It’s the weekend and that means another ‘time to spread the wealth’ diatribe from Business Insider click baiter in chief and disgraced analyst, Henry Blodget:

One reason the U.S. economy is still weak is that big American companies are “maximizing profits” instead of investing in their people and future projects.

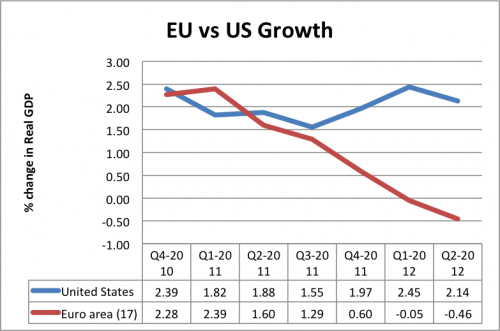

Weak compared to what? The U.S. recovery has been faster than the E.U., as well as record high S&P 500 profits & earnings, consumer spending, productivity, and exports. GDP growth has returned to pre-crisis levels, which compared to the rest of the world is pretty good.

This is an example of moving the goalposts – the economy is weak not because of the actual economic data, but because of it failed to meet some arbitrary conditions stipulated by Henry Blodget. “Unless we have full employment and equality, there’s no recovery!” Secondly, companies are serving the best interest of their shareholders by maximizing profits. It’s not greed; it’s their duty. That’s why CEOs sometimes pay themselves $1 salaries.

moving on..

This behavior is contributing to record income inequality in the country and starving the primary engine of U.S. economic growth — the vast American middle class — of purchasing power. (See charts below).

If average Americans don’t get paid living wages, they can’t spend much money buying products and services. And when average Americans can’t buy products and services, companies that sell products and services can’t grow. So the profit obsession of America’s big companies is, ironically, hurting their ability to grow.

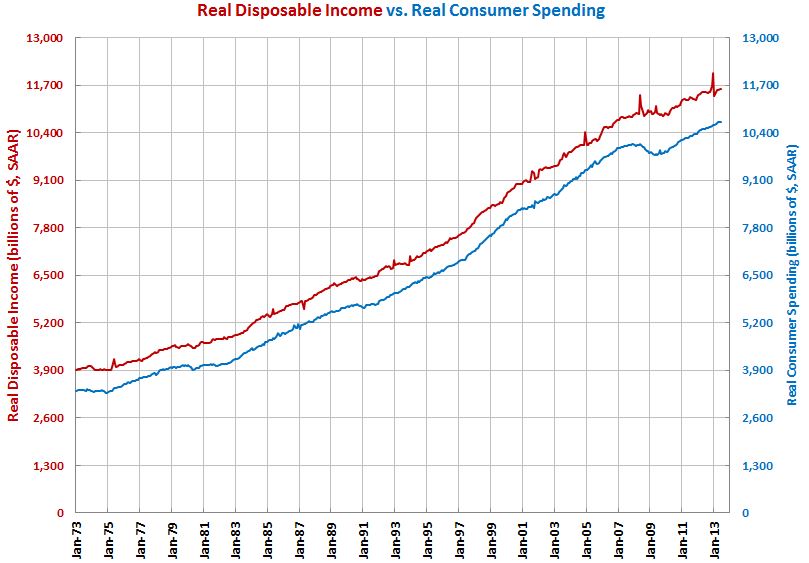

This is a Marxist fallacy that keeps resurfacing on the blogs. We debunk it in further detail. As you can see below, consumer spending and disposable income shows no signs of slowing despite rising inequality:

And we debunk it again here

The push towards lower wages isn’t motivated by greed. It’s looking after the best interest of shareholders and consumers to keep costs as low as possible. The benefits of cheap labor outweigh the potential externalities. Apple can hire overseas labor because those people will never have enough money to buy an iPhone anyway. The Americans that could have hypothetically been hired by Apple will look elsewhere for work. The savings from outsourcing far exceeds what Apple could earn from the increased purchasing power from US Apple employees if some of those employees had slightly more money in their pocket to buy Apple products. Boeing, for example, knows that average Americans won’t be buying its planes, so they can outsource with impunity knowing that it won’t hurt demand for their planes. The added profit means Boeing can sell its planes for less money and this eventually translates into cheaper airline tickets or lower freight shipping costs, etc.

Does rising wages make everyone better off? It could make individuals better off in terms of more purchasing power (assuming they don’t get fired), but from a game theory standpoint no individual company stands to benefit. Since consumption is spread out, the odds that a specific company company will reap the benefits is very small, depending on the business. Mass consumer companies McDonalds, Starbucks, and Walmart may benefit, but others like Boeing won’t. Let’s assume the Burger King employee is paid $10 instead of $8. Even if he takes that $2 and buys a Burger King menu item it will still cost Burger King more money than if they kept the cash. The only way Burger King can recoup the costs of higher wages without raising prices or cutting back is to hope the purchasing power from other people is enough to offset the costs. Unless other companies give a wage hike this is impossible, but even if others increase wages it may not be enough. This is why efforts to raise wages are fraught with so much resistance and why the ‘increased purchasing power’ argument doesn’t sway businesses.