The hype over BRICs has always been stupid and does not threaten the US dollar or US economy hegemony or deserve as much hype as it has gotten. According to wiki:

BRICs is a grouping of the world economies of Brazil, Russia, India, China, and South Africa formed by the 2010 addition of South Africa to the predecessor BRIC.[1][2][3][4] The original acronym “BRIC”, or “the BRICs”, was coined in 2001 by Goldman Sachs economist Jim O’Neill to describe fast-growing economies that he predicted would collectively dominate the global economy by 2050.[5]

Maybe this was true in 2002-2010, but due to hyperinflation, political instability, corruption, stagnation, falling commodity prices, and other problems, such economies not uncommonly have worse dollar-adjusted GDP growth compared to the US or even Japan.

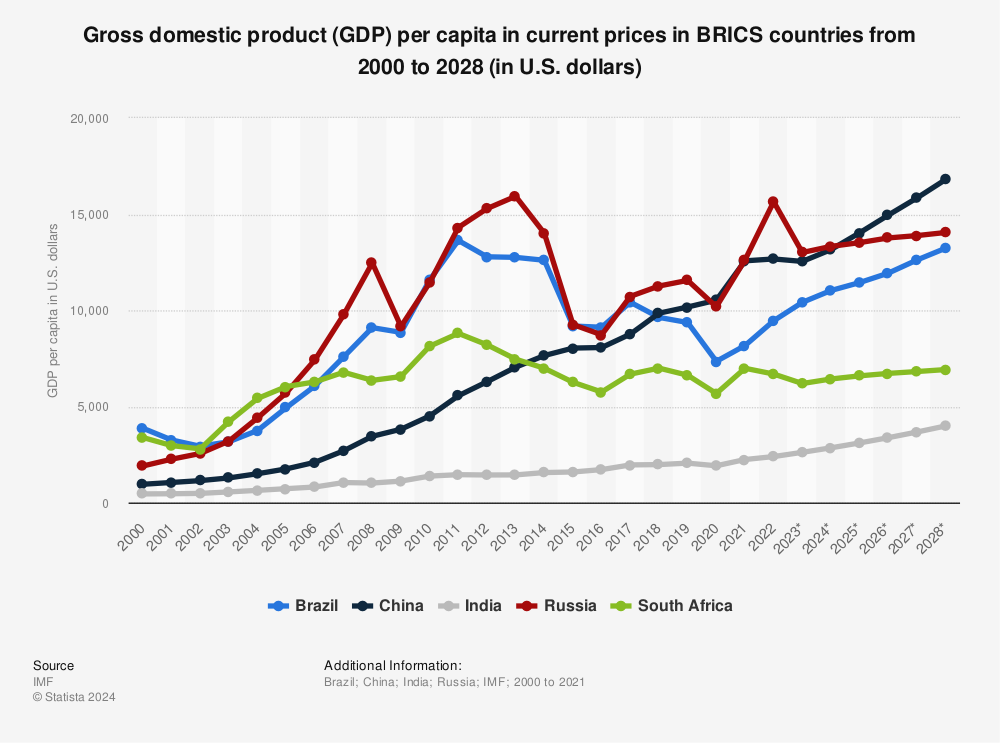

Yes, technically such economies may be growing a lot nominally, but adjusted for inflation and when such growth is converted back to US dollars, the results is stagnation or even decline as shown below. The only exceptions seems to be India and China:

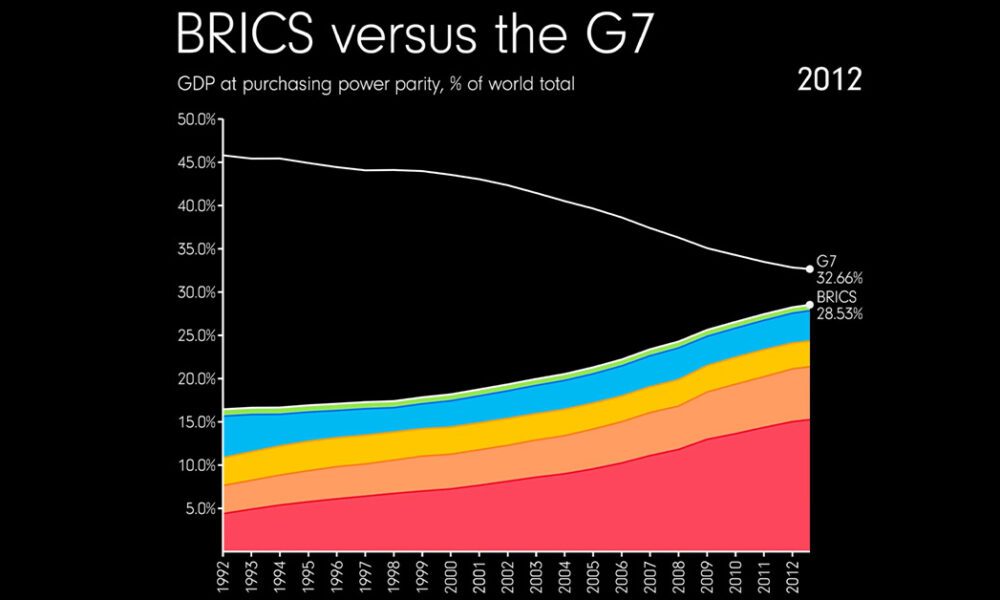

The only reason BRICs seems to be growing is simply because more countries are being added to it, not because the countries are more economically successful individually.

But hey, let’s not facts get in the way of a compelling narrative. As for BRICs threatening the dominance of the US dollar–nope. Same for all the hype over de-dollarization, which is still a fantasy. BRICs countries still retain use of their individual currencies. It is not a ‘single currency’ or a union like the Euro and the EU, as sometimes misunderstood. The US dollar is still indispensable as a global unit of wealth: when BRICs countries trade with each other or with non-BRICs countries, what unit of currency do they use as a conversion base: the dollar of course. Everything in the end is always benchmarked to the dollar.