I saw this going viral: Are Social Media Platforms the Next Dying Malls? It got over 1,400 Substack ‘likes’, which I think is close to a record for that site, indicating considerable agreement or people who want to believe it’s true.

It looks like Mr. Gioia is inventing his own reality again to suit his preexisting narrative. There is no evidence to suggest social networks are in decline.

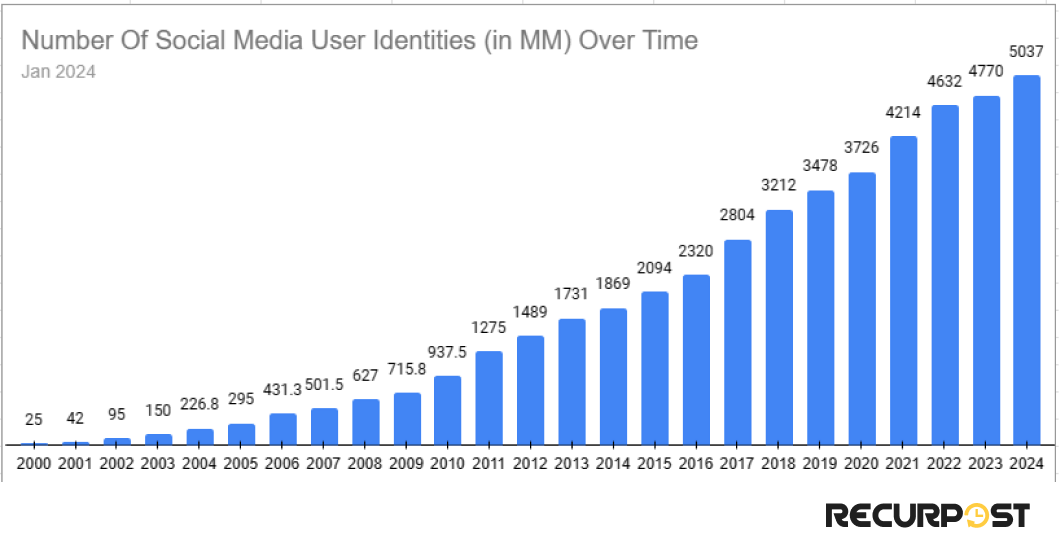

Social network usage continues to make new highs worldwide–the opposite of a dying mall:

And in the U.S. among gen-z:

He writes:

But the real world rarely operates like Field of Dreams. Just check out the foot traffic in Mark Zuckerberg’s Metaverse. A web platform needs something else to build a community, and that something else is getting harder and harder to find in the current environment.

That is some nice cherry-picking, ignoring the vastly bigger and more successful Facebook, WhatsApp, and Instagram platforms. Also, the author’s earlier predictions have not fared so well. In March 2023 Mr. Gioia likened Facebook to a ghost town, citing the apparent failure of the Metaverse, writing:

A year-and-a-half after his corporate makeover, the situation at Meta is more dire than ever. Back in October 2021, Facebook shares were trading above $340, but now they are below $200—that’s a loss of around $300 billion in market value.

Meta stock as of writing this post is above $600/share. Whoops. I guess not so dire. I was correct in predicting the opposite.

Continuing:

People keep telling me that I need to move to Threads. Or Bluesky. Or Twitch or TikTok or Discord or Truth Social or Snapchat or Rumble or YouTube shorts or whatever.

This has always been the case. There have always been many smaller completing platforms to the leading companies. In 2002-2004 there were at least a dozen competitors to Google. They all went away, and it goes without saying Google remained on top. More platforms does not mean the industry itself is in the decline. In fact, we would expect more competition as competitors seek a piece of a growing pie, not fewer platforms.

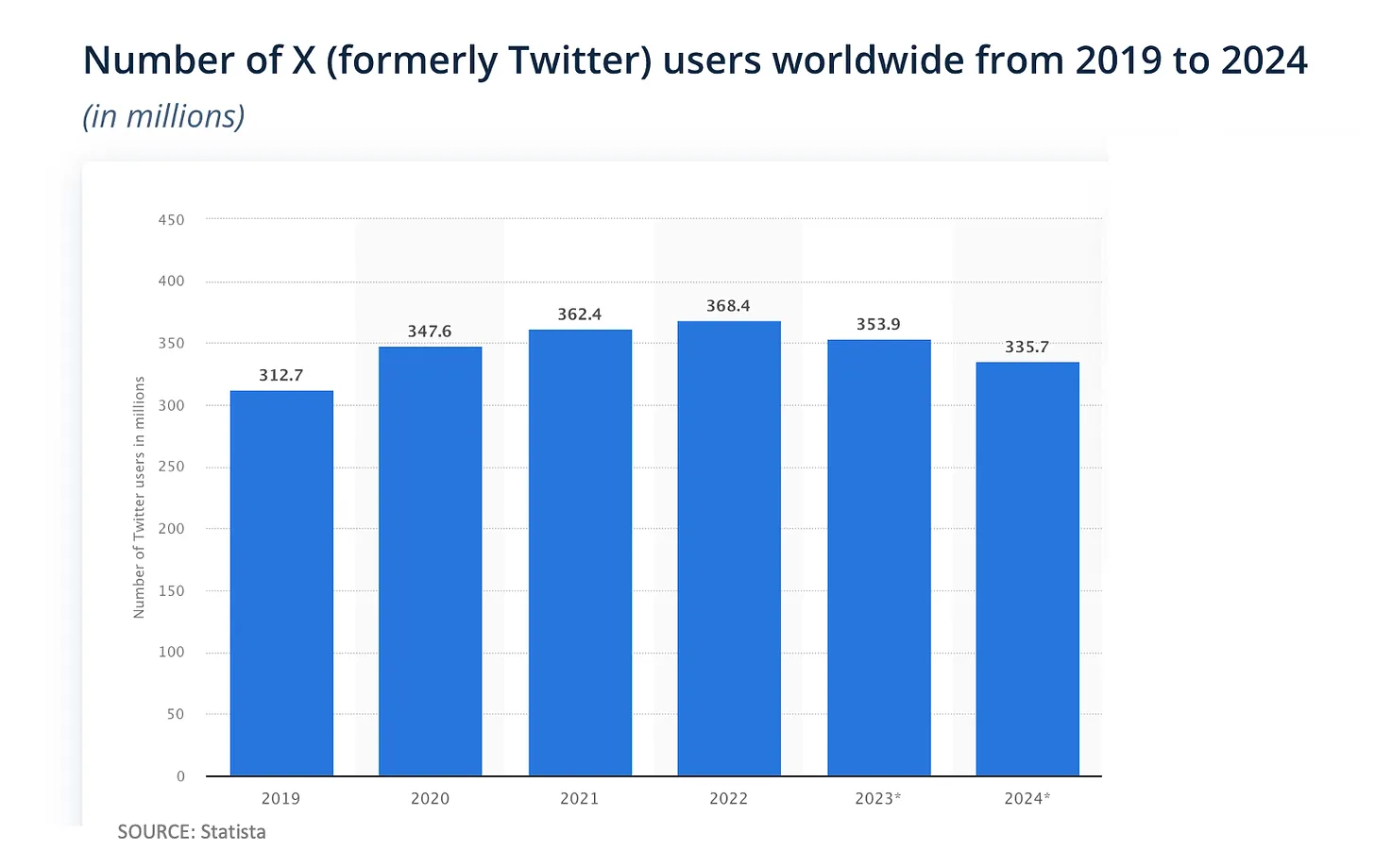

Below he cites Twitter/X as an example , but given that traffic has held up, that is good news compared to the many failed predictions in 2022-2023 of mass defections under Musk’s ownership:

Competing platforms initially got a lot of media coverage, and then faded away or never achieved that critical mass. Everyone is on twitter, so that is where people will go. A lot of people who pledged to defect or did so, have slowly returned to Twitter.

He writes:

That makes all of these platforms vulnerable. If some new player invents a slightly better algorithm—a cooler video slot machine or a more addictive interface—users will switch loyalties in a heartbeat.

This is moving goalposts from ‘social media platforms are dying as a business model’ to ‘the leading social networks are at risk of being replaced by newer competing networks’. Again, I see no evidence of either.

Social media is the online equivalent of this. You can’t actually kill somebody directly on the web—but these platforms are now indirectly responsible for a lot of ruined lives.

This is not new though. It’s like someone in the ’20s saying that cars kill people, which although true, cars are still popular. How is this a convincing argument? It’s more of an argument for not using social media, not that social media as a business is dying , which is a different claim. This is a recurring trend: make a bold proclamation in the title and then smuggle tangentially related points that come off as having an axe to grind or a grab-bag of grievances but does not substantiate the original claim.

In the last three years, they stopped trying to build communities, and shifted to promoting addictive scrolling and swiping. They manipulate their users with a smug attitude that can only be described as contempt.

I agree, but that is the business model. It’s like blaming Las Vegas for acting in its own interests by offering free drinks to entice people to gamble. It seems like it’s working, as all engagement metrics and ad revenue are up.

In his defense, forecasting its hard, but to get something so wrong should be an indication that one ought to change their model of reality, not dig in, unless they have evidence, but he supplies none. Sure, I was wrong about Bitcoin going up, but am still correct or at least supply evidence, that Bitcoin has worse risk-adjusted returns compared to leveraged tech investments, such as FNGU and TQQQ, and is too volatile. Same for being a poor inflation hedge as often touted by its supporters. Bitcoin’s volatility has remained very high despite the price going up a lot.

A lot of people want to see the sun set on the dominance of the ‘big tech’ platforms, but this not going to happen. What made the dotcom bubble of the late 90s an outlier was not its size but rather that it was finite. The post-2009 tech boom has no such apogee of its trajectory. I recall many predictions from 2010-2016 about how Facebook had peaked or how people would grow tired of social media, but it never comes to fruition. His article is just the latest of such failed predictions.