Tim is usually right, but he’s off the mark here.

The media has been saying that ‘valuations are too high’ since at least 2012 when Facebook went public at $38/share, which was considered to be a disappointment at the time. It now trades at $185…so much for that. Not only has Facebook stock increased nearly 400% but earnings have increased so much that its PE ratio has fallen from 100 to 25, which means that Facebook is no longer excessively overvalued by conventional metrics. The media said the same about Facebook’s 2012 acquisition of Instagram for $1 billion, but Instagram is profitable and makes that much in a quarter, and is probably worth $50-100 billion as a standalone company. From Vox Facebook will soon rely on Instagram for the majority of its ad revenue growth:

So far, Facebook’s acquisition of Instagram has been a total success — one of the biggest of the internet era. The app, which Facebook acquired for $1 billion in 2012, now has more than a billion users and should generate $8 billion to $9 billion in revenue this year, depending on whose estimate you use. Other achievements are harder to measure, like how Instagram reduced Snapchat as a strategic threat by cloning many of its features, and how it gives Facebook a connection to young people.

The same for Amazon, which pundits said would never be profitable and that the stock would crash, yet Amazon’s earnings have increased substantially since 2009, and the company is profitable. In April 2019, Amazon posted a record profit and has been profitable for almost four years:

:format(webp):no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/10139745/rQvv8__1_.png)

Tim is right about fake news and FUD as it pertains to Trump and impeachment and so on, but it seems like the Gell-Mann amnesia effect to dismiss one set of stories from a publication as true and the others as factually false. If that same media is spreading lies about Trump, can we trust them to be accurate about tech valuations and the economy? Likely not.

Investors are buying. If they weren’t, these companies would not be worth tens of billions of dollars that they presently are. Just because a company does not go IPO at the very upper-end of its range does not mean that it was a failure. Uber being worth $60 billion is a long way from just a few billion 6 years ago, and many pundits from the left in 2014-2017 predicted that lawsuits, regulation, and protests would doom the company (I in 2015 correctly predicted Uber would persevere and would be worth $50 billion). Same for Airbnb, Snapchat, Zoom, Pinterest, Dropbox, and several others. Not a single one of these companies crashed and burned as so many predicted would happen.

No one really cares that much that Peter Thiel pulled out of silicon Valley. Silicon Valley and the ‘tech scene’ is much bigger than him. I respect his politics, but that does not mean I have to follow his heed.

Tim says that Facebook is losing lots of young users, but those users are only moving to Instagram, which is owned by Facebook. CrossFit and Tesla took down their pages, but , again, that is tiny relative to the number of brands that still use Facebook and is not predictive of anything. It isn’t even clear why CrossFit and Tesla took down their pages, and it’s hasty to assume a political motive as Tim does. After the IPO , General Motors famously pulled its advertising, yet Facebook has been a great investment since then. Advertisers sometimes temporarily pull their advertising as a way to send a message and to generate free press, but they almost always return.

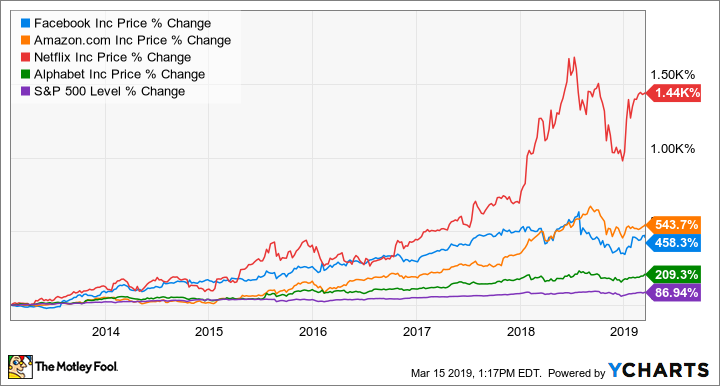

‘Go woke go broke’ is a ruinous investing strategy given the huge performance of such tech companies. Facebook and Google stock have doubled since 2015. Amazon has tripled. Amazon has quadrupled. Even Twitter has done well. Here’s a plot of the performance since 2014:

I sure as hell would not want to short these.

Much of Facebook and Google’s business does not involve politically-charged stuff, but rather brands, celebrities, people posting pictures of cats, movies, appliances, and so on. Far-left and far-right political punditry is just a tiny amount of Google and Facebook’s business and content. Twitter is move vulnerable in this regard, but, still, much of their content is apolitical, harmless, commercial and mainstream stuff. As for tech companies hiring unqualified candidates based on race, Tim could be right, but for whatever reason it has not translated into profits for short-sellers, which is what really matters in the end if someone wants to turn this into an investing strategy. I guess there are enough competent employees that the affirmative action hires aren’t too much of a drag.

Regarding regressive ideologies, many of these tech companies are frequent targets of the left, such as Uber being accused of not paying drivers enough and skirting regulations, or Facebook spreading ‘fake news’ and costing Hillary the 2016 election, or tech companies not respecting user privacy. And now the left is angry at Facebook, again, for refusing to take-down an unflattering video of Nancy Pelosi in which she appears intoxicated. Moreover, many of these businesses are apolitical and are not involved in social networking and have no ability, desire, or capacity to promote or suppress an ideology or party, although of course that can always change. There’s nothing inherently political about food delivery, temporary work spaces, or drones.

The problem will always be companies denying access or censorship based on politics, but that is separate from valuations, and in the case of Facebook, censorship has thus far not hurt the company or stock. Same for Google. Going from “Silicon Valley is woke” to “Silicon Valley is a bubble and tech stocks will crash” and “all Silicon Valley companies are woke” does not necessarily logically follow. Some companies are woke; others are less so or not. Some valuations may be too high; some are not. Some tech companies may crash; but most haven’t, and this is not necessarily because of wokeness but rather due to loss of marketshare due to competitors, loss of enthusiasm, and poor execution. Rather than generalizing, one must look at each company individually and separate the politics from the business model and financials.