It has been a while since I updated about my Bitcoin shorting method. To recap: at the start of the trading session, 6:30 AM PST, I short Bitcoin and go long QQQ/NDX_100 in equal size. So for a $100k portfolio this would entail buying $50k of QQQ/NDX_100 and shorting $50k of Bitcoin. Both legs are kept open for the duration of the trading session and closed at 1:00 PM PST, for a total of four trades. Nothing is kept open overnight. It’s repeated the next day with the same percentage allocation.

So one would assume given the huge rally in Bitcoin this year–from $44k to $70k (59%) as of writing this–that I surely would have lost a lot of money, but to the contrary. My system only realized a 2.5% loss so far this year (from 1.17 to 1.14, assuming it started at 1.00):

(The system unsurprisingly lost money in February when Bitcoin was so strong, but not that much, and it has recovered a bit.)

And zooming out over the past year, the method still profitable, gaining 14%, despite Bitcoin having rallied from $23k to $70k:

On the other hand, had I naively at the start of 2024 shorted Bitcoin with 50% of the account, and went long QQQ with the other 50%, and held the positions and done nothing else, I would have an unrealized loss of 25% vs 2.5% as of 3/14/2024. The math works out as follows:

1. Bitcoin gained 59% from $44k to $70k, so only roughly 40% of the original capital would remain for the short-leg.

2. QQQ/NDX gained 9% from $402 to $438, so the long-leg made 9%.

So starting with $100k, only $75k would remain–$55k for the QQQ part and $20k for the short Bitcoin part. Pretty bad. Trading clearly makes a big difference.

My system works because I am able to isolate the timeframe for when Bitcoin falls, so am able to bet against Bitcoin but with much less risk compared to shorting it continuously. My system profits from two patterns or trends: QQQ and Bitcoin being highly correlated intraday, but also the persistent tendency for Bitcoin to lag or have a downward bias during the market hours relative to QQQ.

It’s not uncommon for QQQ to rally intraday but for Bitcoin to fall or stagnate, so I make money from QQQ rising, while also short Bitcoin and making money there too. It’s also not uncommon for Bitcoin to suddenly plunge intraday 5% or more while the stock market is flat or down a little, so I make money there. The final possibility: Bitcoin rising a lot relative to the stock market is more uncommon, in which I would lose money.

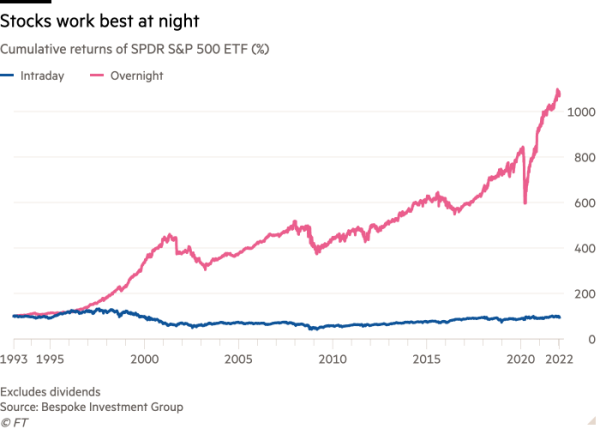

Shorting Bitcoin during market hours takes advantage of hedge funds selling, Silk Road selling, and asset rotation (such as out of Bitcoin and into tech). It’s somewhat similar to the ‘night effect‘ for stocks, which lasted for decades (it recently stopped working, but these patterns can last a long time until they stop working). Similar to stocks, Bitcoin is purchased at night and sold during the day.

This is how you do it correctly and not lose too much money. Most people who are short Bitcoin get their butts handed to them when Bitcoin recovers after the market closes or during the weekend. Not me. I am out of the position then. I don’t stay in it that long. This works just as well despite ETF approval and at $60k compared to $30k. Because we’re talking just percentages and differentials, the nominal price does not matter. ETF approval does not change the tendency of Bitcoin to be weak during market hours.

A 2.5% loss may sound bad in a bull market, but I run this concurrently with the leveraged tech strategies, and I stand to profit greatly if Bitcoin falls and or the stock market falls, as Bitcoin will track the downside of the stock market, but much more so. See 2022, for example, when this system would have worked immensely well as Bitcoin lost 70% of its value that year.

Bitcoin looks like it’s ripe or on the precipice of another crash, like in May 2021 or 2022, and poor risk to reward metrics overall. I think it’s much more likely it falls to $50k, than gets to $100k as so many people seem CERTAIN will happen (just like they were certain in 2021 or 2018). Overall, this is evidence that it is possible to short Bitcoin in a bull market and not lose your shirt.