It’s time to expound on the recent situation involving Israel and Iran. With Israel and Iran in full-swing, all the prediction sites like Metaculus have added markets for wagering or estimating the possibility of war involving Israel and Iran. Thank you–where were you guys a week ago? A lot of good that does.

Yet again–like Covid, Jan 6th, Russia’s invasion of Ukraine, or the Oct. 7th Hamas attack on Israel, all of which no one predicted even down to the year–no one predicted the Iran drone strike on Israel or even escalation between the two nations in 2024. There were no warnings. Everyone–both experts and laypeople–were blindsided.

This shows the inherent problem with prediction markets and forecasting. Forecasters struggle with so-called ‘unknown-unknowns’, which are things that fall outside the purview of what is already known or existing actors. Predicting a second 911 or a second Covid is far less useful or impressive than doing so the first time, as the threat of pandemic or plane-based terrorism has already been implanted due to recency biases.

Hence, one is liable to overestimate the likelihood of a repeat attack or event by those same actors or vectors. Instead, terrorists will likely change their means of attack by finding new unexpected weaknesses. Hence, forecasters are always a step behind and reacting instead of anticipating.

Even when the actors are known, forecasters still have terrible track records. What ever happened to that TikTok ban everyone was talking about a month ago that seemed all but certain? (The author correctly predicted it would not be banned.) Or they get everything wrong: Many pundits wrongly predicted Trump would not leave if he lost. Trump actually did vacate the Office of the Presidency without incident, but no one predicted the Jan 6th Capitol protest and entry.

Also, it’s unclear how one ought to act on such probabilities from a policy or investor standpoint. If a prediction market gives 20% odds of conflict between two nations within the next 2 years, how does one use this? Also, there is so little data or sample sizes to draw upon. What does a ‘40% chance of a conflict’ mean when there have only been a few conflicts ever? In the insurance industry, the odds are calculated based on having a lot of data, but this not possible with geopolitical events.

However, instead of trying to predict the next crisis, which is almost always a fool’s errand for which no one possesses any skill at doing, I have found that pundits, experts, and laypeople alike tend to way overestimate the severity and duration of crisis when it does occur.

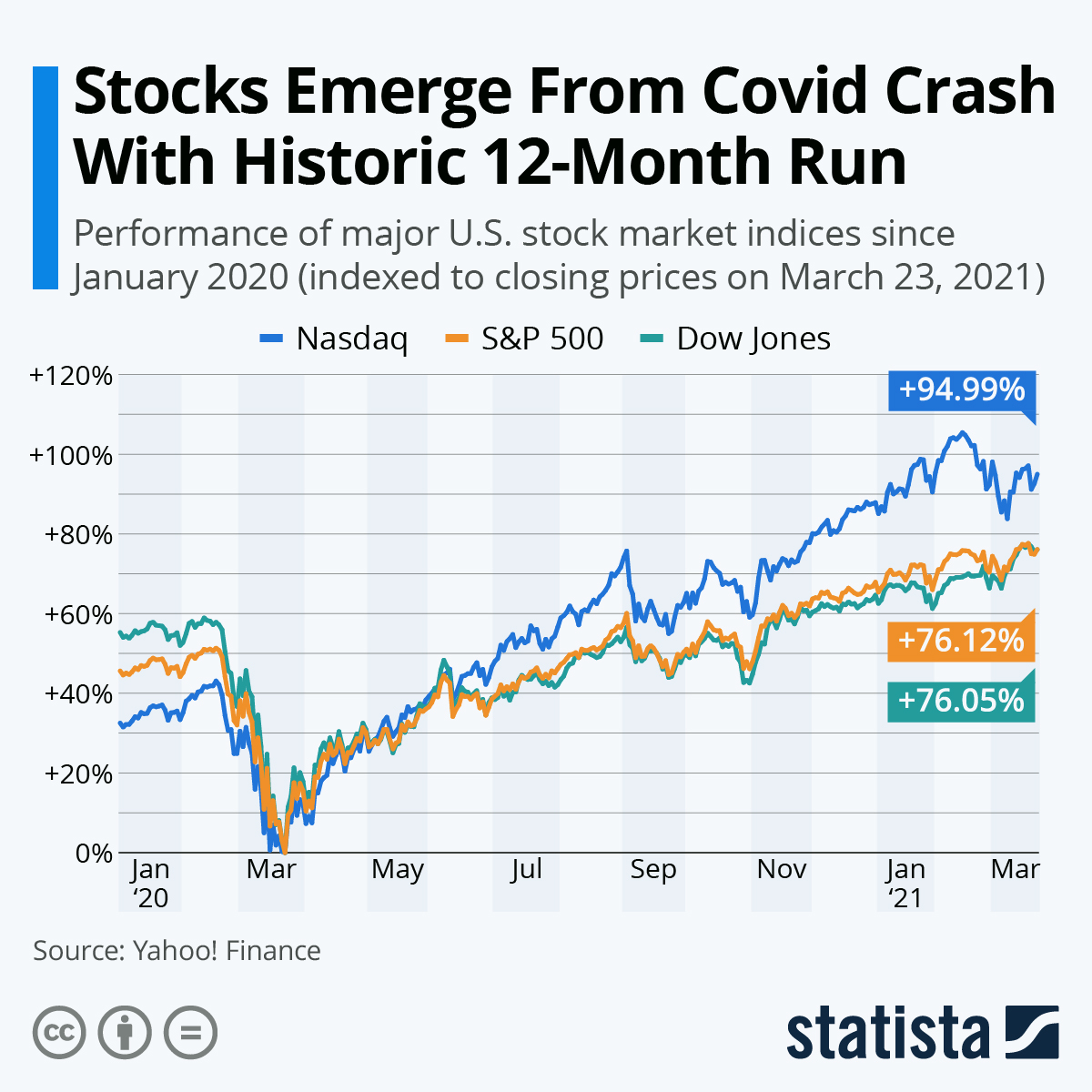

They tend to way underestimate the resiliency of the U.S. economy and the resolve and ingenuity of policy makers and the propensity of the U.S. consumer to keep consuming. This was true after 911, 2008, and during Covid, in which things recovered far faster than anticipated. The S&P 500 recovered all its Covid losses in under a year, and as did GDP, which similarly staged a v-shaped recovery thanks to stimulus, the recovery in tech, and other factors. Even the most optimistic of forecasts didn’t see such a huge recovery.

The 2008 banking crisis, as bad as it was, did not lead to another Great Depression, as many were certain it would. Despite WW3 and nuclear war memes after Russia invaded Ukraine, nothing close to that happened. Despite dire initial forecasts, Covid was not nearly as bad as the Spanish Flu, affecting the elderly and the infirm instead of the young and economically productive (the opposite of the Spanish Flu), and a much lower infection mortality rate overall [0]. The disruption to the New York economy after 911 was also very short-lived. It took just 2 months for the DJIA to recover all of its 911-related losses:

Same for endless failed predictions of China invading Taiwan or trade war or other strife between the U.S. and China. But always being wrong won’t stop these people from trying. Surely they will be right eventually, in which they can take credit for having known it all along. Remember when people collectively lost their minds over an errant Chinese balloon last year? Will those people in the media apologize for stoking fear for ratings? No way. Now the panic is over plane doors. It’s always something.

In keeping with my heuristic, when Israel fails to respond, calls it off, or the response is weaker than expected–expect a rally in stocks to new highs. Israel’s response will be underwhelming, assuming anything happens. That is typically how these things play out if history is any guide, as the aforementioned examples show. Iran is obviously much bigger and more powerful than Hamas, and Israel stands to lose Western support by being too aggressive given the implications of unrest and economic disruption that war with Iran and possibly other countries would engender. Biden will pledge plenty of aid and unconditional support to reassure Israel to back down.

So, overall, unlike predicting if, where, or when there will be the next crisis, there is more money to be made predicting a fast recovery or predicting that things will not be as bad as initially assumed and buying the dip, like during Covid, in which the S&P 500 and the Nasdaq 100 staged huge recoveries:

NOTE: This heuristic only works if it involves the US; crisis and malaise affecting other countries tends to be way worse and protracted. Of all major countries, the U.S. economy, consumer, and stock market had the fastest recoveries from Covid and the 2008 financial crisis.

China and much of Europe have still not recovered fully economically from Covid, in the former having doubled-down on ineffective, self-destructive lockdowns, port closures, or other measures. Regarding the 2022-ongoing inflation crisis–Germany, France and the U.K. experienced worse inflation and surge in energy prices compared to the U.S. (>11 % gains vs 5-7%):

[0] Way more people being diagnosed with Covid but asymptomatic, paradoxically, was good news as it implied a much lower infection rate than originally feared. The lethality of Covid was significantly downgraded in April 2020 as more pandemic case data came in, such as from prisons, in which the infection fatality rate was downgrade by a factor of 50-100.