A common belief by proponents of the legalization of insider trading is that insider trading can help expose frauds so that the ‘little guy’ doesn’t fall victim to the next Enron or Worldcom. The idea is that insiders, privy to the fraud, will sell their shares and cause the stock price to fall to its ‘true’ value, which in the case of Enron would be maybe a few dollars instead of $90 before the fraud began to unravel. Disregarding the dubious ethics of insiders profiting off frauds that they themselves may have helped instigate, let’s deconstruct the argument that insider trading helps protect the retail investor.

From Washington Post Insider trading enriches and informs us, and could prevent scandals. Legalize it.

From Reason Magazine Insider Trading Is Really Common. Awesome!

Markets work best when goods are priced accurately, which in the context of stocks means that firms’ stock prices should accurately reflect their strengths and weaknesses. If a firm is involved in a giant Enron-style scam, the price should be correspondingly lower. But, of course, until the Enron fiasco was unearthed, its stock price decidedly did not reflect that it was cooking the books. That wouldn’t have happened if insider trading had been legal. The many Enron insiders who knew what was going on would have sold their shares, the price would have corrected itself and disaster might have been averted.

This is an overoptimistic assumption. The chart to scalar theory says that insider trades can theoretically be detected if the stock underperforms an index, but a sufficiently large counter-inflow from buyers in the context of hype surrounding the stock or from an underlying bull market may mask insider selling. If an insider dumps 1m million shares and and another person buys 1 million, legalized insider trading won’t necessarily reveal potential nefarious activity. Even if insiders sell everything, it may just not be enough shares to make the price fall appreciably.

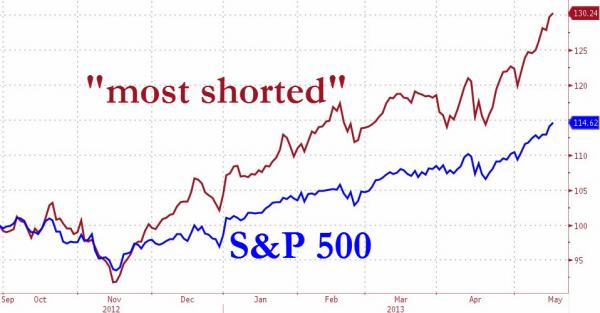

Let’s assume that company insiders tell friends and family and maybe even hedge funds about the impending bad news. Those newly informed individuals would do one of two things: sell the stock short and or buy put options. To an outsider, this activity would be be manifested in many ways: the stock becoming ‘hard to borrow’, elevated volume of put contracts, a steep volatility smile, put/call parity violation due to strong negative skew. But here’s the catch: there are many stocks that have these characteristics and the overwhelming majority are not frauds. In fact, there is some evidence that heavily shorted stocks can outperform the market due to the short squeeze:

So using these ‘telltale’ signs of informed trading can lead to too many false positives.

The easiest way the ‘little guy’ can avoid disaster is to buy index funds.