The Krugster is at it again with another prediction of recession that is certain to be wrong: Krugman Sees Possible U.S. Recession With Little Fed Wiggle Room:

Nobel laureate Paul Krugman said the U.S. economy may be heading into a recession at a time when the Federal Reserve doesn’t have the firepower to properly combat a slump.

There is a common misconception that because rates are low, that fed policy is ineffective. Japan, for example, in spite of permanently low interest rates has navigated numerous boom-bust cycles over the past few decades. Also, he’s so blinded by his partisanship that he doesn’t realize that interest rates are not at zero anymore, but are at 2.5% or so. His logic is: raising interest rates too fast will hurt the economy, yet having rates too low makes fed policy ineffective at stopping a recession. This doesn’t even make sense.

I don’t mean to make this too partisan, but it’s evident many on the left really want the economy to fail, in order to increase the odds of Trump losing. In fairness, many on the ‘right’ wished the same upon Obama.

But Krugman’s track record at predicting is awful, yet because of his academic clout, he’s taken seriously. The financial media has been predicting crisis for years to no avail, as stocks keep going higher and the economy defies predictions of its collapse. For every time these pundits get it right (such as in 2008), they are wrong at least 50+ other times. Peter Schiff has finally seen his reputation erode from begin wrong about everything for the past decade. Dollar collapse? Nope. High inflation? Nope. Tariffs hurting economy? Nope. Shutdown hurting economy? Nope.

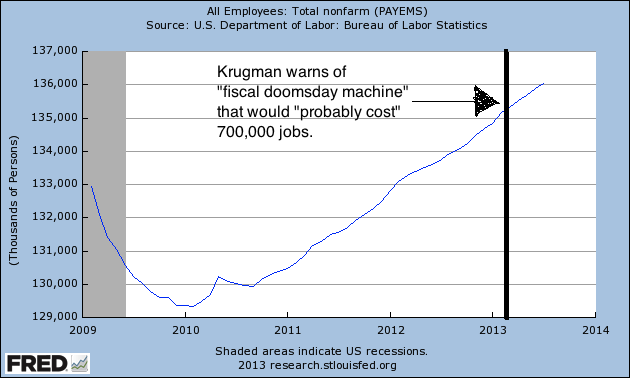

Regarding Kurgman again, here are some of his failed predictions. In 2013, he predicted that the government shutdown, debt ceiling, and sequester would hurt the U.S. economy.

On October 2013, he wrote (in his usual hyperbolic, hyper-partisan language):

But as I and many others have emphasized, even if this is possible, it would be a catastrophe, because the Federal government would be forced into huge spending cuts (Social Security checks and Medicare payments would surely take a hit, because there isn’t that much else). We’re looking at something like 4 percent of GDP, which given fairly standard multipliers would imply an eventual contraction by 6 percent.

Except that standard multipliers are wrong — it would be much, much worse. I haven’t seen anyone making this point, but it’s very important.

As we all know, the exact opposite happened. There was not even a hint of recession, and the economy has since boomed. Unemployment is at just 4.0%, the lowest it has been in decades. The S&P 500 has gained nearly 40% since then.

From the post No, Krugman, Economics Didn’t Fail. You Failed:

He also predicted, incorrectly, that the sequester and alleged ‘GOP obstruction’ would hurt economic growth and job creation. Wrong again. Stocks keep making new highs, economic data keeps being blowout, and unemployment is just a 2% higher than 2006 – the lowest level in six years.

In April 2012, Krugman published the book End This Depression Now. By “ending the depression,” what he really means is implementing more Keynesianism, even though the Obama stimulus was already $1 trillion. There never was a depression, and the timing of the book was terrible and coincided with the longest and one of the biggest economic expansions ever, which continues to this day 7 years later.

Numerous times in 2011, Krugman predicted the failure of the Euro. Wrong again, Krugster. Niall Ferguson is correct that no one should take Krugman seriously.

And after Trump won, Krugman warned “…we are very probably looking at a global recession, with no end in sight. I suppose we could get lucky somehow. But on economics, as on everything else, a terrible thing has just happened.” LOL, with the S&P up 30% since Trump’s win, unemployment at just 4%, and GDP growth other metrics strong, the Krugster was wrong about that, too.