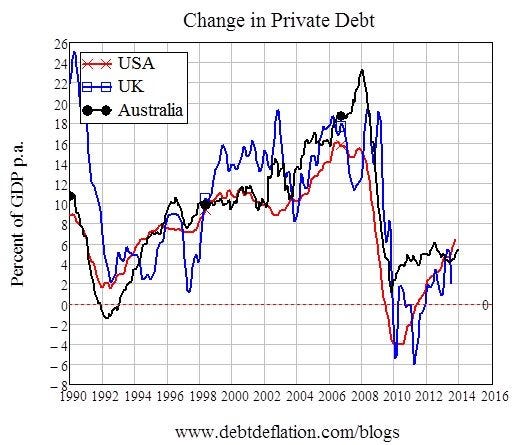

Today the economy is growing briskly, especially compared to Europe. Between the end of World War II and the beginning of the last recession, in 2007, economic growth in the U.S. averaged nearly 3 percent per year. Most of this was due to average labor productivity, which expanded at about 2 percent per year. In addition, the total number of hours worked also grew by one percent per year, in line with the overall growth in population. GDP growth is expected to settle at around two percent per year, or about the same as it was before 2008. The level of private debt, an indicator of business activity, is rising:

Interest rates and inflation are at some of their lowest rates in decades, due to the huge liquidity from governments and private institutions that is keeping rates lower than they would otherwise be. Despite unending criticism and predictions of hyper-inflationary doom & gloom, fed policy, in fact, has been very effective and isn’t making the mistake it made in the 80’s, 90’s or 2000’s of raising rates. It’s lowered interest rates because macro-economic conditions afford it the luxury of doing so, while dispelling any possibility of rates going up.

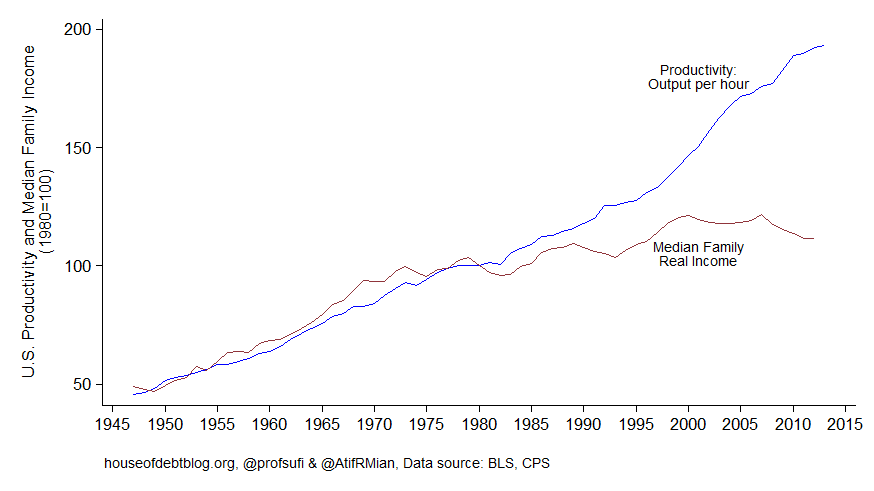

Instead of weak or collapsing corporate profits, as happened in the ’70s, corporate profits today are at all-time highs. Fortunately, real wage gains have stagnated since the late 1970s, providing a tailwind to economic growth. We’re becoming more productive, but the benefits of this productivity aren’t going back to the bulk of the population.

In the 1970s there was a bipartisan effort to deregulate markets ranging from transportation to finance to energy that was continued by Reagan, Clinton and Bush. Looking back, too big to fail policy has worked. Instead of growth sucking regulation, the solution is to have systems in place to nip crisis in bud, as was demonstrated with the overwhelming success of TARP or the bailout of Long Term Capital Management. When used to promote pro-growth policy, corporate welfare is better than regular welfare. Look at the success of TARP, tesla, and defense spending, for example. Liberalism is the problem, not crony capitalism.

In what has been called the web 2.0 stimulus, billions of dollars are flowing into high-end real estate and other luxuries. Unlike the failed Obama stimulus, this was borne out of the private sector. Industries that a decade ago didn’t exist are being created to serve the New Rich. Everything is wonderful – a cornucopia of wealth creation, prosperity, innovation, and being smart. The left said in 2008 there would be a permanent economic downshift – well, maybe in their own little world of negativity, but certainly not in Silicon Valley or the broader economy.